18Sep11:25 amEST

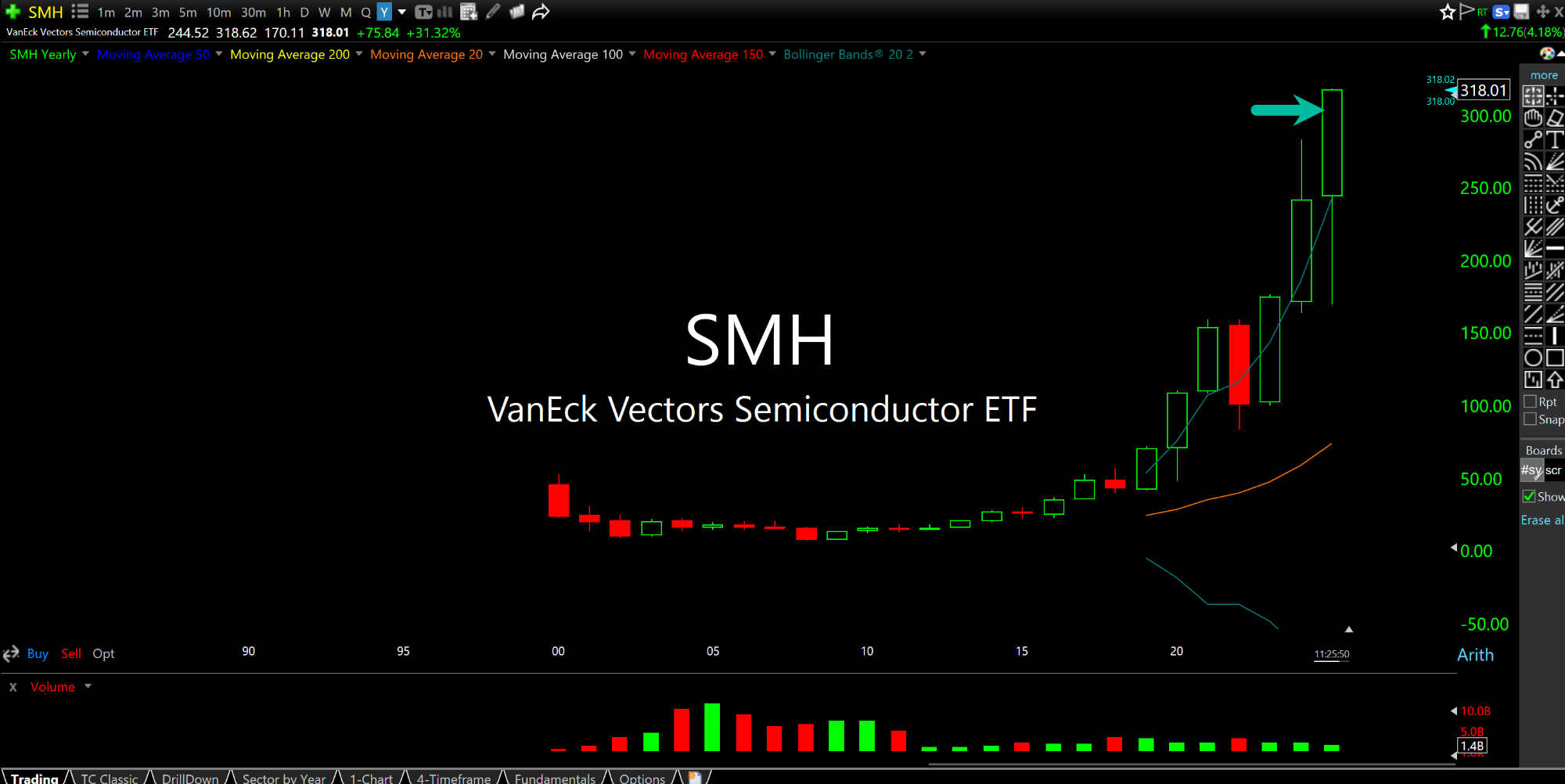

A Rare Triple Lindy

On news of the NVIDIA $5 billion stake and partnership with Intel we have semiconductors shooting higher, leading the tape this morning after yesterday's FOMC rate cut.

