24Mar2:30 pmEST

Getting a Bit Too Cute

As I wrote back on March 5th, "A Thousand Blows Could Ruin the Art of the Deal."

Specifically, markets may stop assigning much faith at all to President Trump's use of tariffs as a now-you-see-it-now-you-don't negotiating tactic, given his propensity to dial back the rhetoric as he did last evening.

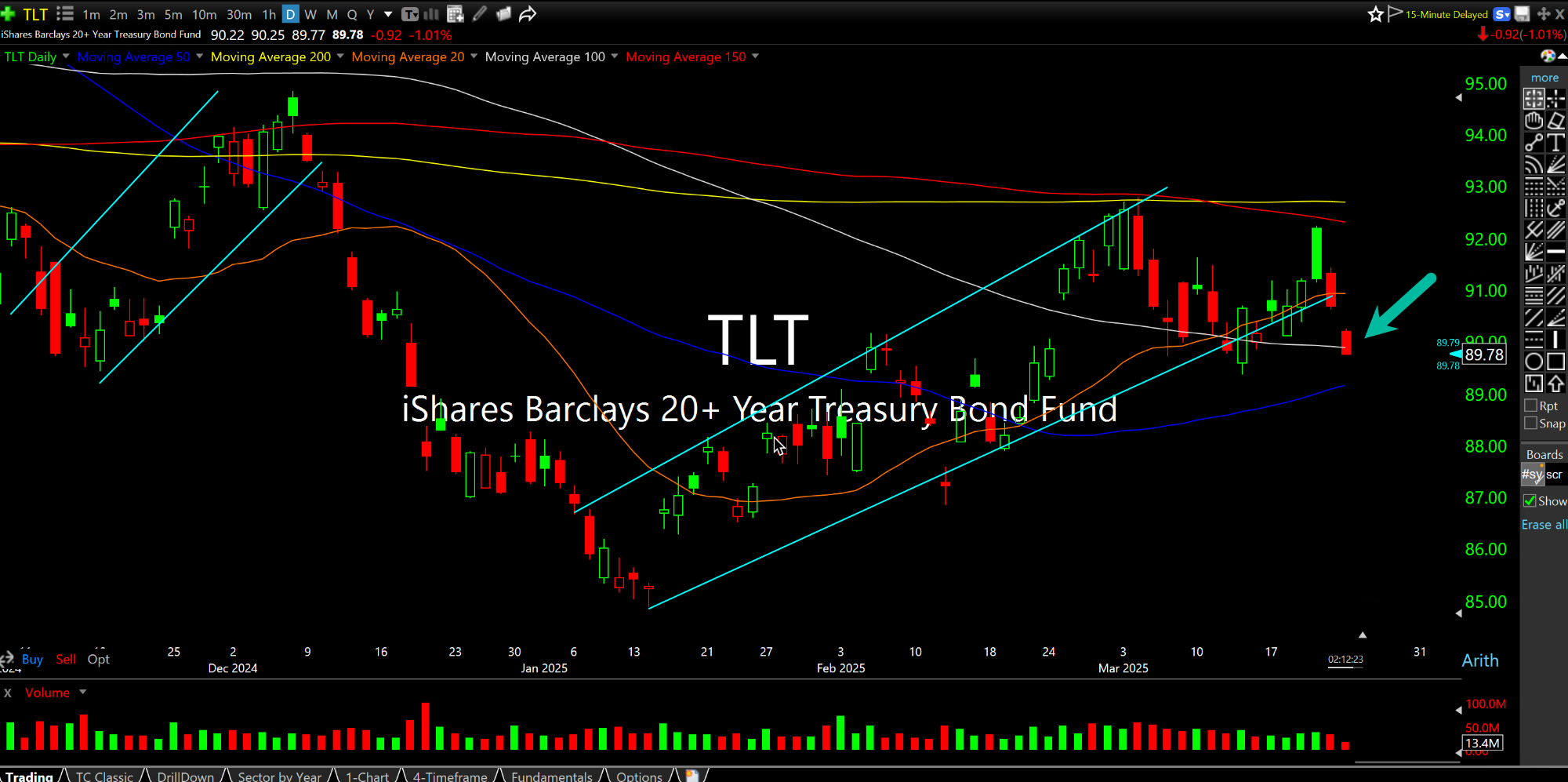

While bulls in equities today are celebrating the easing of tariff tough-talk, you will note the selloff in Treasuries on the first daily chart, below, for the TLT ETF. As TLT goes down, rates on the long end of the curve go up. And we know that runs contrary to what Treasury Secretary Bessent has repeatedly said since he was confirmed, with his goal being to see rates on the 10-Year Note drop considerably.

Should we see this rising channel breakdown on TLT continue to confirm lower, as rates head higher, I strongly suspect will launch a new round of talk-tough by the White House on tariffs--And round and round we go.

If the sounds familiar, that is because it is--We have seen this from Trump in his first term and we have also seen this attack-and-retreat act from The Fed itself regarding inflation for years now. The sad part is that they may very well kick the can down the road a bit. But the overwhelming majority of Americans--working class folks--are the ones who truly suffer as inflation rages on and prices, overall, remain on a much higher plane than they were before the pandemic.

Simply put, the only way out of this vicious cycle is a deep recession.

As for equities, the second daily chart for the S&P's ETF shows price tagging the 200-day moving average from underneath as sentiment quickly flips back to rather bullish. I am curious to see if bulls remain steadfast this week even if the 200-day offers up tougher resistance than many seem to expect.