18Jun3:32 pmEST

Is This Powell's Waterloo?

"Waterloo" commonly refers to a decisive or crushing defeat. This meaning originates from the Battle of Waterloo, fought in 1815 near Waterloo, Belgium, where Napoleon Bonaparte suffered a final, devastating loss. The term is often used in the idiom "meet one's Waterloo," meaning to face a final, insurmountable obstacle or defeat.

In his post-FOMC presser this afternoon, Fed Chair Powell came out and said that Fed projections have move towards slower economic growth coupled with higher inflation. That combination is the essence of "stagflation," a concept Powell openly mocked as not applicable to the current economy a good while back.

Now, though, Powell does not seem as smug.

But, then again, the market still expects rate cuts later this year.

Thus, the issue is whether The Fed should actively be considering rate hikes. Clearly, rare hikes are a contrarian view. However, the inability of The Fed to adjust in a timely manner to inflation bouncing back after each time the inflation rate receded was at the epicenter of the 1970s stagflationary era, complete with surging gold prices and oil spiking due to issues in the Middle East.

Hence, on the two-hundred and ten year anniversary, to the date, that the Battle of Waterloo was fought, it would behoove Powell to defy President Trump all the way and look to hike rates before I suspect the market forces him to later this year (again, I recognize this is an extremely contrarian position).

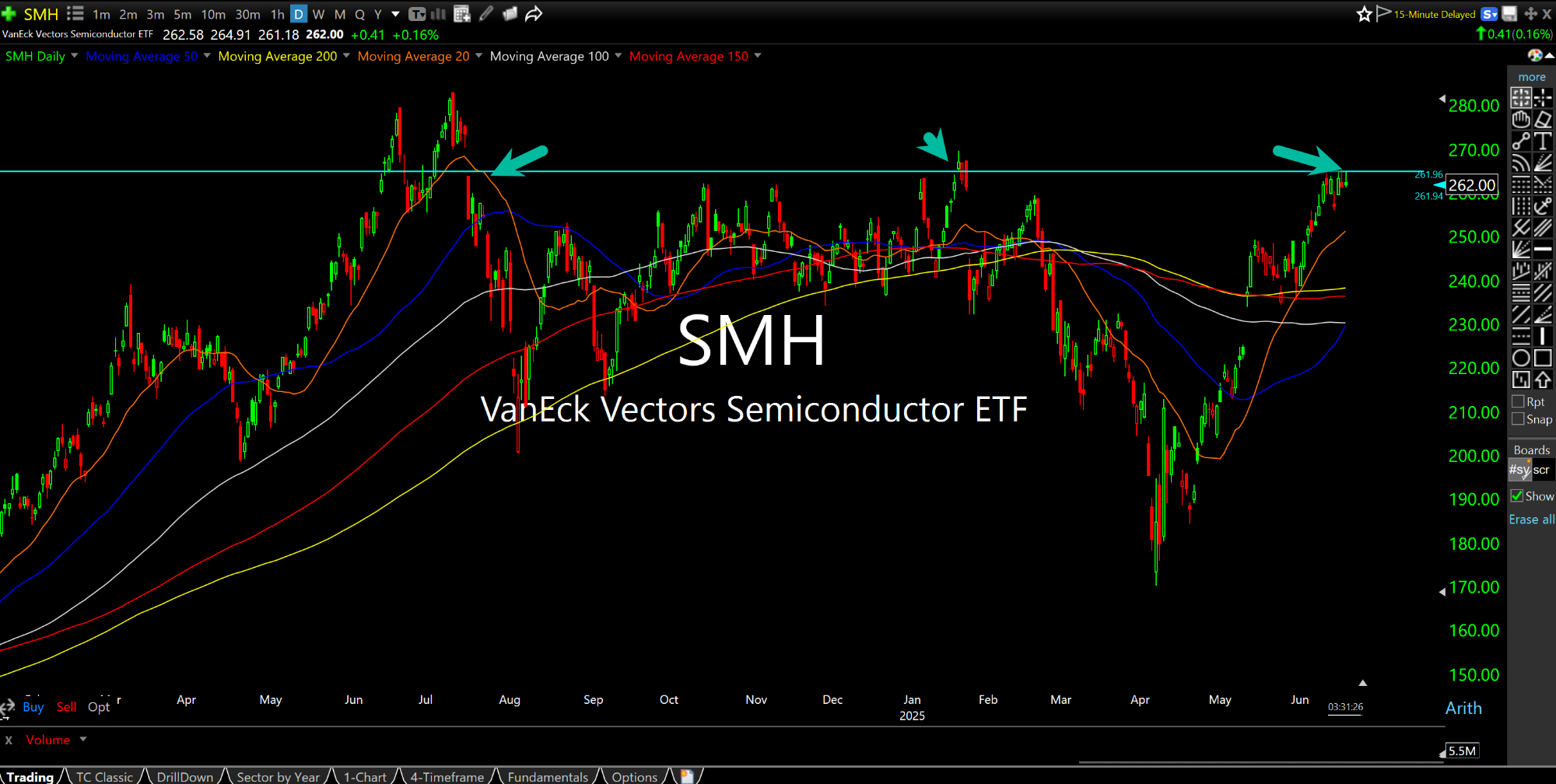

As for the tape, keep an eye on the $265 level for the semiconductor ETF, below on the daily chart. Note how firm the resistance has been for a long time now. It was acted as an area where sellers appeared this week, too.

It's Taking its Ayatollah on... Afternoon Update 06/20/25 {V...