01May1:45 pmEST

Don't Get High on Your Own Overhead Supply

Microsoft is surging more than 8% today, a sizable move for a name as large as it is in terms of market cap. For several quarters now we have profiled the relative and absolute weakness in MSFT, to the point where bulls ignored the name, essentially, during the winter months in favor of whatever was working at the time. However, at a certain point the weakness in "Softee" became too glaring and other mega cap tech names eventually followed suit.

Now, however, after this earnings pop today, the main issue is whether Microsoft has bottomed. Beyond that, the next issue is whether MSFT is now leading a new bull market higher in tech, even as the consumer/retail names struggle.

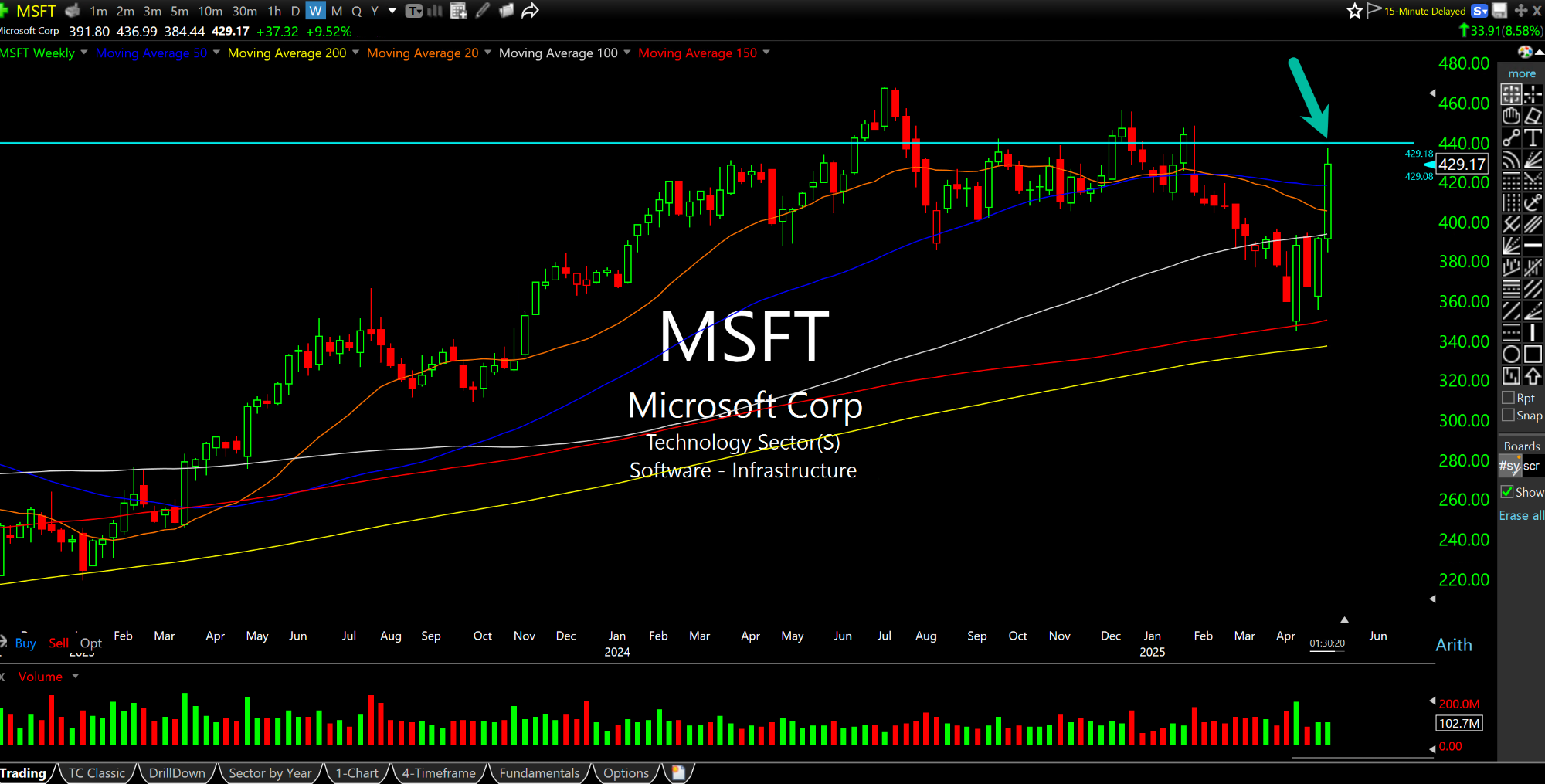

On the updated MSFT weekly chart, below, we can see today's gap higher influence the ongoing weekly candlestick. The area above $440 proved to be a difficult one for bulls to hold above, dating back to the summer of 2024, almost a full year now.

In technical parlance, "supply" essentially means likely resistance, insofar as prior buyers who have endured a tough ride lower from the higher prices and are now close to being made whole. Behavioral finance suggests these market players are now much likely to sell than they are to buy more or even hold, given the roller coaster ride they endured merely to (almost) break even. Indeed, Microsoft has tons of likely overhead supply looming at $440 and above.

While the pandemic and even 2023 were examples of V-shaped recoveries with no looking back, I continue to have serious doubts we see another unfettered bull run this time around. And Microsoft figures to be one of the best tests of this view, seeing as we are an overhead supply setup staring at us front and center.