17Jun3:10 pmEST

It's Taking its Ayatollah on Me

I must admit that the swirling headlines about trade deals and now the potential for American to officially enter into World War III has become more tedious than usual regarding the knee-jerk reactions by the markets (and general indecision). All of this seems to have drowned out tomorrow's FOMC. However, it is a mistake to overlook The Fed even though no rate cut is likely to happen tomorrow or even in July.

Instead, the key will be Powell's language (and body language) regarding the September and autumn meetings. In addition, markets are closed on Thursday for Juneteenth, which means we could easily see an outsized move on Wednesday afternoon during Powell's late-day presser as market players position for the mini-holiday.

Oil and silver (plus natty gas) are among the best performers today amid the market selloff this afternoon, as the threat of full-blown war sees market players reallocating to some commodities. Recall that in the 1970s at various junctures we saw commodities like gold and oil become the very best performers during that decade.

Given slowing housing, a frozen jobs market, and some poor retail sales figures this morning, the last thing the consumer needs is a spiking gas price. I recognize that many, including President Trump, have been pointing out lower gas prices compared to where we were a few years ago.

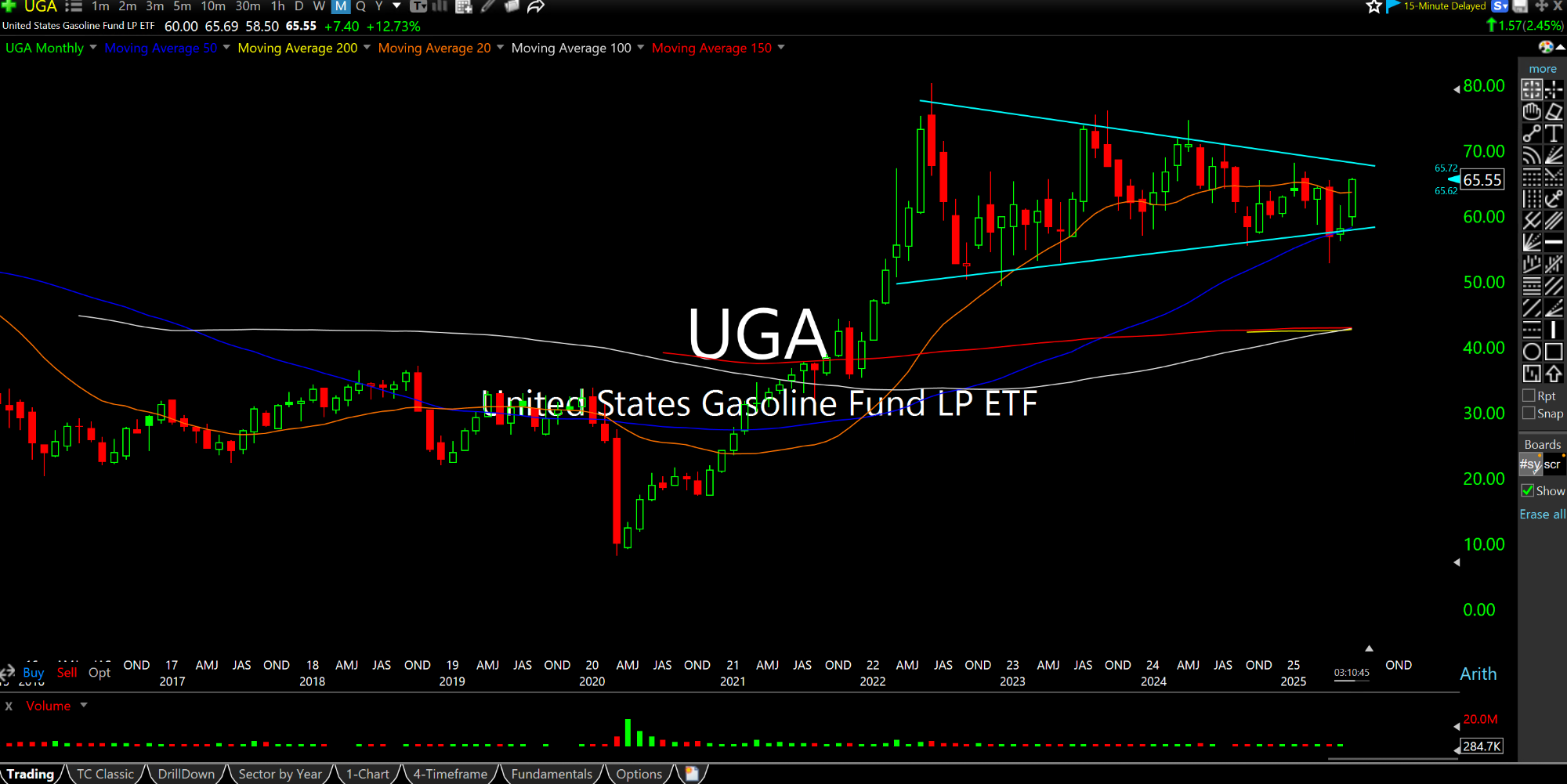

However, for perspective note the UGA (ETF designed to track the daily price movements of gasoline) monthly chart, below. Much like the crude oil ETF itself (USO), gas prices have been basing in a range for years after the initial post-pandemic surge.

The issue is not so much a news-driven pop in oil and gasoline so much as whether it extends into summer and creates a problem like the Arab oil embargo in 1973/1974.