31Dec12:04 pmEST

The Royal "They"

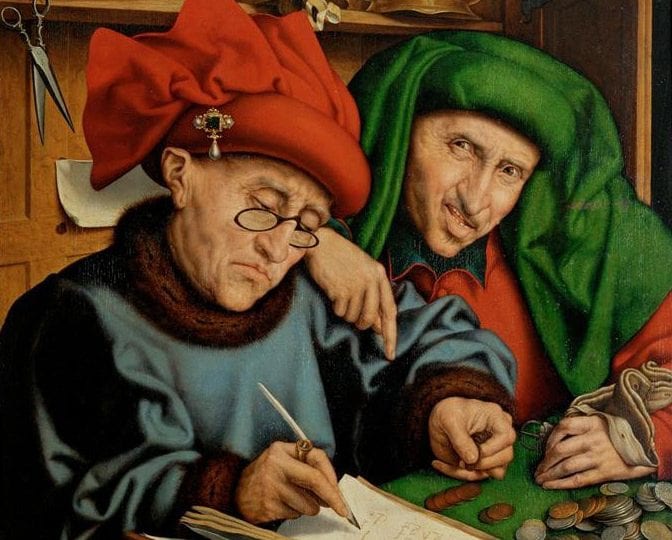

(Painting: Tax Collectors by Quinten Massys [1466–1530])

As we count down the final hours of 2025, equities are mired in an underwhelming "Santa Rally" period, thus far. To be fair, the Santa Rally does not officially conclude until next Monday, January 5th, 2026, at the closing bell. Also, just because the Santa Rally disappoints it obviously does not guarantee a bearish 2026, as no indicator on Wall Street is ever foolproof.

However, in the midst of the volatility in precious metals offering some action (and distraction) for a holiday week, two thoughts about equities during this end-of-year trading seem inescapable to me.

First, the small caps, as seen below on the updated IWM ETF daily chart, could not hold the much-ballyhooed breakout to new highs a few weeks back. Suddenly, the IWM is firmly back below the breakout level (from above $250) without much buying interest yet. Although a close below the low point of the base ($228.90) is required to confirm a false breakout, this action has the makings of a bull trap.

Next, the QQQ (and many mega cap tech names) topped out months ago, on October 29th, a fact overlooked or ignored by many. It remains to be seen if this is the big, bad, top. But certainly a two-month top is something which goes above a basic dip.

And the above analysis on both points becomes even more ominous when you overlay it with sentiment and consider how many folks, especially market veterans, have completely abandoned the teachings of history. A big reason why history tends to repeat, or rhyme, is because we do not heed the lessons.

Specifically, I cannot tell you how many otherwise smart, savvy, market veterans now casually make comments like. "They will simply not let stocks drop." Whether the "they" refers to The Fed, Trump, Bessent, Yellen, Biden, Pelosi, or anyone else, is also irrelevant at this point. Instead, what matters most is the cognitive dissonance between history's lessons and the current landscape where it truly does seem like "they" will not let stocks drop.

As you might imagine, I do not subscribe to the view that "they" fully control the market. The easy monetary and fiscal policies have almost assuredly seen money filter through the financial asset plumbing and into equities for years now. But when the tide turns, I do not believe the seemingly omnipotent Beltway gang will be able to blunt a full-blown bear market. With positioning and sentiment maxed out long, "they" had better be right in 2026.

I wish you all a happy, healthy, and safe New Year's Eve celebration.

All the best in 2026.