28Nov9:38 amEST

Hey CME, Turn Those Machines Back On!

Futures were halted for ten hours overnight, as traders were not been able to buy or sell CME futures and options, including for U.S. indexes, Treasuries, metals, and oil due to "cooling problems" at a key data center. Conspiracy theories aside, the precious metals and derivative miners are flourishing here, following-through on the setup and strength we noted pre-Thanksgiving both here and with Members.

As I write this on a half day (markets close at 1pm EST), silver, palladium, and platinum are leading the sector higher. I still view part of this overall sector strength as the precious metals pushing back against the nonstop dovish wishes out of the White House all the while trying to talk away inflation as nonexistent, coupled with a Federal Reserve with an obviously dovish inherent bias. And Congress offers the cherry on top with no backbone in sight to actually cut spending.

As per the 1970s playbook, not to mention common sense and logic, the metals should continue to thrive against this backdrop.

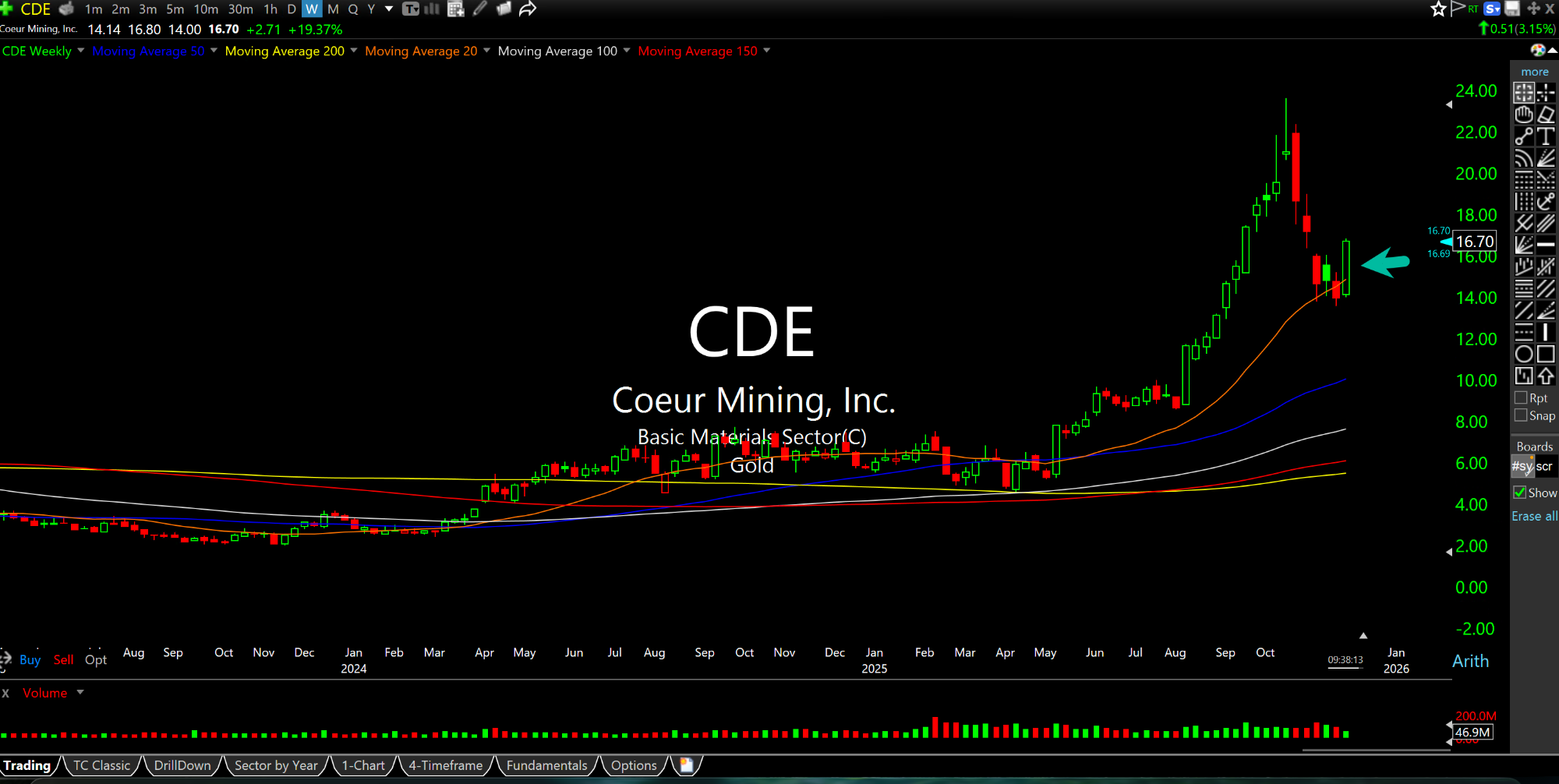

Regarding fresh ideas, keep an eye on catch-up precious miners like Coeur, below on the weekly chart bouncing hard off its 20-period weekly moving average after the October correction.

Tremendous Moxie for Their S... Nothing Ever Happens, Right?