19May1:26 pmEST

A Few Tough Looks

Equities are mostly shrugging off the Moody's downgrade into the afternoon portion of this session, as the initial morning selloff petered out in a familiar way. Specifically, retail dip-buyers continue to ride their "heater" since early-April, using any and all dips as spots to reload longs.

The issue, of course, is whether that retail surge of buying is enough to push equities back to new highs.

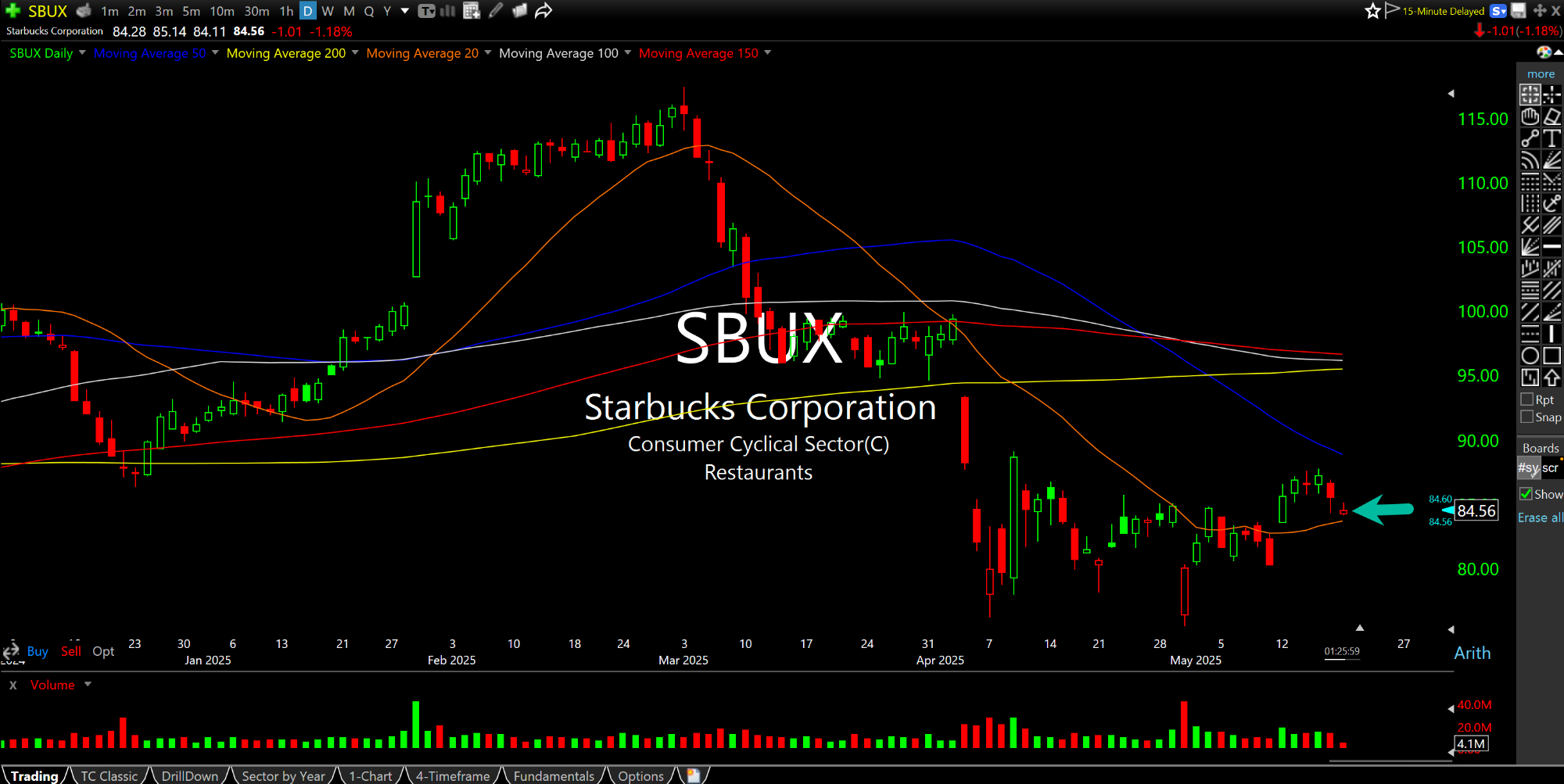

A name like Apple, for example, which is currently the third largest firm by market cap in the world, remains firmly below its declining 200-day moving average is lagging the market again. In addition, a key consumer name like Starbucks is threatening to roll back over from its recent meek bounce, seen on the first daily chart, below.

