10Dec3:26 pmEST

Non-Inflation Inflation, Non-QE QE

Today's presser featured Fed Chair Powell acting like the lamest of ducks, with his tenure set to lapse next May 2026. He acted like a Fed Chair who knows he is leaving behind a bloody mess but he, once again, did not have the intestinal fortitude to do anything remotely close to the right thing in order to try to get inflation down to target after five years of failing to do so.

Even with the likes of MSFT NFLX NVDA all red (and MSFT NFLX notably breaking down), the broad market liked the dovish presser enough, including the announcement that The Fed will begin Treasury Bill Purchases on Dec. 12th, in effect "non-QE QE," to surge with small caps leading higher.

Naturally, this market reaction has me returning to the precious metals and miners. After all, if Powell has no heart to fight inflation anymore then why shouldn't the metals and miners have the green light to shoot for the stars?

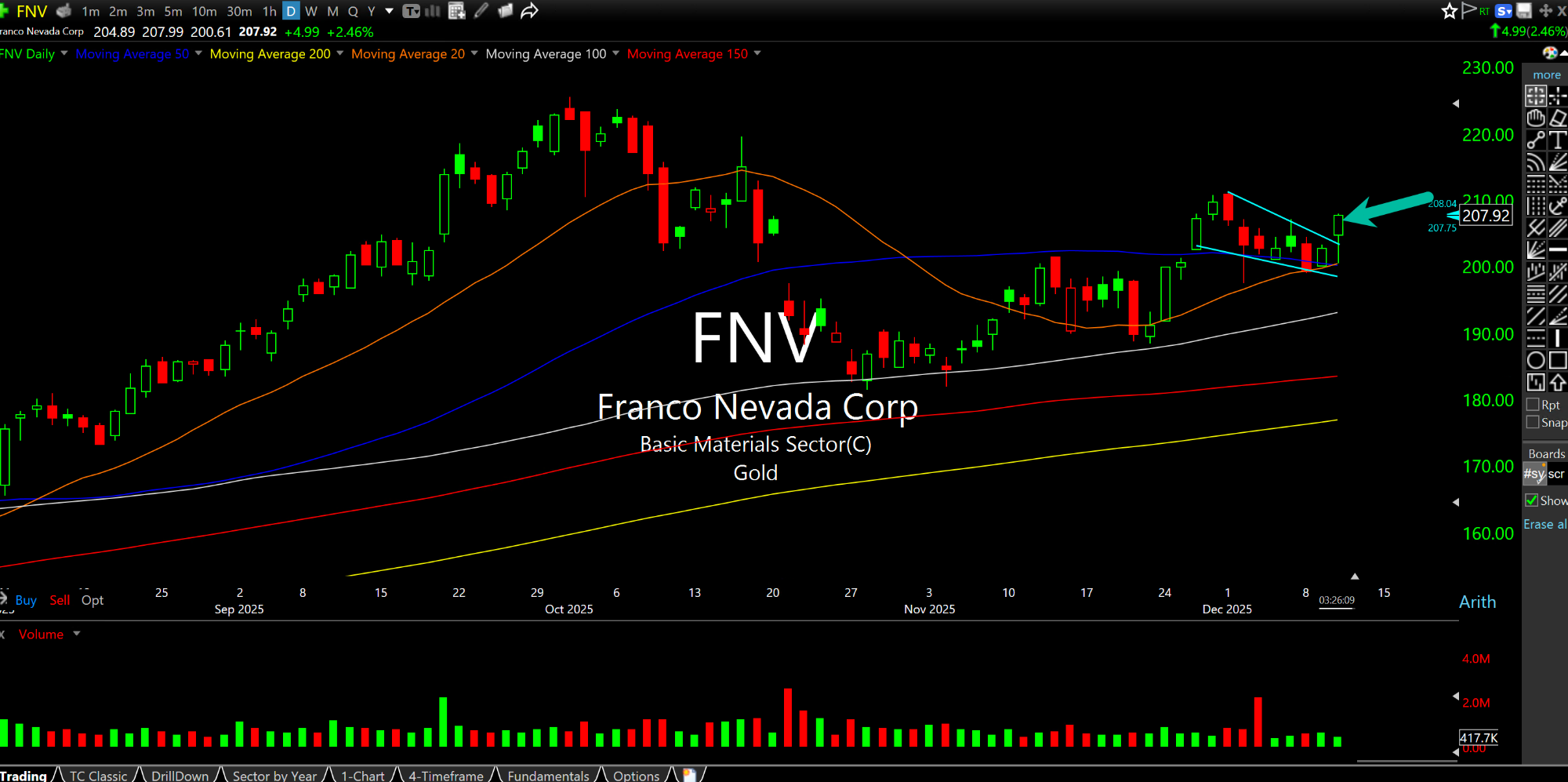

On the daily chart, below, we have another finely setup precious miner in Franco-Nevada Corp.. Most miners have this pattern, with an orderly consolidation in the context of a prior uptrend.

Equities, of course, still may charge their mind after a night to sleep on today's FOMC. Also note that rates on the 10-Year are, suspiciously, barely down on all the rate cut/non-QE QE news.

It's the Print After the FOM... 'Til I Gain Control Again (R...