15Jan3:31 pmEST

Robinhood: Longs in Tights

One of the consequences of the liquidity bonanza which markets have enjoyed for many years now is that the hottest of stocks which should be forecasting future business leaders of America eventually turn sour and are subsequently ignored by investors and speculators alike.

Mind you, I am well aware of creative destruction in capitalism, and that most stocks over the long run eventually get delisted (just look at some of the Dow components back during the Roaring Twenties and Great Depression and see if you recognize most of those names).

However, the key difference now is that due to the liquidity and passive investing flows, when prior red-hot names like Robinhood break bad the market quickly moves on to the next hot thing without much in the way of a price to pay for the downward spiral of a former leader.

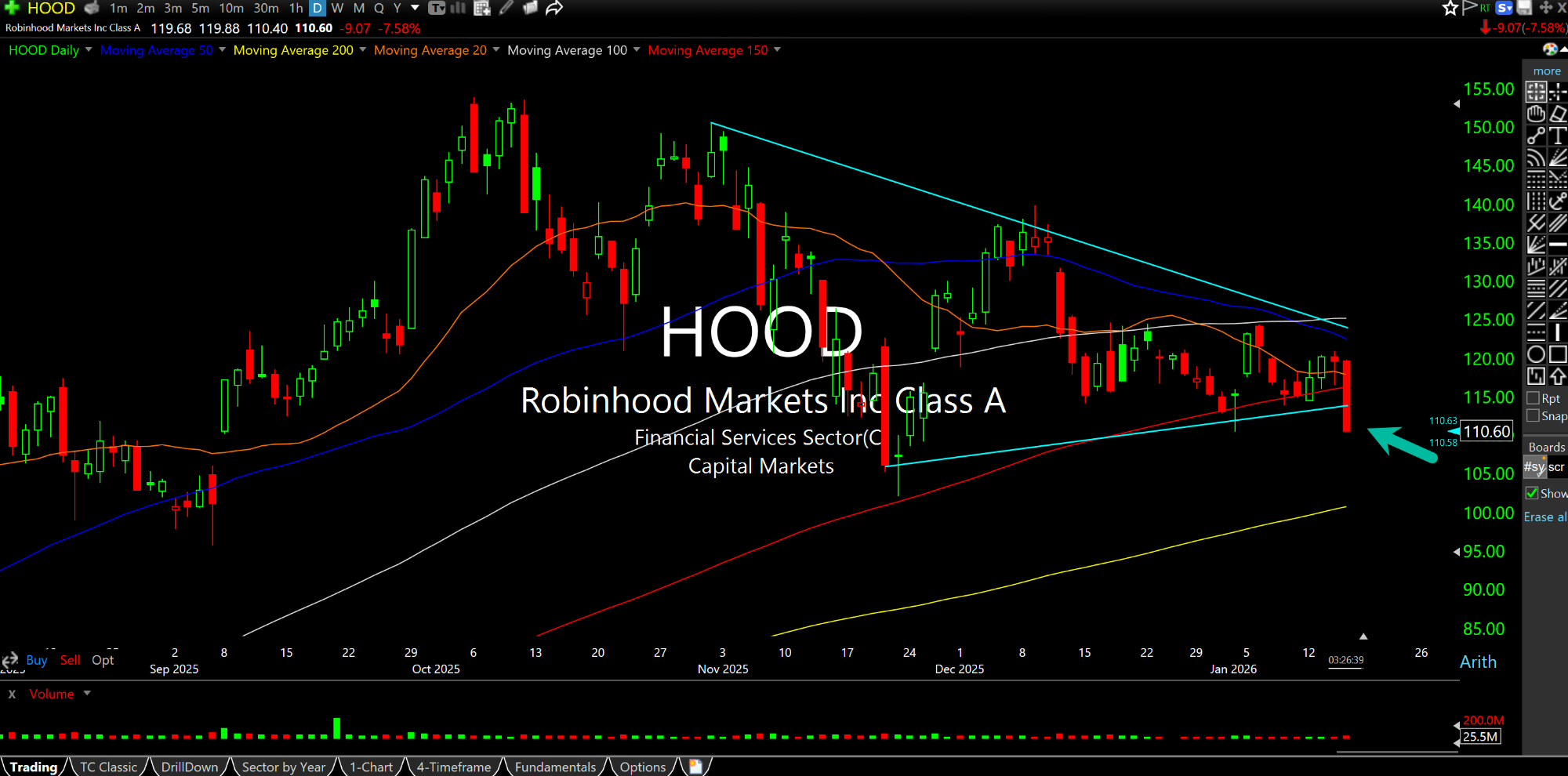

In the case of HOOD, below on the updated daily chart, while the stock remains above its 200-day moving average (for now), unlike META MSFT which have already broken and held below theirs, you can see the breakdown threat again today which is largely being ignored by pundits, investors, speculators alike.

Robinhood topped out roughly three and a half months ago, again to little fanfare, once seen as a pulse on the rise of retail participation in markets coupled with AI innovations. But you have not heard much about that recently, especially with the move in TSM and the semiconductors providing ample distraction from the HOOD fallout today.

Still, Robinhood was one of the true market leaders off the lows last April 2025. And there is a long way to drop if this move unfolds the way it seems to be so far.

Elsewhere, the dip in precious metals and miners looks tame, particularly after the Iran escalation fears last night fell flat. Seeing many precious miners like GORO EXK CDE HL green here seems to add credence to the overall bull case for an early inning long-term uptrend still unfolding.

The Overbought in a Downtren... Sunday Matinée at Market Ch...