20Oct2:13 pmEST

A Tough Score to Take Down

Amidst all of the trade war ballyhoo, on top of all of the other swirling headlines about various markets and politics these days, it is likely true that natural gas is the last thing on just about everyone's minds. After all, the commodity has a vicious reputation for breaking the hearts and minds of bulls over a period of many, many years, which is one reason why we have consistently viewed it as a trading vehicle only, good for quick pops here and there, if that. Overall, natty gas prices have endlessly been trending lower or sideways for more than three years now.

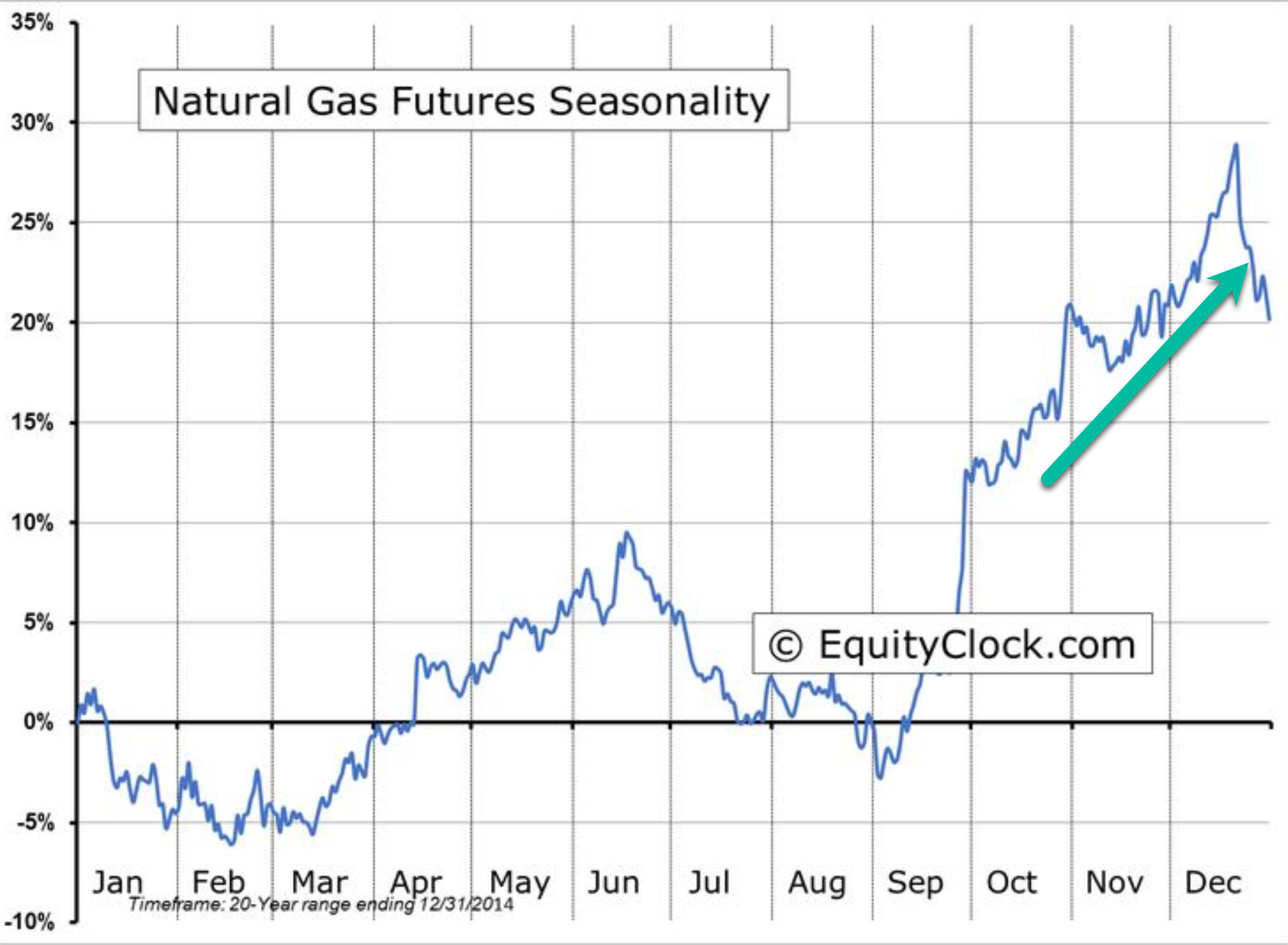

However, as one of our Members astutely noted earlier we have a booming seasonal period for natty gas, as seen on the second chart below for seasonality dating back twenty years.

Simply put, from now until just before Christmas is as good as it gets for the commodity, as the market likely prices in the coming winter. As usual, the markets loves to discount the future. So, if you are waiting for nasty weather in February before buying natty you will probably be too late.

This analysis seems all the more relevant today given the outsized gap higher in the commodity as cooler weather is expected after some warm autumn days.

On the weekly chart for the UNG ETF, first below, can see today's gap up coincides with a weekly bullish RSI divergence (bottom pane), giving long-frustrated natty bulls some light for a reprieve, at a minimum.