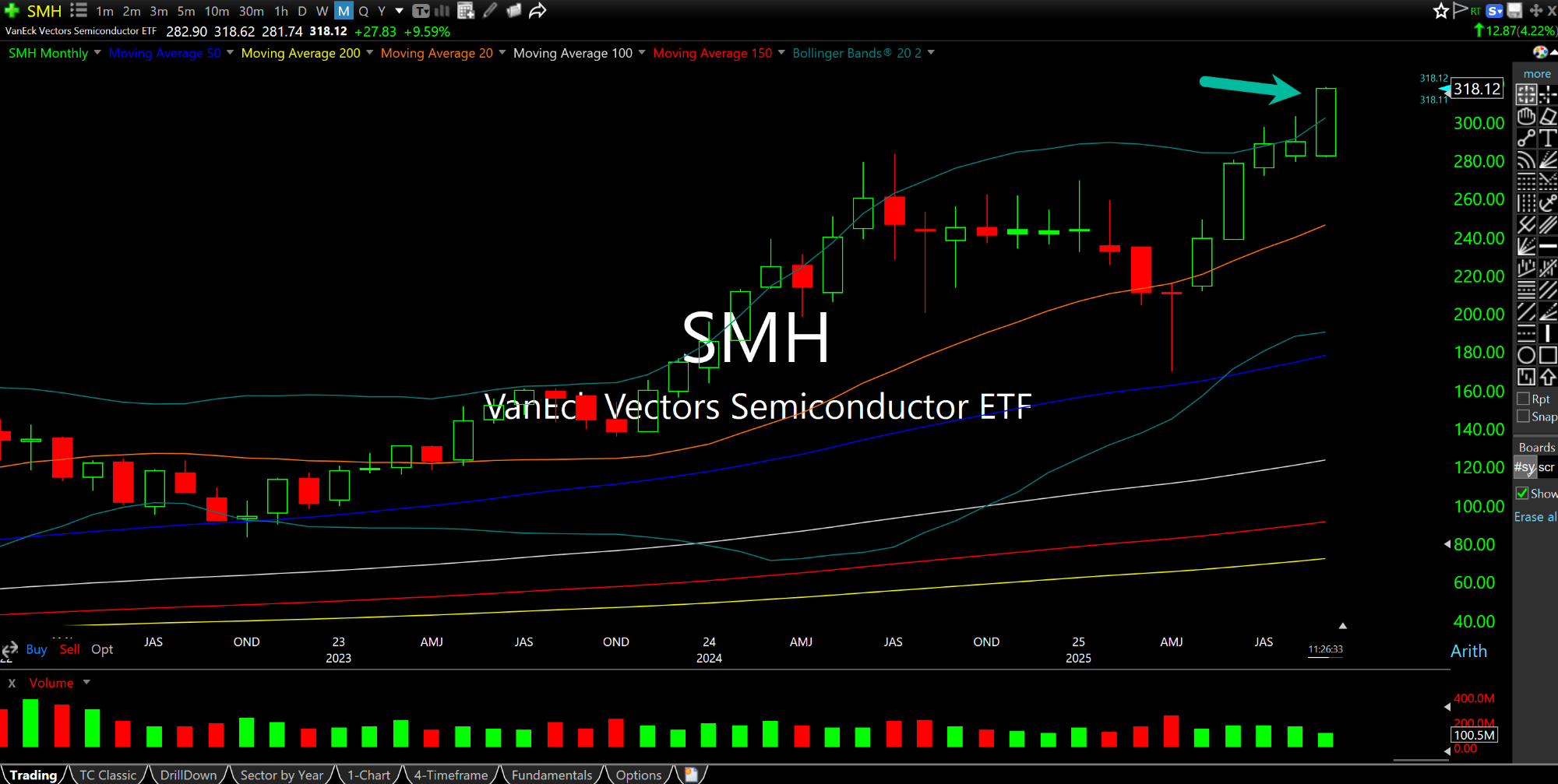

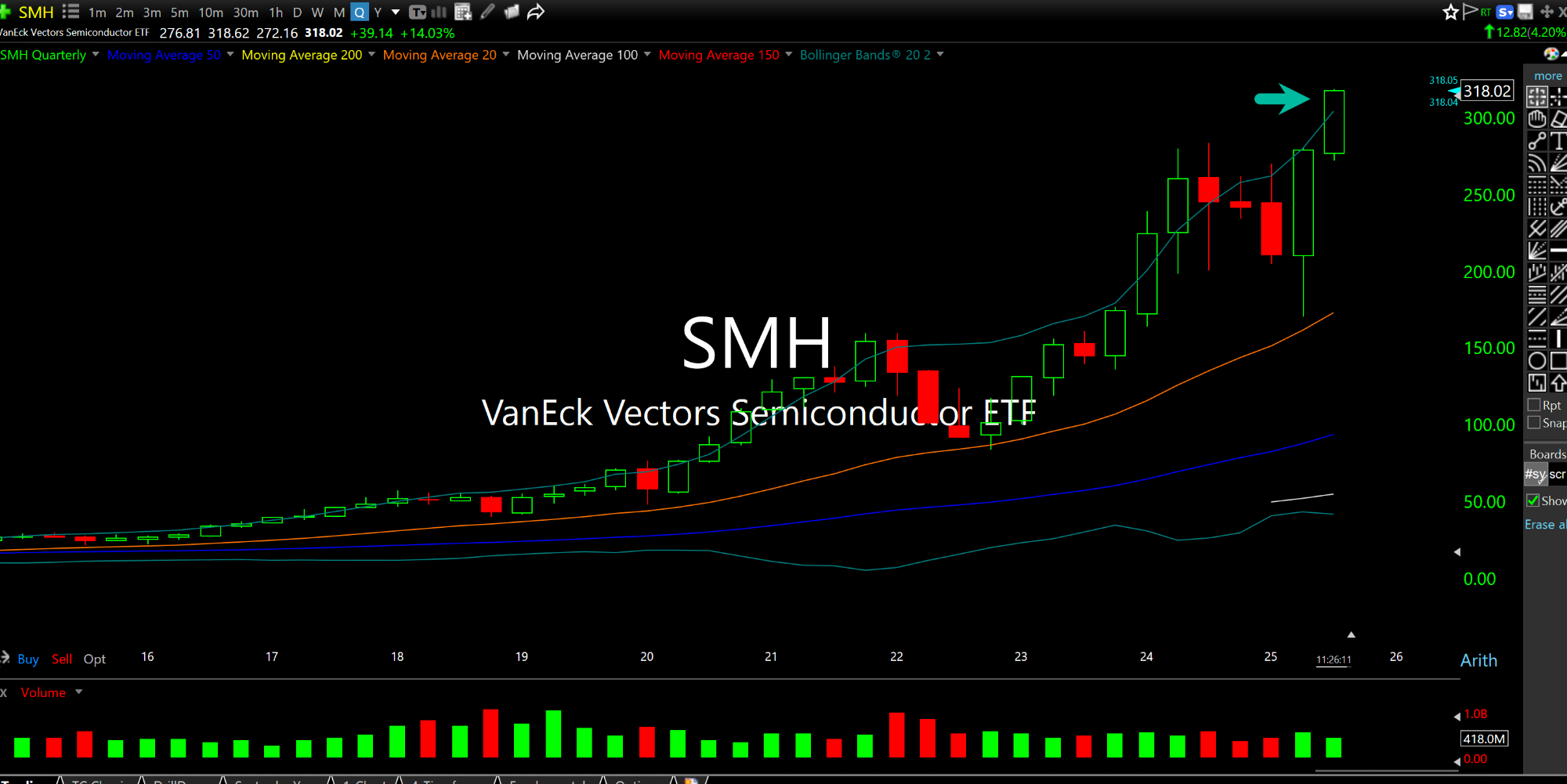

The SMH, sector ETF for chips, is now very overbought (clearly above its upper Bollinger Band) on the monthly, quarterly, and yearly charts, all respectively below. To see these three long-term timeframes align for very overbought is indeed rare and a sign of the times--The Nasdaq and many of its parts are blowing off and in historical bubble territory, regardless of how many people try to deny it. Any somewhat objective student of history will acknowledge that markets simply do not function like this the majority of the time.

Also note that bonds are selling off, not unlike the reaction we saw to the rate cut at the September 2024 FOMC, where rates on the long end began to spike higher even as The Fed began a mini cutting cycle.

Overall, I am still inclined to watch the Nasdaq bubble and let it burn itself out as the back half of this decade is slowing falling into place with sticky high rates, deep value dividend stocks, and commodity-related stocks likely to outperform.