24Sep1:58 pmEST

Everyone Who Wanted to Sell Oil By Now, Already Has

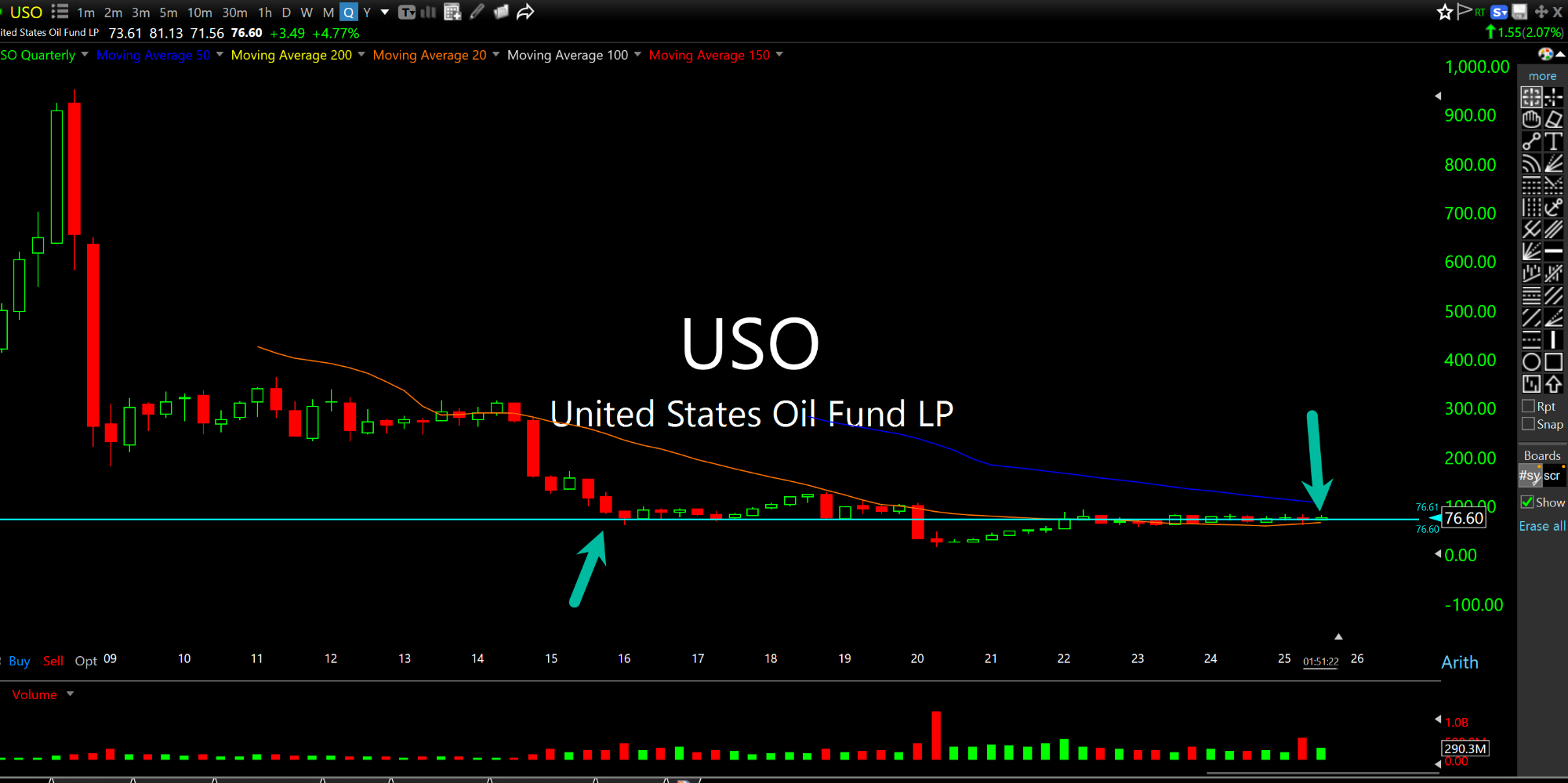

One of the more instructive aspects about observing long-term timeframes is to gain clarity. Specifically, in the case of oil we have the ETF, on the first quarterly chart, below, sporting the "bull killer" pattern of a crash more than ten years ago followed by the last ten years of, overall, tedious sideways action.

In other words, since the 2015 lows we have rallies and selloffs alike for crude being aggressively faded, including the 2020 COVID crash.

The net result of this quagmire of a chart is that virtually everyone, even rigorous fundamentally-driven oil bulls, have pretty much given up on the idea of a sustained bull run in black gold and its related stocks. Further, everyone who wanted or needed to sell oil and oil stocks by now likely has, since we are talking about an extended period of many years with underwhelming price action all the while we have an epic mania in large cap tech/AI/select growth and semis elsewhere. Heck, even some commodity names like OKLO are in the mania mix, outshining every single oil stock listed on an index.

