12Jan11:25 amEST

All of a Sudden He's Got a Backbone

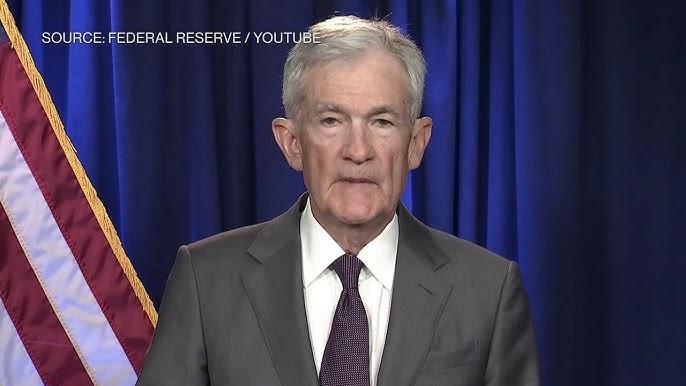

An uncharacteristically confrontational and sharply-worded video response released last evening by Fed Chair Jerome Powell has clearly become the top story for markets today, as Powell said the Department of Justice had subpoenaed the Federal Reserve under threat of criminal indictment.

While equities are largely shrugging this news off as we speak, precious metals and miners are surging, with silver up nearly 7.5% as I write this. To be sure, gold and the metals/miners were already in a bull trend. But the Fed/White House rift has been brewing for a while now, too. And it is no coincidence that President Trump has not yet officially announced his next Fed Chair nominee, with Powell's term set to lapse.

Overall, the precious metals have likely been sniffing out a major issue headed into the midterms in the form of an ugly battle for power between the White House and The Fed, which could easily become much nastier than many expect.

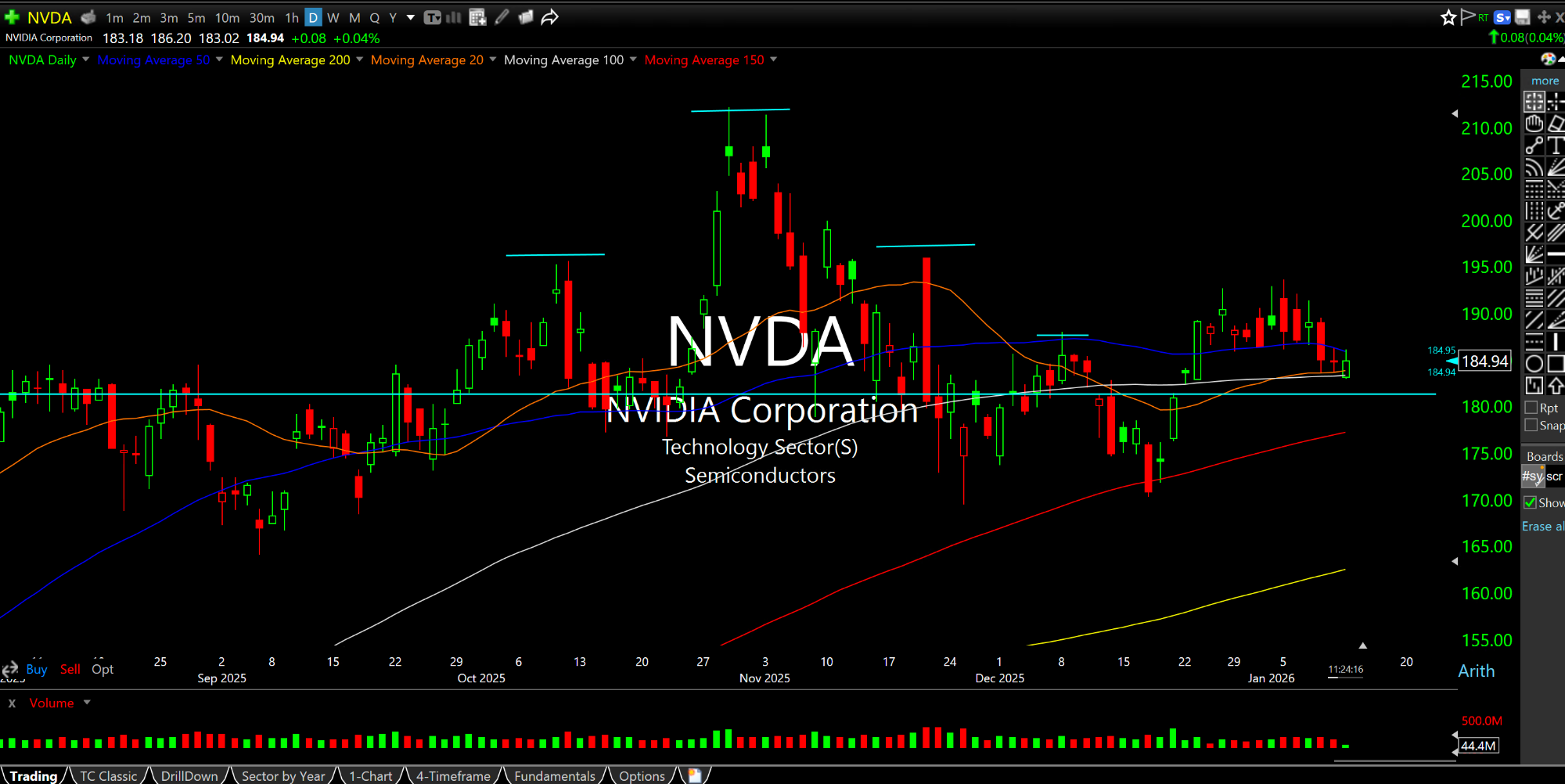

Under the cover of this news, the lingering negative divergence of NVIDIA remains overlooked.

While the semiconductor ETF (SMH), S&P 500, and the Dow are all at or right near all-time highs, NVDA topped out a few days before last Halloween, as seen on the updated daily chart, below. Recall that NVDA remains the largest firm in the world by publicly-traded market cap, even after this recent dip.

Thus, one would think the divergence would be not only discussed but even feared. Instead, in a sign of the times of a complacent market, it is being conveniently ignored as nothing to sneeze at. While NVDA has not yet staged a decisive breakdown (a break and hold below $170 for that), it is hard not to view this overlooked divergence for the market's largest firm as representing a heightened sign of cognitive dissonance on the part of speculators who want to see the fervor carry on at all costs.