My view remains that equities will begin too struggle in terms of sustaining bounces from here on out, with the possibility of multiple failed breakouts into Memorial Day weekend. As we segue into June I expect the downside to then materialize.

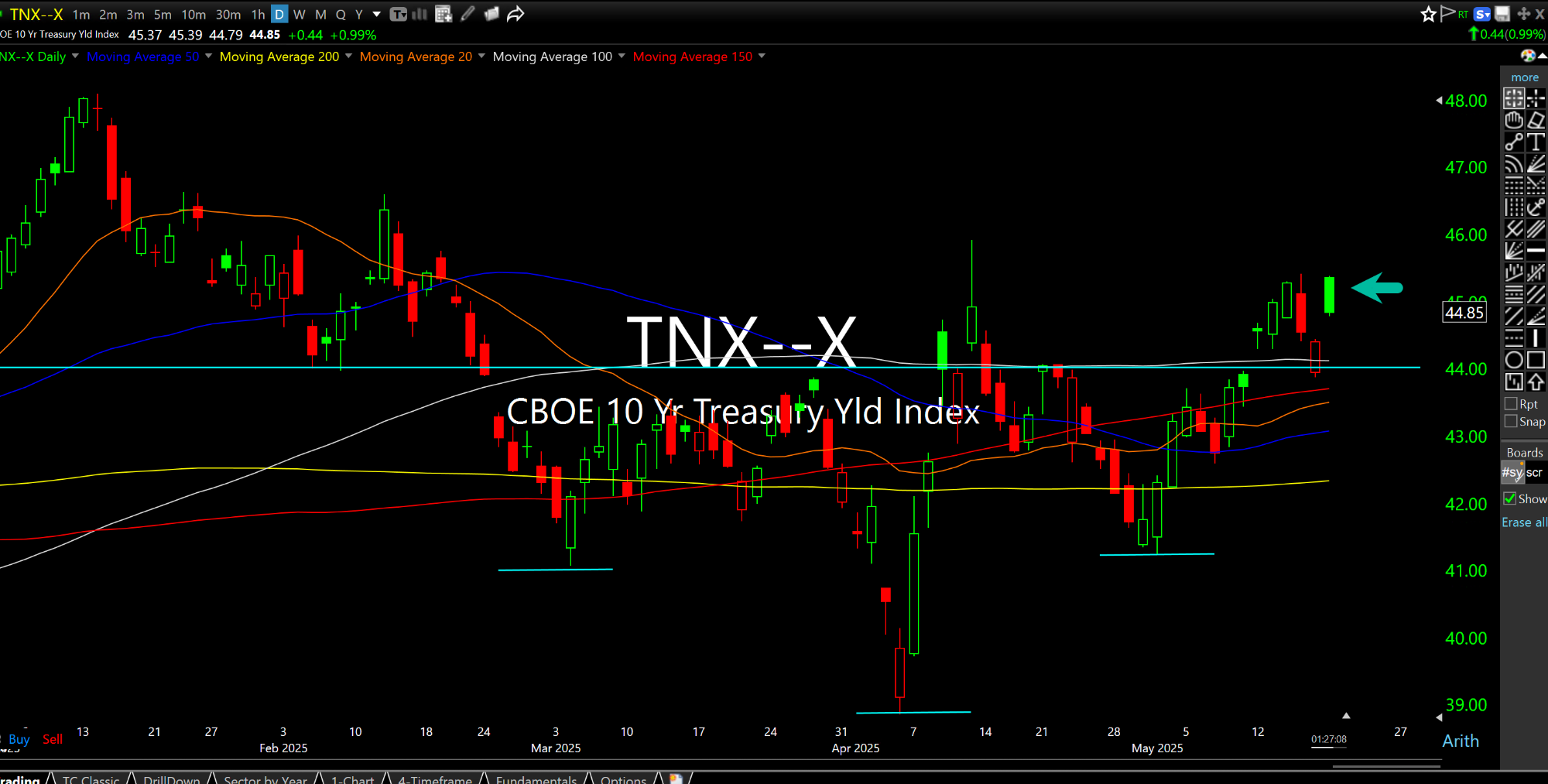

As always, rates are a key piece of the puzzle. With the White House seemingly giving up on DOGE and considerable spending cuts, the door is open for rates to surge back to 5% on the 10-Year Note--Today's move higher in rates confirms Friday's hold of 4.4% (or 44 on the second daily chart, below). Treasury Secretary Bessent has quickly pivoted from trying to talk down rates on the long end of the curve to suddenly boasting about GDP outpacing debt levels.

I will believe that when I see it.