23Jun3:03 pmEST

Operation Midday Hammer

On the news that Iran's retaliation today against a U.S. air base in Qatar appeared to be nothing more than face-saving theater, equities reversed back up sharply from red while crude oil plunged, with the USO ETF down by more than 7% as I write this.

I do not doubt the assertion that tensions with Iran may begin to subside if these telegraphed retaliatory strikes are all she wrote.

However, my view remains that inflation is picking back up into the back half of 2025 and beyond, despite formerly hawkish Fed members like Bowman and Waller now dovish, likely as they vie to be Trump's pick for next Fed Chair after Powell's term ends. And that inflation resurgence, ultimately, should prove to be the more damning issue for markets which are currently focused on Iran above all else.

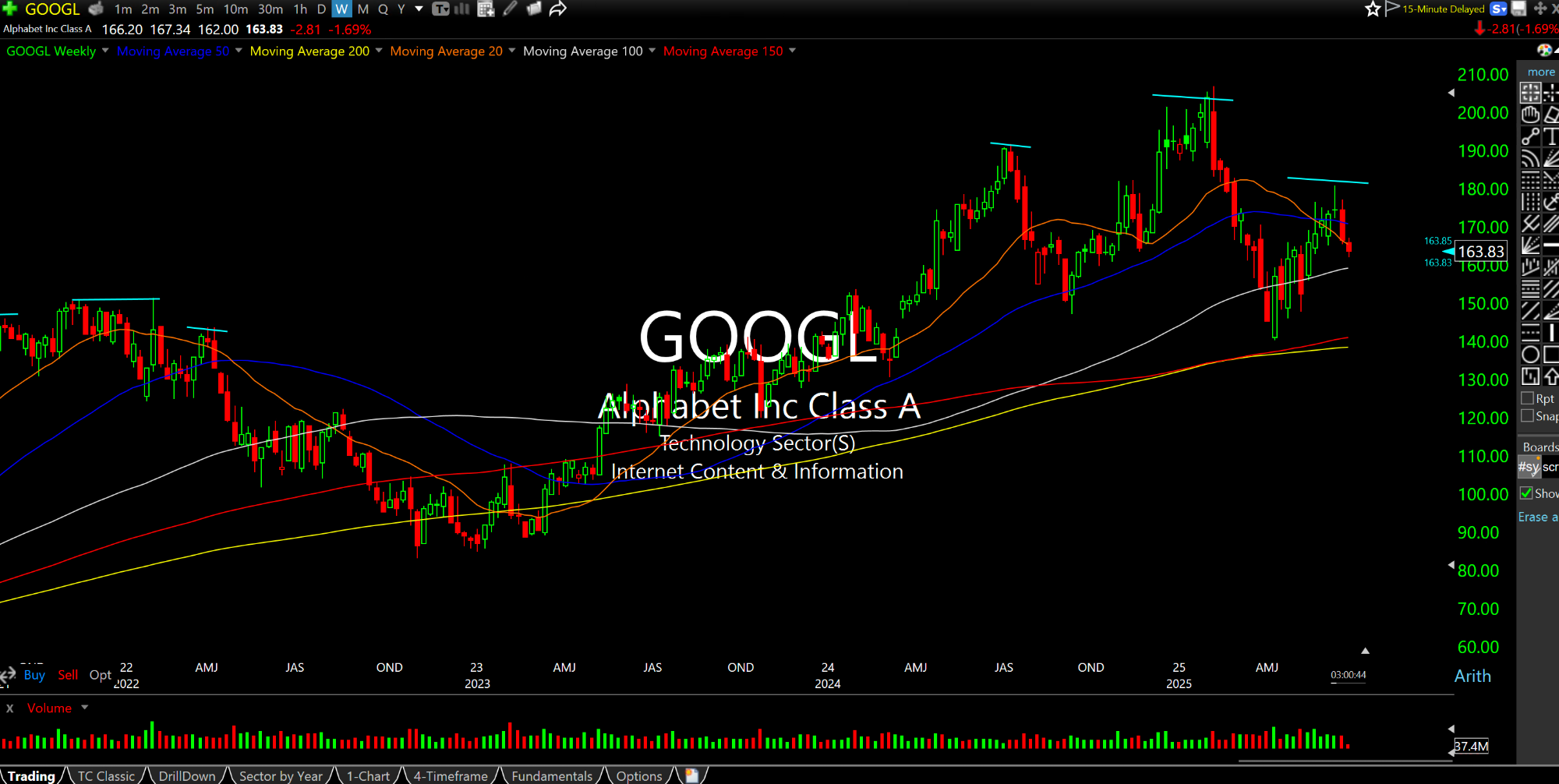

With this in mind, we continue to key off GOOGL, first weekly chart, below, as a good tell if the head and shoulders top dating back almost a full year comes to fruition. So far so good today, as Alphabet notably lags the market and is weak in absolute terms, too. Another wave of inflation should be bearish for richly-valued tech/growth stocks.

