06Oct3:13 pmEST

It's Still Lock and Roll to Me

You might have looked at the daily charts for both GLD (ETF for gold) and SMH (ETF for semiconductors) and arrived at the conclusion that they bear an uncanny resemblance to each other.

After all, they both have enjoyed a steep multi-month uptrend and are gapping up aggressively today, the former on happenings in Japan and the latter off the AMD/OpenAI news, among other factors.

The key difference, of course, is long-term sector positioning and sentiment.

Even though gold has been acting great you would be out of line to declare it in a bubble, especially when considering other precious metals and (still) cheap precious miners, as underweight as they are on the books of fund managers and retail players alike.

Semiconductors, meanwhile, especially those with anything to do (or say) with AI, are the hottest things going in a sector which has, by and large, led equities since March 2009. Furthermore, in terms of valuation there is no comparison: Precious miners remain dirt cheap compared to chips.

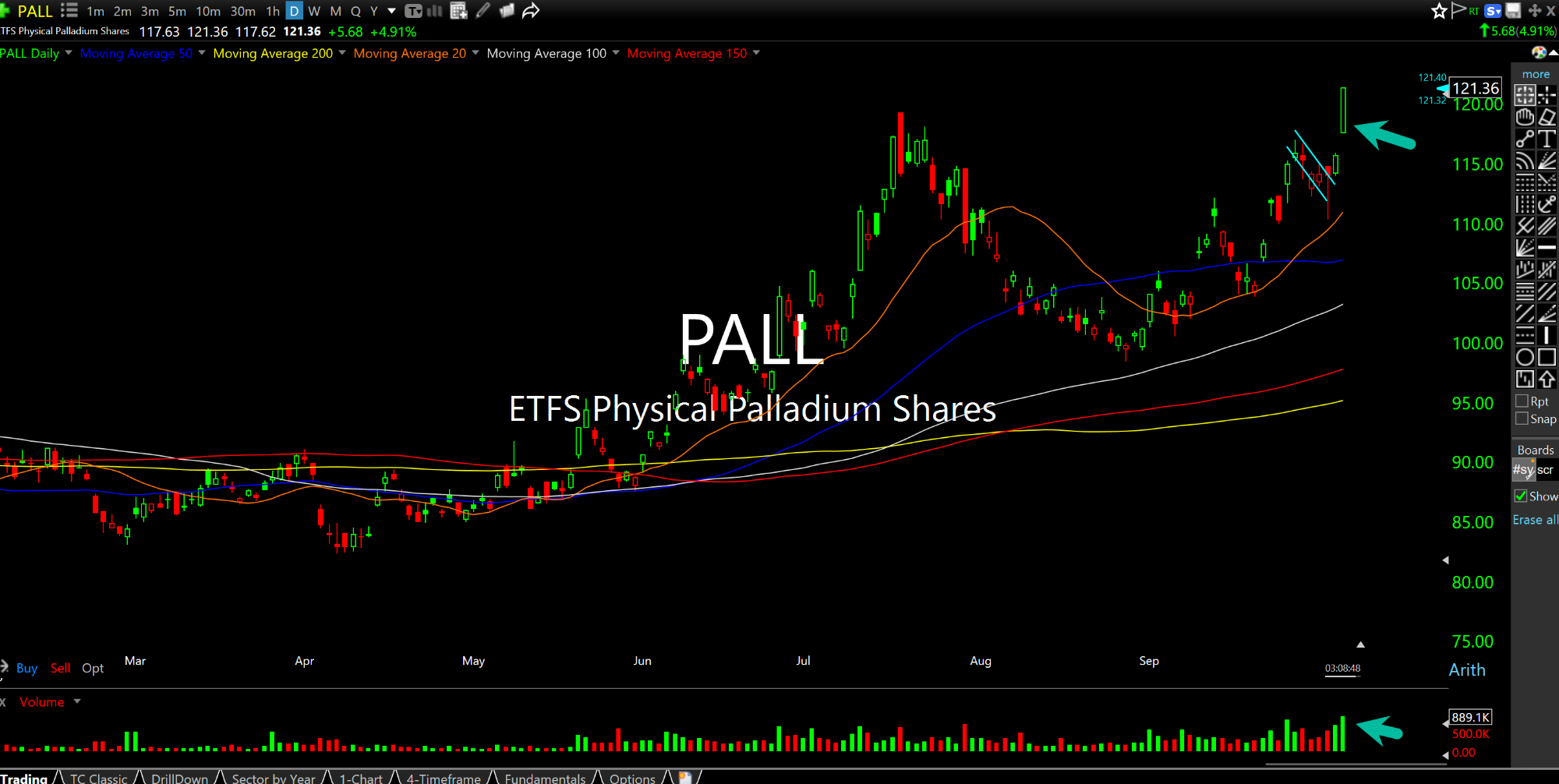

Beyond that, within the precious metals we have one of the hallmarks of a new bull market: Locking in some gains on very extended parts of the sector like some precious miners, and rolling them down to Palladium, which was well set-up headed into this week as profiled here and with Members.

On the PALL ETF daily chart, below, we can see the "roll" of capital down to Palladium from other parts of the metals/miners, as the bullish cup and handle patterns breaks higher on strong buy volume (bottom pane).

No Consolidation Lasts Forev... Change the Seasons, But Not ...