27Oct2:27 pmEST

Playing with Fire

Much like with oil, perhaps the only thing really holding back prices from truly getting even more out of hand for the consumer has been the soft ags lagging.

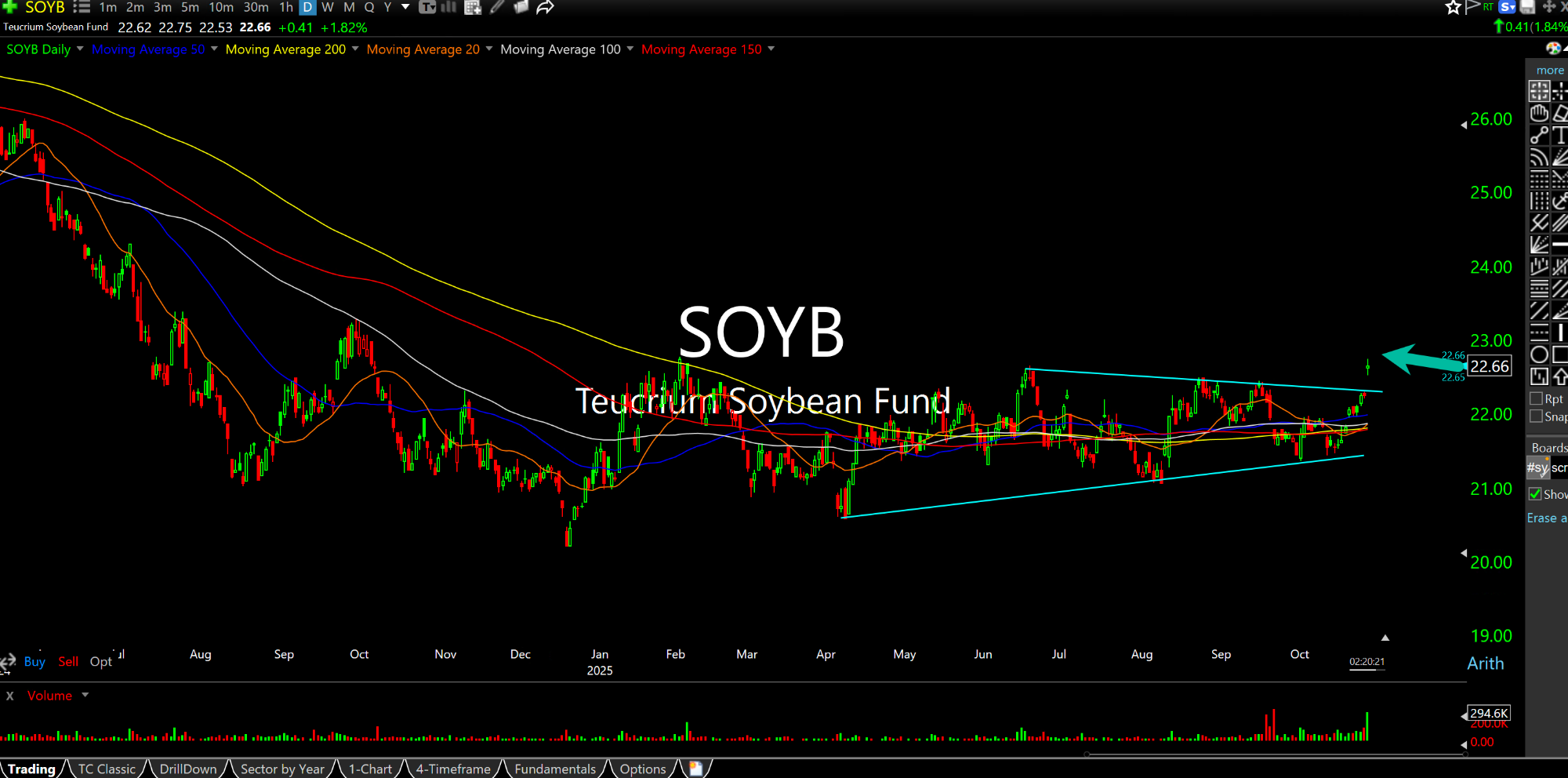

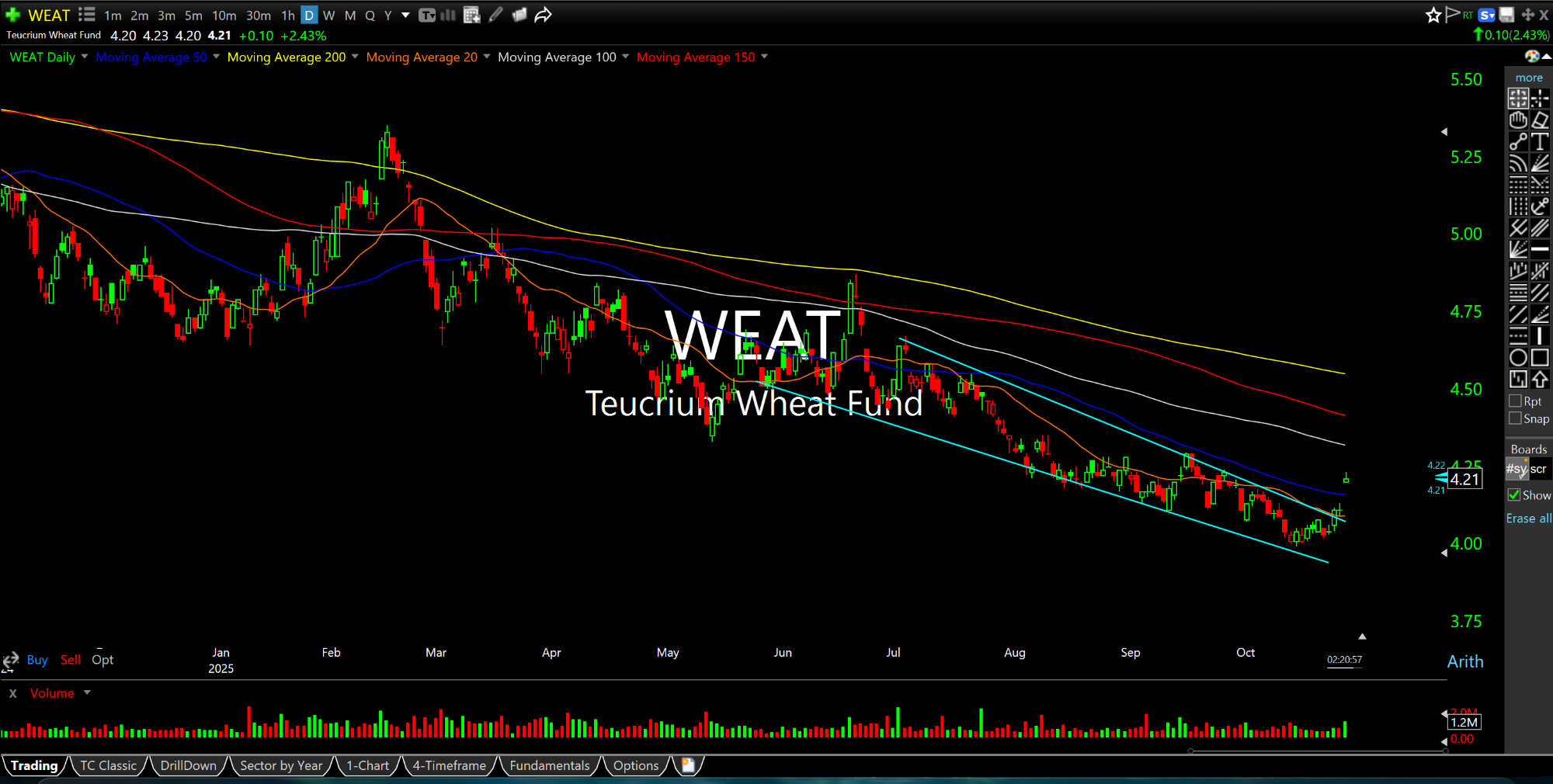

But if that changes and we see corn, soybeans (the latest political football between the U.S. and China) and wheat, all respectively below on their daily chart ETFs/Funds/ETNs, begin to turn higher for a sustained trend we should have an even more serious problem on our hands.

As you can see today is a strong session for the soft ags.

Naturally, virtually no one knows or cares about these moves given the Nasdaq gap up on weekend news of China/U.S. trade tensions apparently easing headed into Wednesday's FOMC likely rate cut.

But, again, with oil and now the soft ags showing signs of life and potential bottoming patterns we should not discount a major inflection points for these long-time laggards and major source of input prices for firms and consumers.