09Dec3:01 pmEST

It's the Print After the FOMC That Matters

Both rates on the long end of the curve and precious metals/miners have been heating up as we head into a likely 25 bps rate cut (of the overnight, or Federal Funds, rate) by The Fed tomorrow afternoon at 2pm EST.

At first blush it would seem that the metals and government bond markets are signaling to The Fed a view I have personally held for a long time, that easing into an environment with entrenched inflation has too many deleterious consequences to not only the economy but society at-large. However, the powers that be seem to dismiss that view out of hand, instead preferring to continue down the road of historical government spending and seeing nominal GDP growth at any and all costs, while The Fed is infatuated with any weakness at all in the labor market as an excuse to turn a blind eye to inflation above target for years on end.

Ultimately, the true test is how bonds and metals react well after tomorrow's events, particularly Fed Chair Powell's presser in the immediate wake of the FOMC statement in the late-afternoon portion of the trading session.

But the setup its clearly present: Rates on the 10-Year have been working through a multi-year symmetrical triangle after a ferocious rally off the pandemic lows. And silver continues to lead the metals, with platinum surging today, too.

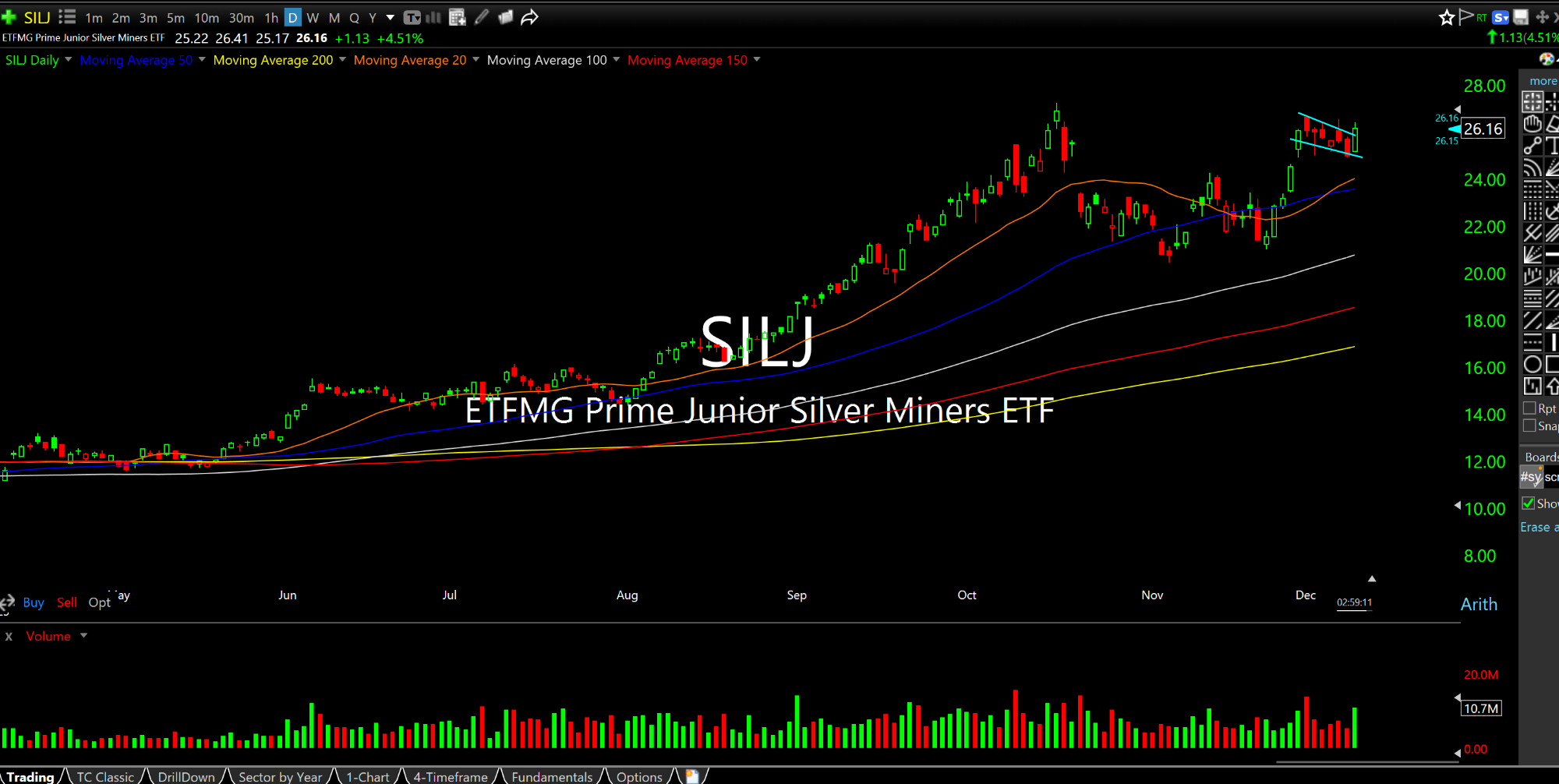

The junior silver miner ETF, below on the daily chart, is about as bullishly set-up as one can hope, with a tight flag in the context of a smooth uptrend for SILJ. Names like EXK SVM should be stalked.

It is a sad reality, but one I have had to accept, that The Fed and Congress/White House will simply continue down the easy-way-out road of printing and easing in lieu of crushing inflation once and for all unless and until the bond market and metals spiral out of control to the point which forces their hands.

Make no mistake, the consequences are far worse with inflation than deflation for America, despite what many have said to the contrary--All you have to do is know your history to understand that embedded inflation absolutely destroys society as we know it in due time, whereas deflation is a painful but necessary part of the business cycle in capitalism which ultimately sets up wonderful opportunities.