22Sep3:05 pmEST

Let Them Eat Punches to the Face

If the plan after April's pivot by the Treasury Secretary (recall, "It is Main Street's turn now," which lasted about as long as a blink of the eye) and White House Administration at-large was to goose virtually all assets at the expense of the overwhelming majority of Americans' cost of living, then so far so good--Just today we have another intraday super-spike in NVDA while assorted hot money chases names like BETR SNAP SOUN higher.

In addition, the precious metals are surging, perhaps serving as one of the more damning pieces of evidence that both monetary and fiscal policies are erroneous, not unlike during the 1970s. Gold, silver, platinum, and palladium are all up nicely, as precious miners continue to ignore overbought conditions. Rates are slightly higher but, overall, clearly higher since The Fed rate cut last week, conjuring up memories of last year when the long end of the curve went higher after the cuts.

Overall, it is surprising to see the White House go down the same road as the previous Administration, given how deeply unpopular those policies were with most voters and the obvious adverse effects on cost of living to prop asset prices up to this degree.

But, then again, that is a good lesson as to why inflation is a scourge and has been throughout history--It takes tons of courage and intestinal fortitude to effectively crush inflation. It is easy to talk tough about punching people in the face, however.

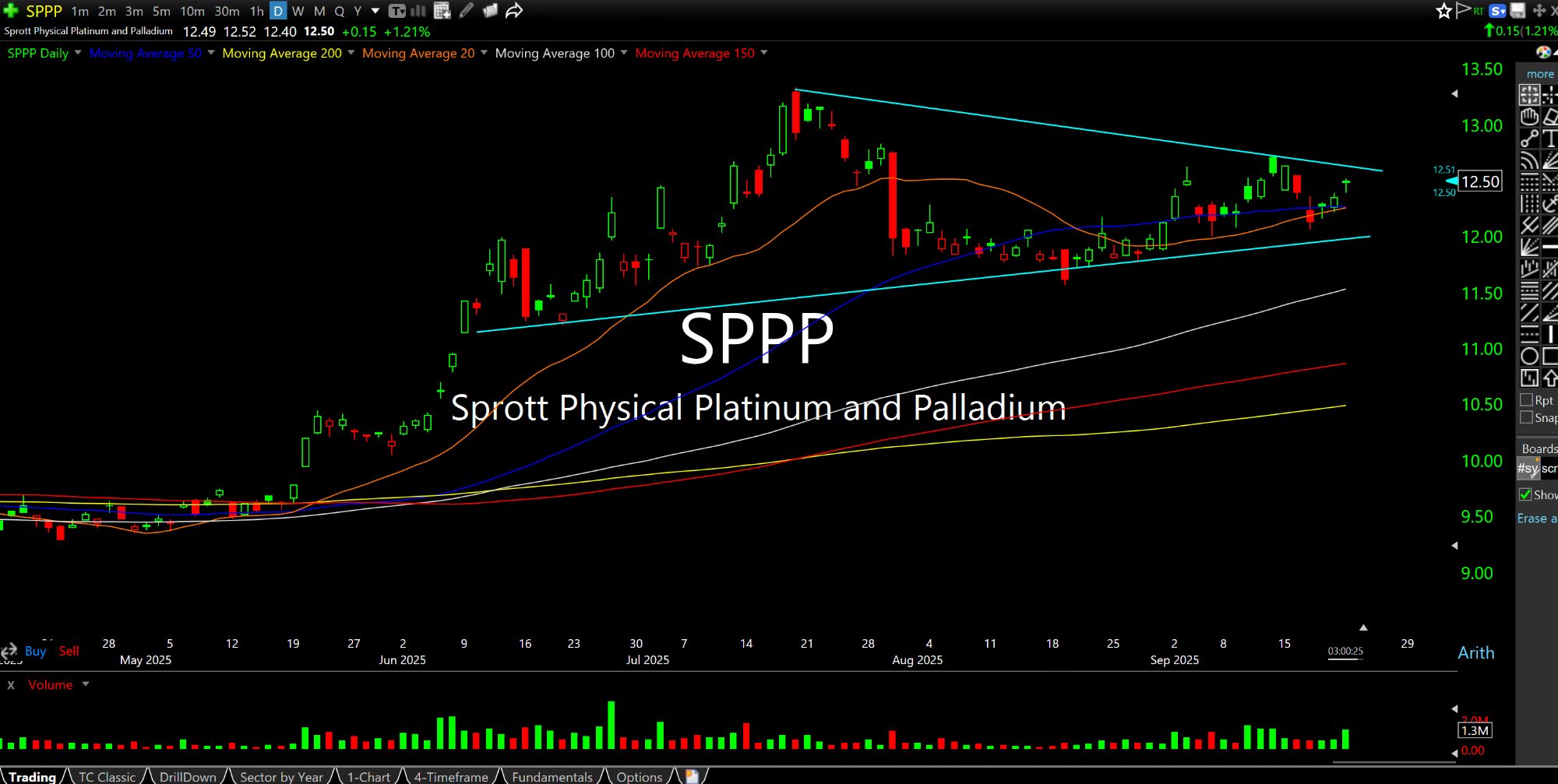

On the actionable side, SPPP is the Sprott two-for-one physical Trust for platinum and palladium, below on the daily chart. Note how coiled the chart is, as the symmetrical triangle narrows. I like this as a long idea back over $12.70.