20Aug1:25 pmEST

I Respect the Strategy

News of Pepsi raising prices by 10% on their carbonated soft drinks in a few weeks hit the wires today. In addition, I saw a report that Monster Energy (of which Coca Cola owns a piece) plans to raise prices on its U.S. energy drinks.

These price increases during an entrenched period of inflation should come as no surprise to anyone. However, given how many have been so cocksure that inflation was thing of the past it should come as a shock. As for me, I am surprised at how long it look to get here as I expected these types of price increases sooner.

But that brings us to an important concept about inflation.

As Milton Friedman famously said, "Inflation is just like alcoholism. In both cases, when you start drinking or when you start printing too much money, the good effects come first, the bad effects only come later. That’s why, in both cases, there is a strong temptation to overdo it — to drink too [or] and to print too much money.”

Here, the initial "good effect" of inflation were nominal surges in earnings for many firms. Eventually, as inflation rages on, profit margins get squeezed and firms have little choice but to pass on the price increases to weakening consumers. And that is what we have happening with Pepsi and Monster. Thus, we are pivoting to the "bad effects" part of inflation.

Beyond beverage firms I expect to see more and more price increases across the board in retail and consumer names.

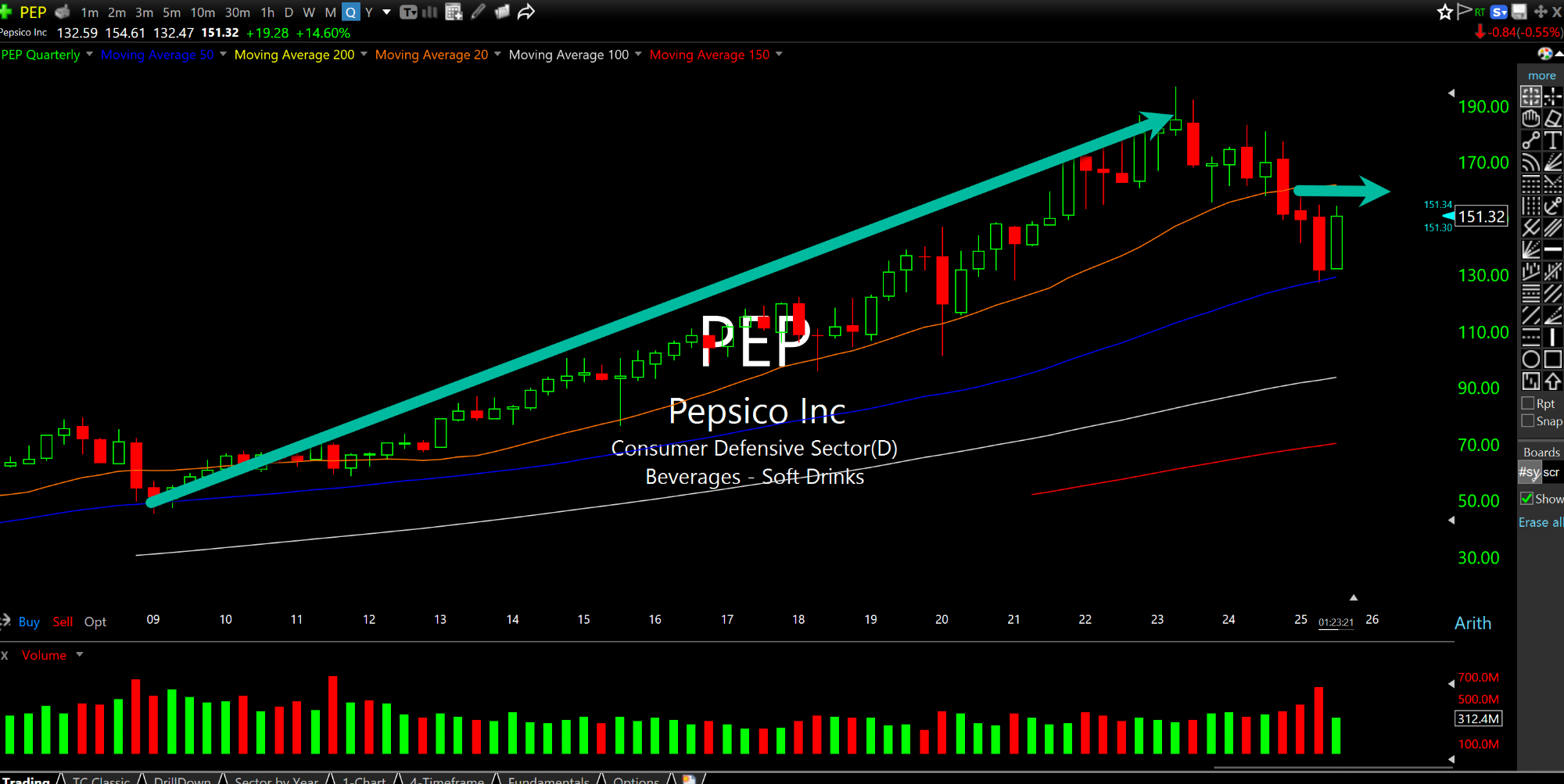

Regarding PEP as an actionable trade, the quarterly chart, below, shows the steep trend since 2009 threatening a major reversal. Into this bounce, I expect the $160 area to present a good short opportunity. PEP is still not cheap on valuation and I expect it to get much cheaper in the coming years. There are other defensive names offering better value here, that is for sure.