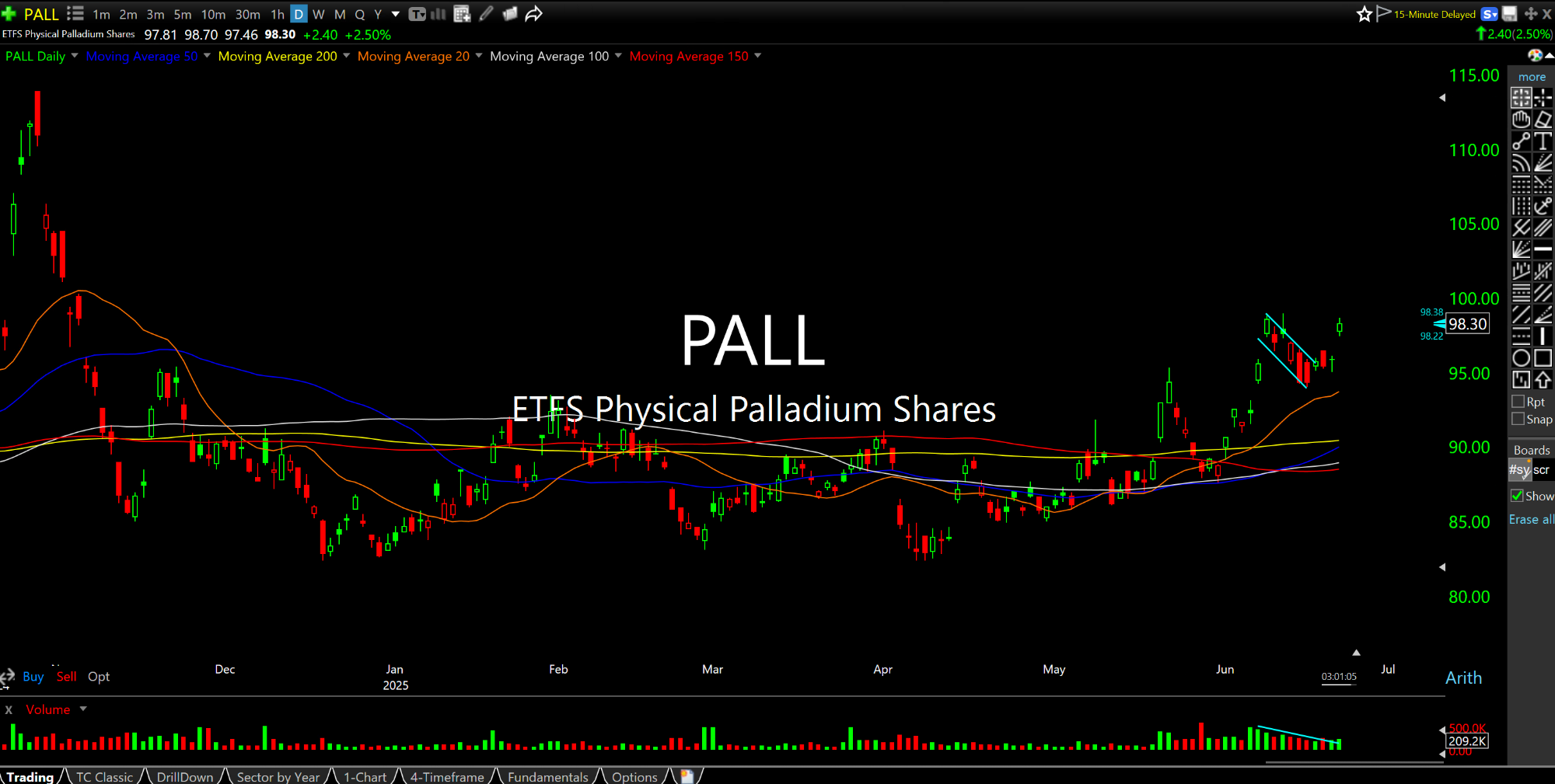

Another piece of the inflation puzzle is the commodity complex, which should benefit from higher inflation. Palladium, on the second daily chart, is hot today alongside platinum. Note the PALL ETF bull flag breakout attempt. Consider just how under-owned and under-appreciated palladium truly is.