17Dec9:47 amEST

Beer and Circuses, Blockade and Puffery

President Trump said he will deliver a White House address in primetime tonight at 9 p.m. EST., likely recapping his first year in office and also likely at least touching on this full blockade of some oil tankers in and out of Venezuela.

Oil has been notably weak of late, perhaps giving Trump the cover to ramp up aggression on an oil-rich country like Venezuela. At first blush I see many experts quick to dismiss any risk of an oil spike on this news, for a variety of reasons. The 1970s, of course, saw the Arab Oil Embargo of 1973-74 which coincided gas lines and stagflation that decade as precious metals flourished.

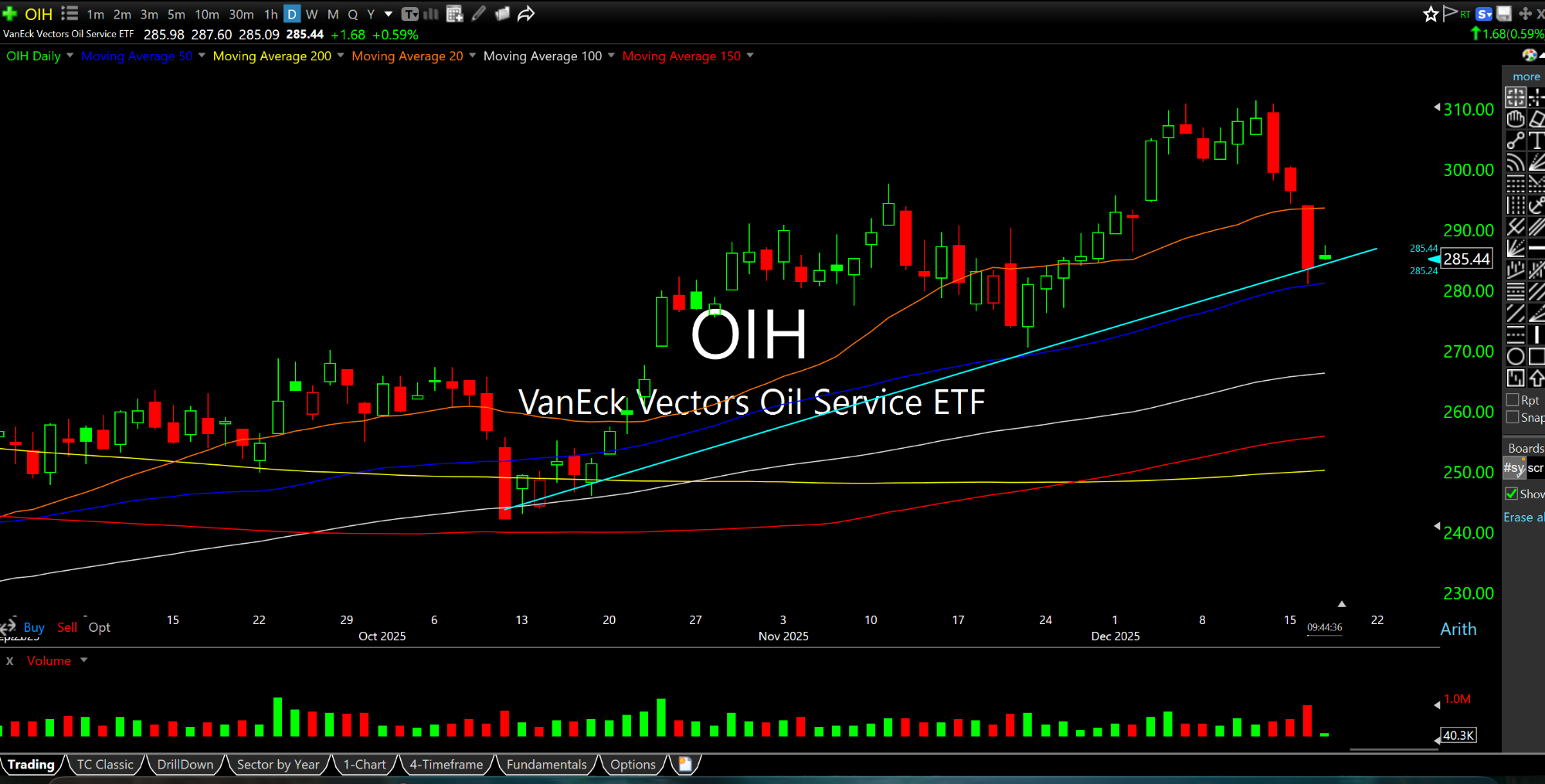

Now, apples to apples is not the way to go in terms of the current cycle. However, we do have silver surging to new highs again this morning. And now even oil, on the ETF daily chart, first below, is at least showing some life by bouncing off prior support in the mid/upper-$60s. Also note the oil services (OIH ETF, second daily chart) are making higher lows for the time being, far from a decisive breakdown.

The Trump speech tonight could also be a tactic for a President with sinking approval numbers in desperate need to turn things around before the midterms next year. The solution, of course, is the polar oppose of what he has said and done since April, however. And that would be to crush inflation via aggressively cutting spending and appointing a hawkish new Fed Chair for next year.

But here in reality, stagflationary pressures persist, even with oil weak. As an example, beyond silver and the metals we have aluminum names red hot of late to little fanfare. Again, these are all major input prices which will continue to pressure producers and consumers alike even as the labor market slows.

It's Starting to Come Togeth... Circular Financing, Circular...