20May2:11 pmEST

Cutting it High and Tight

We have another slow-moving, mixed tape today as the holiday weekend approaches.

Bearish seasonal forces are beginning to emerge, likely competing against the constant retail buying spree into any and all micro dips. The news flow is not disastrous, but it does not seem to inspire a sustained move higher either. Hence, the grinding action.

That said, my view remains that rallies in tech/growth and small caps will sputter from here on out as a bearish June likely sets in--Recall the hard data illustrating just how bearish this time of year until around the Fourth of July truly is.

NVDA reports one week from tomorrow, after Memorial Day. And I am looking for a report and move similar to what we saw from Cisco twenty-five years ago, almost to the month--Good numbers which see the stock sell off. anyway, and cement a major top.

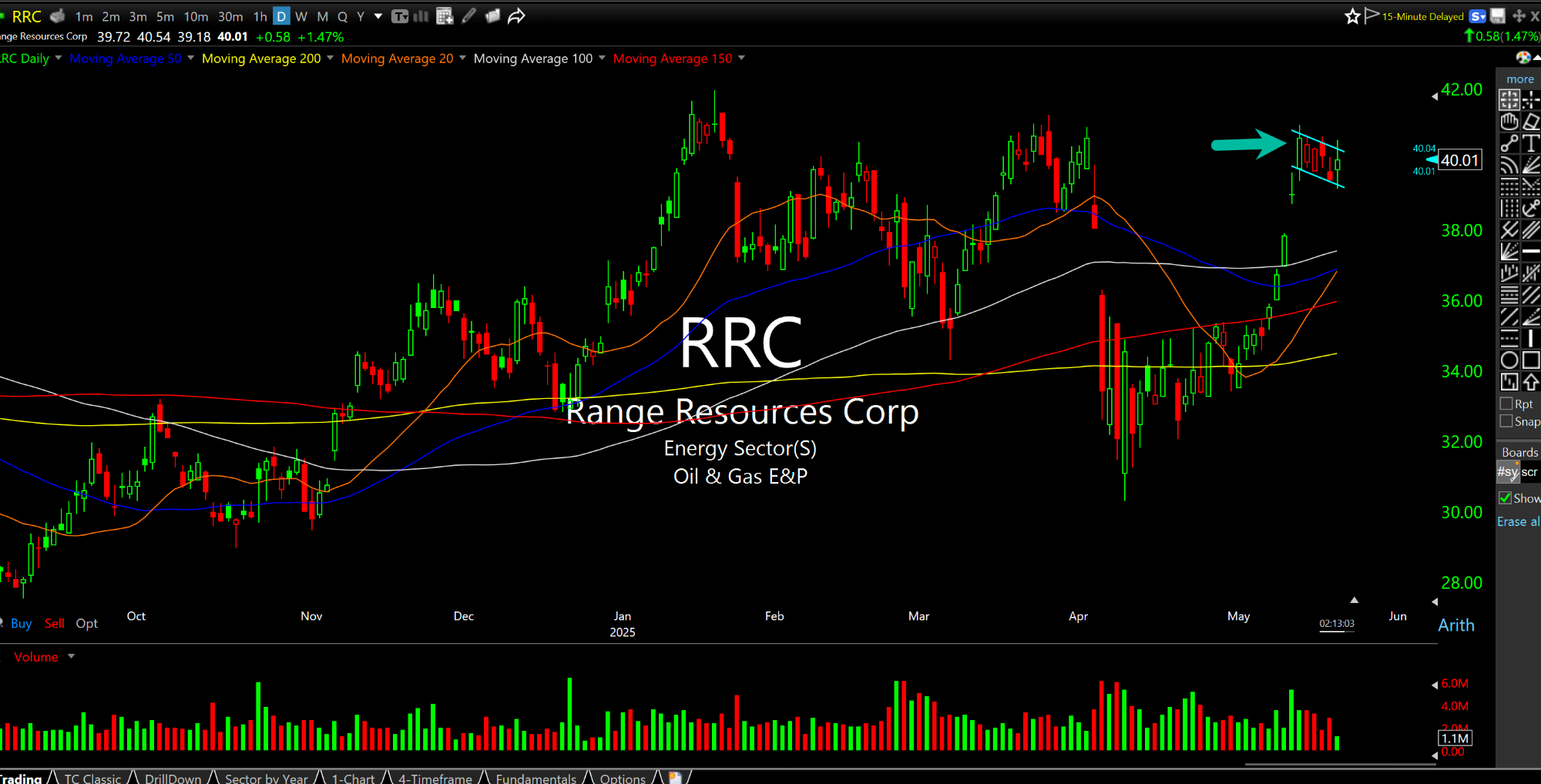

On the commodity front, gold miners are improving, while natural gas is snapping back nicely from its drubbing yesterday. Note how the natty-related stocks are some of the best around, still. Range, below on the daily, is one example of a high and tight bull flag that many of these names are sporting, in the context of up-trending charts.