15Dec3:01 pmEST

It's Starting to Come Together, Pepper

I am going to present two noteworthy RSI divergences to price on the charts, below, which are highly relevant to the current market situation headed into 2026.

For reference, the RSI is simply the "Relative Strength Index" used to identify changes in technical momentum. Above 50 is generally considered a bullish RSI, with above 70 viewed as overbought. Trending below 50 is considered a bearish RSI pattern, with below 30 considered oversold on any given timeframe.

However, we also look for divergences, where price makes a new high or low in the context of a prior steep trend, either way, but the RSI fails to confirm said new high or new low.

On the first weekly chart, below, we have AVGO (Broadcom) following-through lower after last Friday's heavy selloff post-earnings. The prominent semiconductor stock has been in a uniquely steep uptrend since at least April of this year and frankly, for many years before that. But on the bottom pane of the chart you can see the RSI failing to confirm recent highs.

Beyond that, and perhaps of even more significance, is that the RSI divergence was already established well before the earnings selloff. We always like to examine multiple timeframes for this reason, as the steep uptrend eventually becomes the equivalent of a too-stretched rubber band prone to snapping. Given AVGO's status as a major chip this development seems even more important headed into 2026.

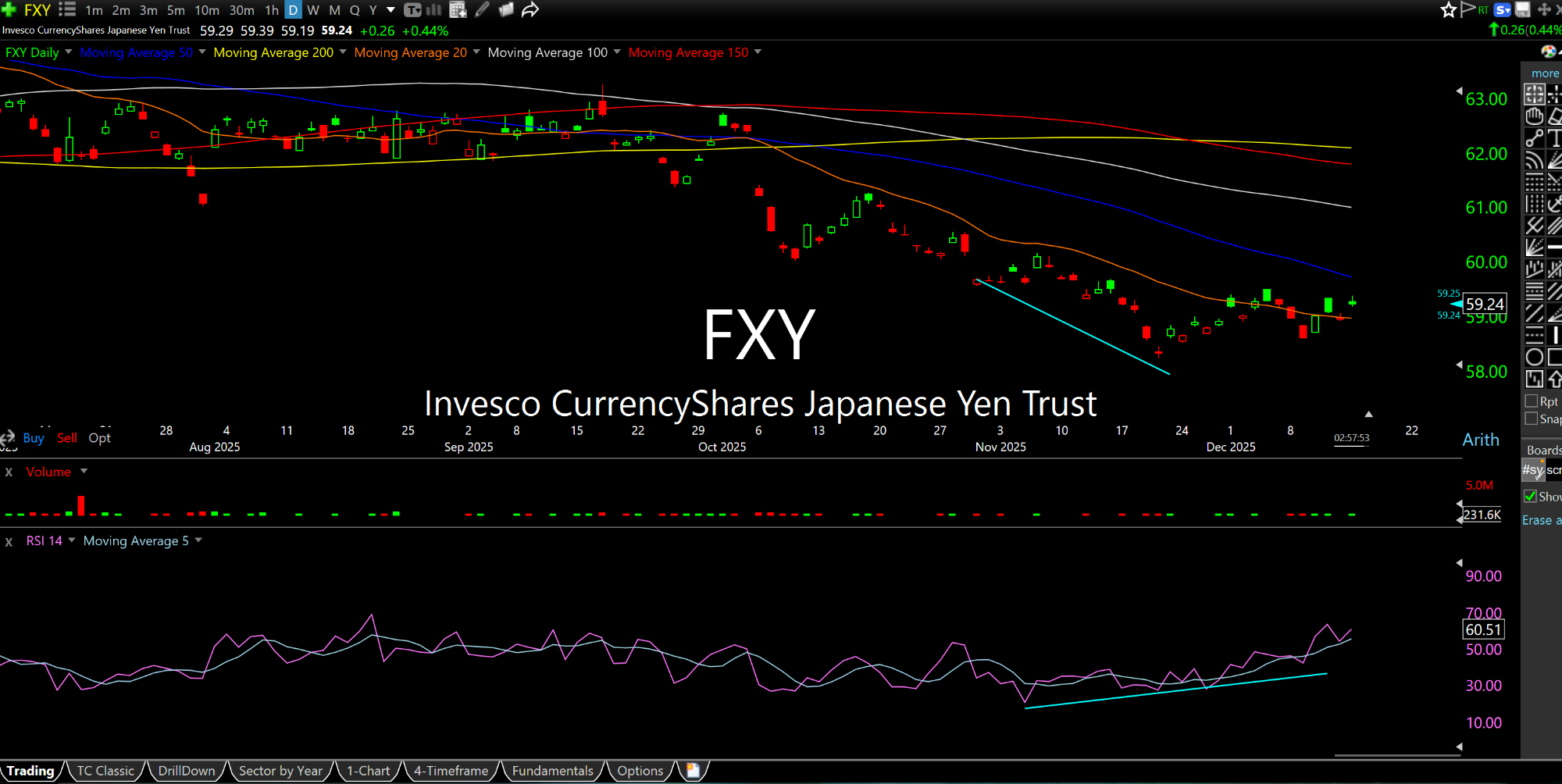

On the second chart we have the Japanese Yen current ETF daily timeframe.

Note the Yen sporting a bullish RSI divergence to price, the opposite of AVGO, suggesting the Yen may have put in a good low.

With the Bank of Japan expected to hike rates later this week there is a legitimate risk of the Yen carry trade (borrowing a cheap Yen and speculating around the world with it, oftentimes in high beta stocks in America) unwinding aggressively as money returns to Japan and rotates out of America. I recognize there are views out there warning that this will not happen and not to worry. But that seems a bit too rose-colored. After all, if market has been a one-way move for this duration of time it stands to reason that Japan tightening while The Fed is easing and doing non-QE QE could easily unwind many leveraged trades.

Afternoon Update 12/12/25 {V... Beer and Circuses, Blockade ...