29Oct3:19 pmEST

Strung Out

After the FOMC cut rates 25bps as expected earlier this afternoon, Fed Chair Powell seemed to upset markets by suggesting that the December FOMC would not automatically continue with the rate cutting regime. Of course, as is his reputation, he then seemed to assuage markets by noting that The Fed did not see an asset bubble in AI, which saw stocks climb back to flat and the Nasdaq slightly green as I write this in the final hour.

Thus, today's FOMC is more or less a push as far as equities go, although the bond market is seeing a more pronounced reaction in the form of TLT selling off an rates across the curve moving higher, especially the 10-Year back above the key 4% level.

Going forward, we turn our around to five monstrous earnings the next two evenings: GOOGL META MSFT tonight, then AAPL AMZN tomorrow.

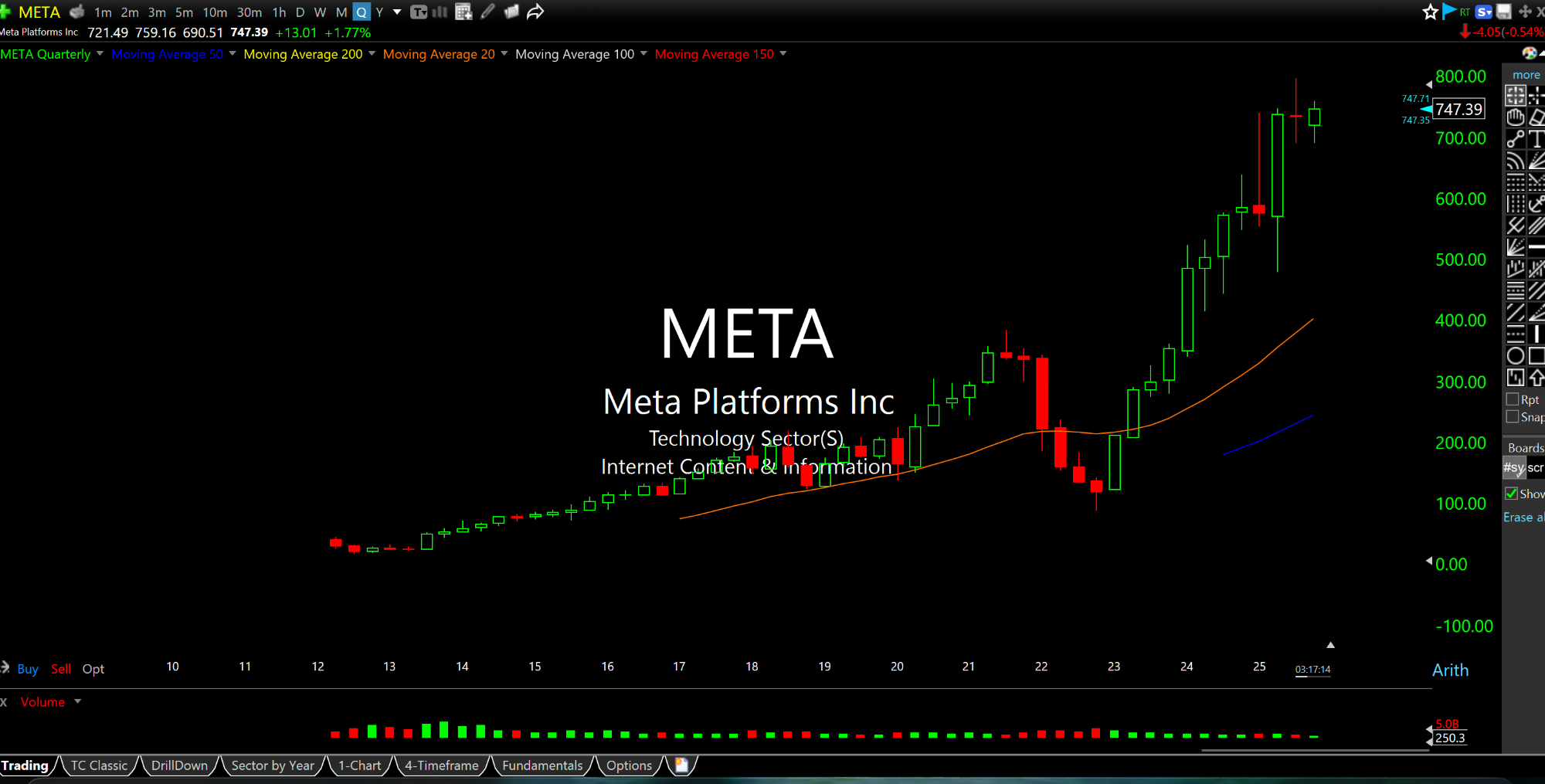

You will note that META, on the quarterly chart, below, has a similar long-term abnormally steep angle of ascent the way Netflix did before last week's earnings selloff. Over the long run large cap stocks typically do not act this way--It is very much an outlier, regardless of what the Fed Chair says. META is indeed strung out on the AI bubble and I am looking for at least a few of the Mag7 names this earnings season to (finally) hit the wall.

Also note the pronounced weakness in the REITS (IYR ETF) and banks (XLF KRE ETFs) being overlooked by many as rates spike higher. Again, this is all happening in the wake of another Fed rate cut.

Once again, the FOMC only controls the overnight rate and not the longer end of the curve.