19Aug3:08 pmEST

Rethinking Old Battle Lines

Today seems like the first day in forever that we are seeing coordinated heavy selling at the epicenter of the bubble in AI/growth/tech. High-flying names likes PLTR HOOD, chips like AMD MRVL, as well as monsters like NVDA are all being sold fairly aggressively into the final hour.

Naturally, one session does not a new downtrend make, especially in this sort of historically resilient, one-way market.

But there remain plenty of classical signs of a top underway in the mania, from the latest Chamath SPAC to META downsizing its AI division on bubble fears, among many, many other signs including retail and foreign money buying these stocks hand over fist.

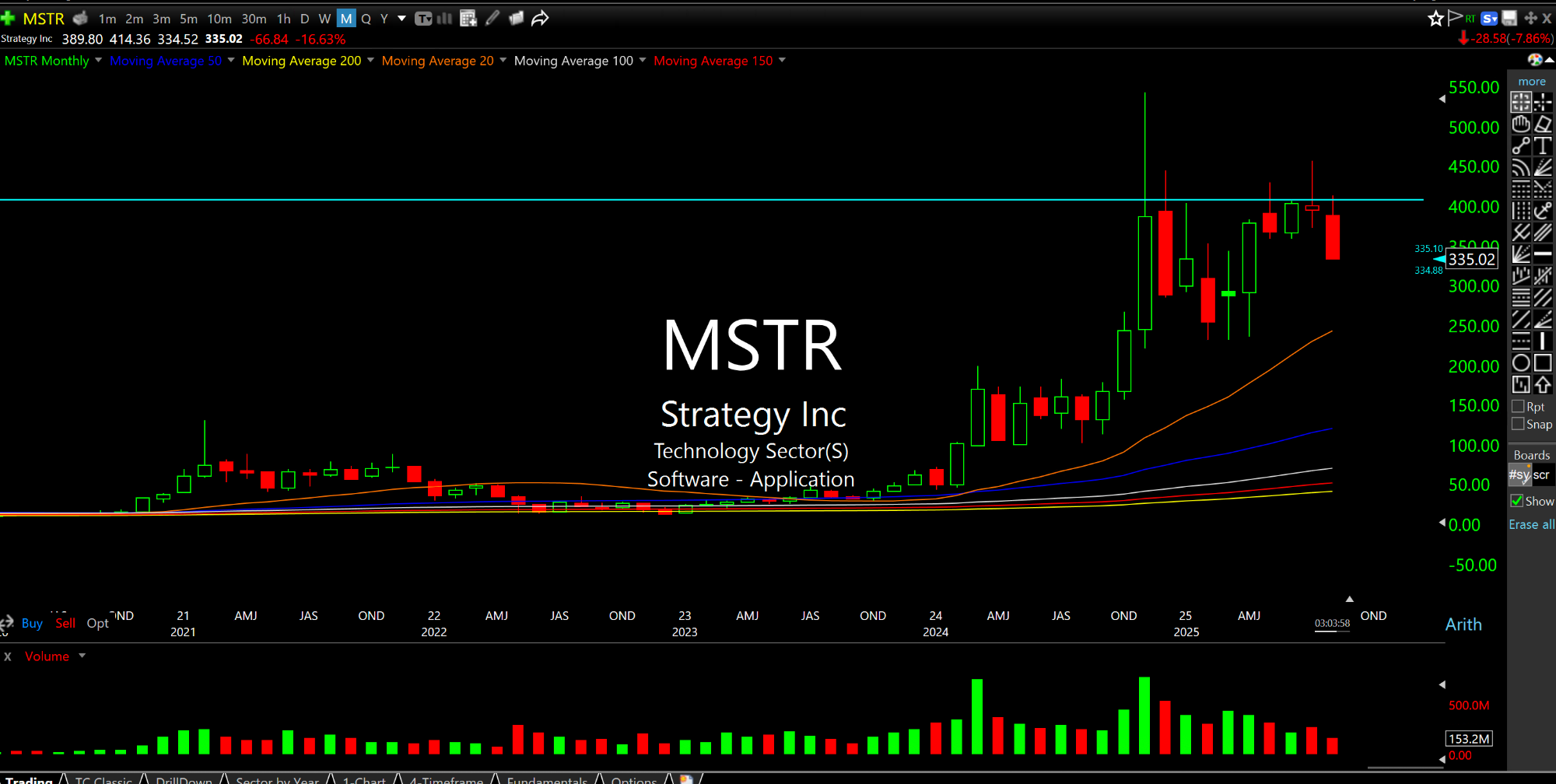

And then there is Michael Saylor's crypto-integrated MicroStrategy (now DBA as Strategy, Inc.), below on the daily and monthly timeframes, respectively.

Note MSTR piercing down through the 200-day moving average on heavy sell volume today. As Bitcoin has backed off its recent high of $124,290.93, MSTR has already been unwinding. On the monthly chart we can see $400 as sharp resistance for the stock, potentially flagging a major top in the crypto/growth darling.

Overall, it is still difficult to draw too many inferences from today's action given Jackson Hole looming, with Powell's Friday morning speech serving at the centerpiece of this week's events. But the risk-off price action today seems like a rare moment (for this market, at least) of humility that, perhaps, META is on to something about AI growth numbers being overhyped.

If so, then we know plenty of stocks have already been priced beyond perfection, let alone overstated numbers.