08Jul3:38 pmEST

Halitosis Ruins a Market That's Expialidocious

We are winding down a fairly stale summer session today, as Trump's 50% copper tariff likely marks the big news of the day (See: FCX rallying sharply and improving in recent months, as we noted previously here and with Members).

Tomorrow afternoon's Fed Minutes (from the last FOMC meeting in June) figure to be the big known macro event of an otherwise slow week, given the lack of earnings reports. Indeed, rates on the 10-Year Note are now back above the key 4.4% level, as I write this.

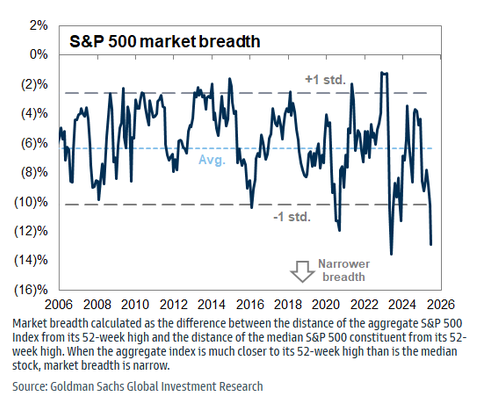

Below, you will find a chart making the rounds today, courtesy of @Barchart on X and Goldman Sachs.

This chart illustrates what we have already known for a good while now.

Still, it is instructive to see it in visual form. Market breadth remains horrendous despite the indices pushing new all-time highs and certain stocks like MSFT NFLX PLTR seemingly on a permanently new all-time high plateau. Simply put, this is not a healthy, broad-based bull run.

While there is certainly no guarantee the bearish divergence in breadth needs to resolve with the indices sharply lower in order to "catch down," we can likely infer that passive flows continue to dominate and distort risk assets.