14Aug3:22 pmEST

If You Don't Like the Temperature, Just Change the Thermometer

Even with one of the hottest PPI prints I can recall in years earlier this morning, the CME FedWatch odds for rate cuts at the next FOMC (and each subsequent one into early-2026) are still well over 90%. Now, The Fed may opt for a 25 bps cut in lieu of 50 bps given the hot print.

But unless Jerome Powell can summons the fortitude to shun both the White House and the futures market, as of now you have to think a cut is still, unbelievably, coming soon. Jackson Hole kicks off one week from today, where Powell may have the opportunity to talk down rate cut expectations if he is willing to take the heat from the President and his minions.

I remain incredulous not at Powell's frail backbone, since we know he has a long history off taking the easy way out. Instead, I view inflation as clearly reaccelerating. Hence, a rate cut would be devastating into autumn and beyond, repeating the mistakes of the 1970s.

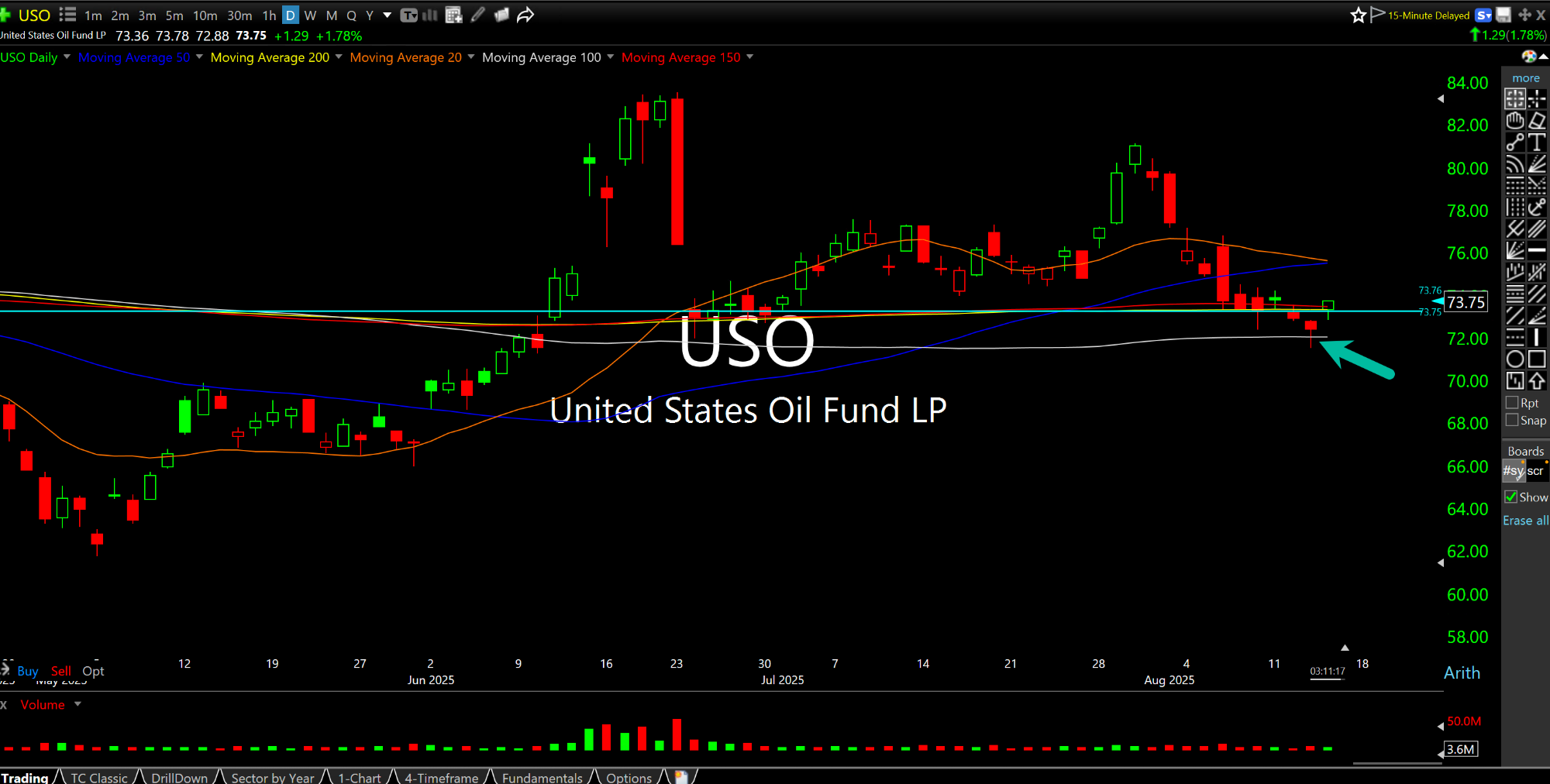

On that note, crude oil is a missing piece of the inflation/stagflation puzzle and the 1970s analogy. On the USO ETF daily chart, below, yesterday's weakness may prove to be the last good shakeout before oil finally rallies. It is now or never for oil bulls, lest we refer to them as, "all hat no cattle." $73 did recover nicely, however, as key support.

Elsewhere, TLT has been steadily lower all session as rates push higher. The long end of the curve calls the shots whenever it feels like it. And no matter how much pressure is on The Fed to cut, rates on the 10-Year out to the 30-Year will get the final say as to whether a cutting cycle has any kind of staying power beyond September.

Prepare for the New Era of T... Afternoon Update 08/15/25 {V...