13Nov1:56 pmEST

Diminishing Returns

We are seeing a fairly steep broad sell-off this afternoon. And, perhaps, of even more significance is the fact that the likes of CNBC is struggling to assign a reason for said big move. It is often said that when markets sell off on (seemingly) no news it can be seen as all the more bearish, as opposed to headline-drive swoons.

Of course, one would say the sell-off is driven by concerns of a Federal Reserve suddenly much less dovish and not inclined to cut rates again at the December FOMC. There is also the issue of unknown macro data due to the government shutdown, in terms of GDP and the labor market, not to mention the CPI report we did not receive this morning. And then there are the growth/AI monsters this year like HOOD PLTR RGTI which are suddenly getting walloped.

On top of all of that, President Trump objectively had his worst week as a politician in many years and, perhaps, ever, with much uncertainty going forward about his tariffs, H-1B policies, stimulus checks, and of course the Epstein risk lurking as a Nixon-type of 1974 scenario (the stock market did not do well during that time).

But markets largely knew about these issues leading up to today, anyway. Hence, identifying the one golden reason for this sell-off seems like a fool's errand.

Instead, what we can say with more vigor is that the tech/AI trade is experiencing that stubborn principle of diminishing returns, as defined by adding more of one input to a production process, while keeping other inputs constant, will eventually lead to smaller increases in output.

Applying that definition to markets, the more "pumping" of tech stocks we have seen by the White House, bullish analysts, bulls in general, high profile CEOs, the less returns longs are enjoying. In fact, these marquee names are beginning to turn the other way.

Even looking downstream from the Mag7 and semiconductors, it gets much worse for the likes of the software stocks.

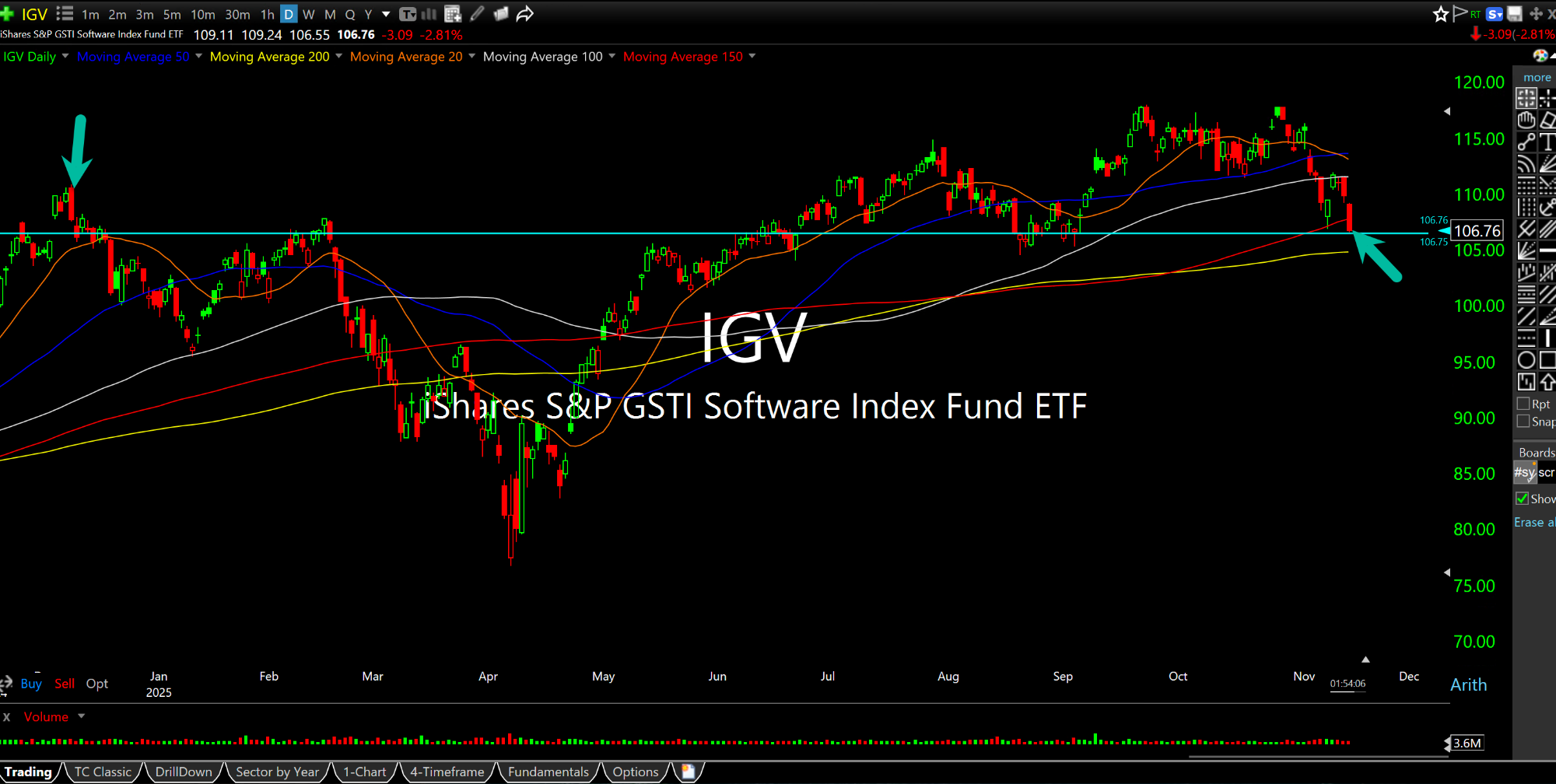

On the IGV ETF daily chart, below, the software sector is back below its 2024 highs (left arrow). After a recent weak bounce, the risk is now of a major breakdown on a multi-quarter basis.

Trapped But Plotting an Esca... Afternoon Update 11/14/25 {V...