12Nov3:26 pmEST

Trapped But Plotting an Escape

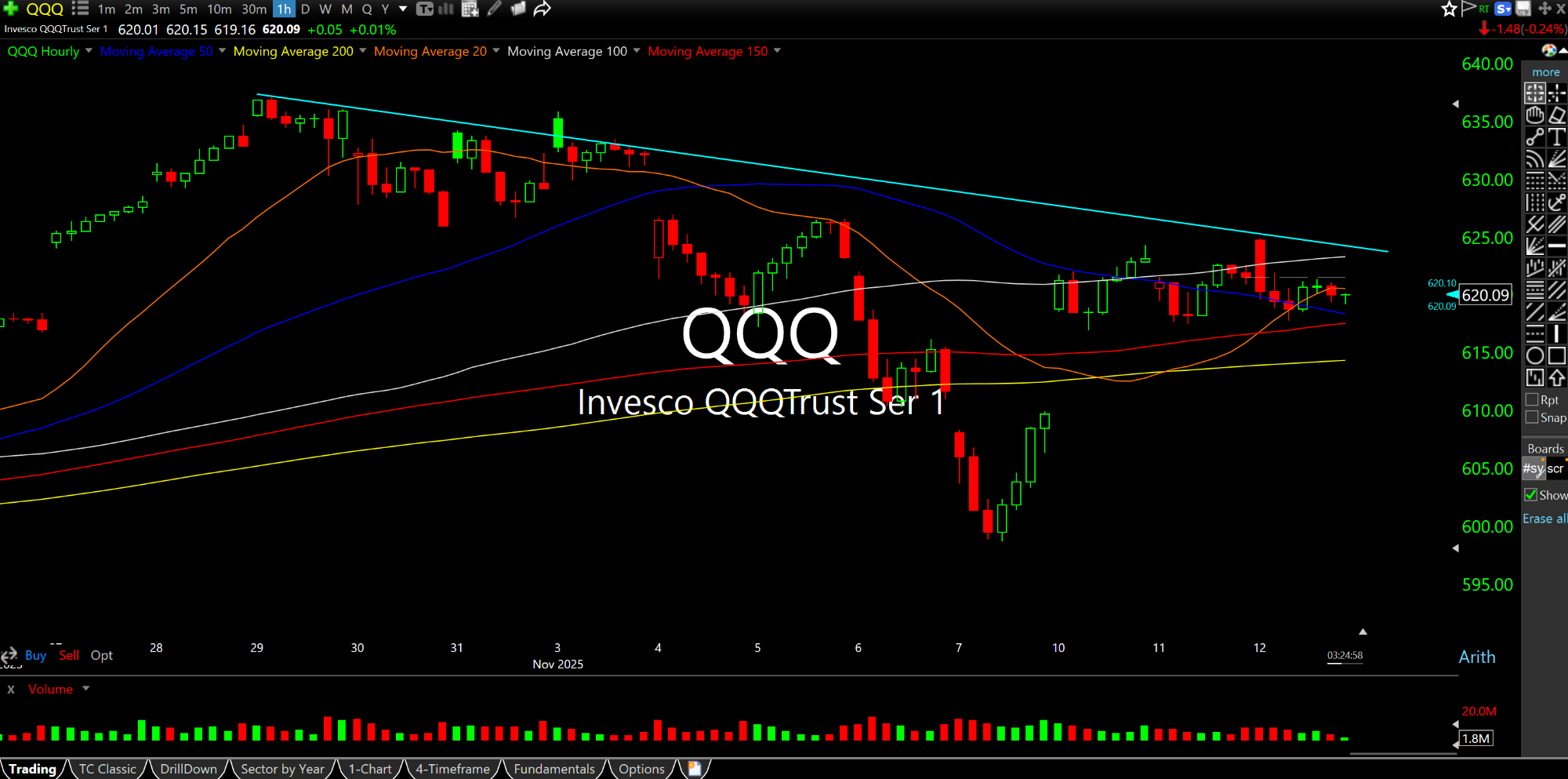

The updated chart, below, of the QQQ ETF, on the hourly timeframe dating back to the October 29th highs exactly two weeks ago, pretty much sums up where the Nasdaq is at the moment. We have a corrective structure in the near-term, with bulls arguing this is but a mere blip before an inevitable end-of-year melt-up, while bears counter that every major top necessarily begins with a seemingly benign short-term top like this one. NVDA earnings are not for another week, and the White House confirmed today that we should pretty much not except any major economic data releases for the time being.

I see two main issues stand out about today's session. First, silver continues to outpace gold, typically a sign of risk-on in the precious complex. Combined with recent jobs market weakness, the silver strength likely reinforces stagflation rather than robust economic growth.

Next, the Dow is getting rotation. Historically, rotation to the stodgy old-hat names in the Dow can be seen as a sign of de-risking, as the likes of hot-to-trot RGTI CRWV continue to unwind aggressively after prior melt-ups.

Ultimately, bears still need to crack the likes of QQQ SMH and the Mag7 in general alongside HOOD PLTR to truly inflect damage on this market beyond a mere pause or pedestrian dip. You can be sure that the Treasury Secretary and President are doing everything they can and say to talk up stocks around the clock, which adds to the stakes of NVDA next week and the corrective pattern, below.