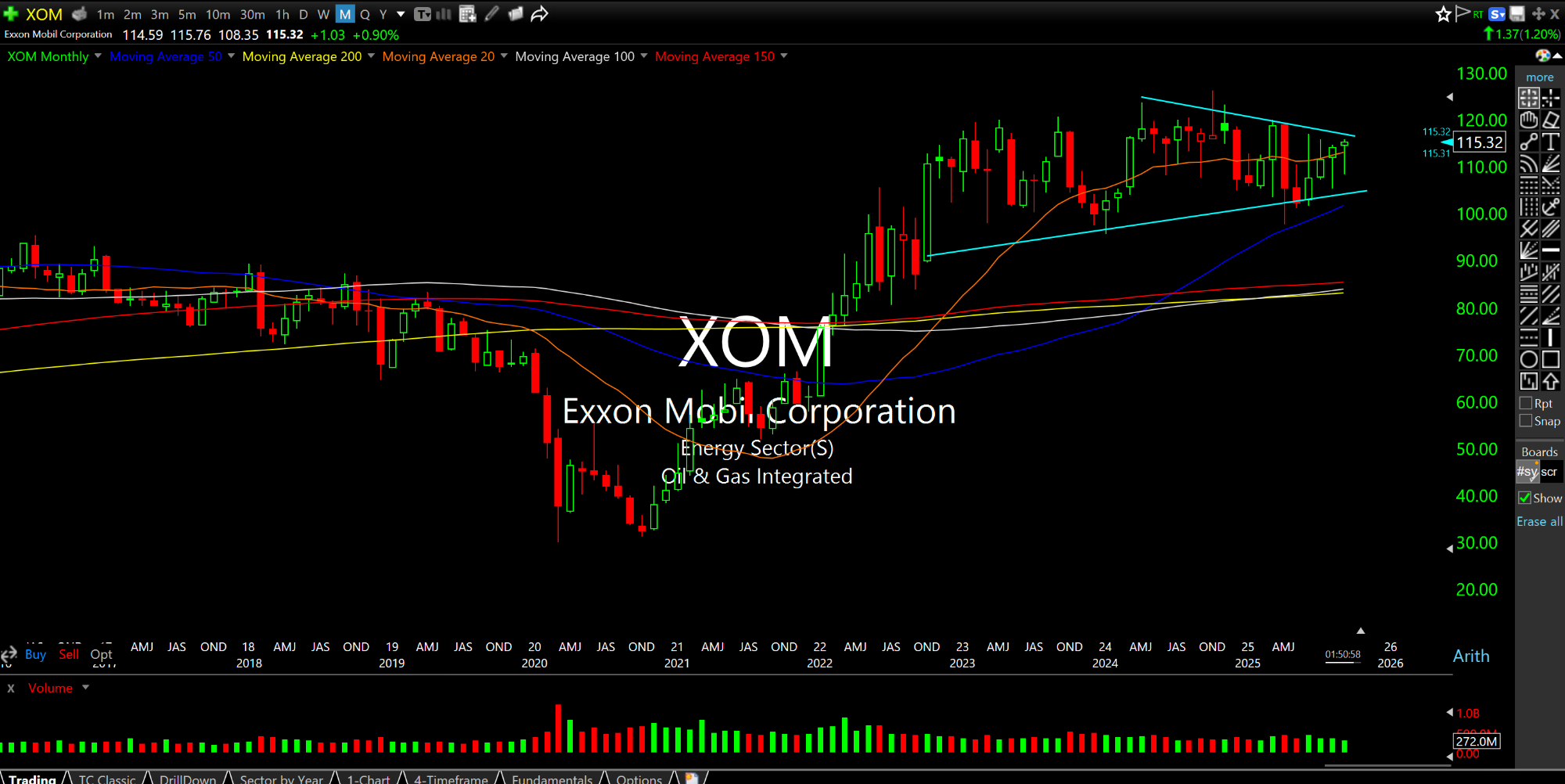

The second chart, below, is a monthly for Exxon, illustrating several years of narrowing consolidation after the prior run-up off the COVID crash lows. Here, again, we have an iconic name in the oil patch which been asleep for years.

In these types of scenarios, with a given market essentially laying dormant with obvious underweight positioning amongst retail and institutions, we then look to the macro backdrop for clues. And when we do it is clear that stagflation remains a glaring risk, not unlike the 1970s, with the Fed Chair reluctantly using stagflationary buzzword even when he knows if he outright says the word it will be a total embarrassment for him in light of his statement a few years ago that he does not see the "stag" nor the "flation"

Well, I see both. And with gold already unleashed it seems like only a matter of time before oil becomes a problem for the powers that be.