08Apr3:03 pmEST

Now That's a Fade

Today's fade off a 4%-plus broad rally from earlier in the session seems like more evidence that we are in a new market regime, transitioning from long-term bull to bear. Tons of market players and pundits alike, respected veterans included, have planted the proverbial flag in the ground in recent sessions to declare a bottom is locked in, without question.

However, the longer a rally takes the materialize the higher the risk of a washout to fresh lows as there is a scramble for the suddenly-narrow exit doors. After all, as bulls love to say, bottoming is an event and topping is a process. Hence, the "event" should come and go in the blink of an eye and effectively trap in shorts, rewarding aggressive longs.

But that is not the case so far, as the Nasdaq is down 1.3% as I write this into the final hour after being up by well over 4% earlier.

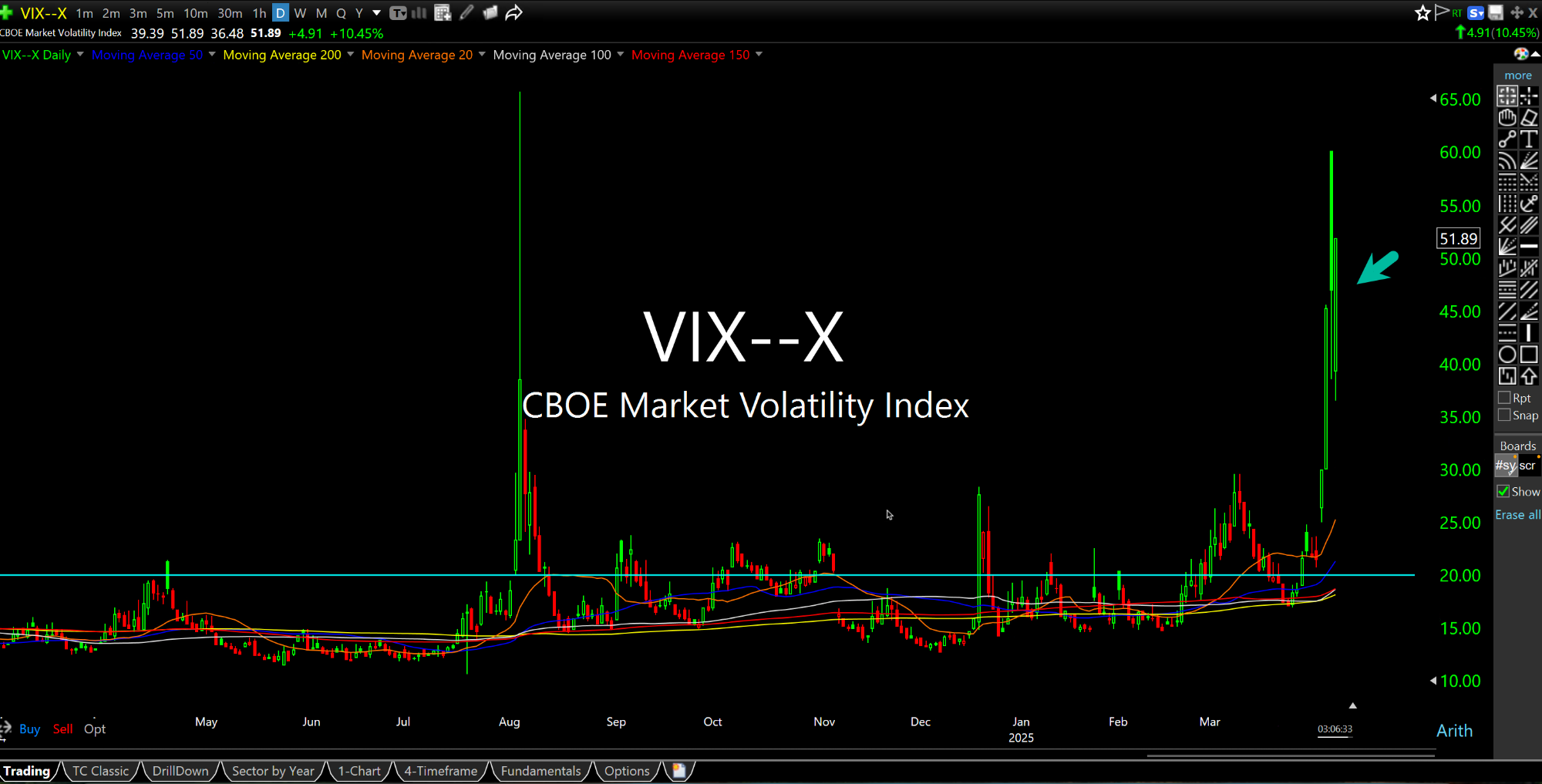

In addition, as we noted here and with Members over the last few months, the VIX "tell" would be a pop and then subsequent hold at higher levels above 20 insofar as gauging whether we were in a new bearish regime for equities.

On that note, today certainly has the look and feel of a sea change--The VIX was down big earlier in the session from a high level and is now roaring back.

In prior instances since 2020, the VIX (even during 2022) would always come immediately crashing down after each and every single pop, with last August 2024 being a prime example.

But with the VIX futures now in backwardation (when near-dated expirations are trading at a premium to later maturities, the futures curve will be downward sloping, or backwardated, also known as inverted), a sticky higher VIX is now a bright red flag for equities beyond the stickiness of rates on the long end of the curve.