03Feb3:31 pmEST

Reminder: This is Still Nothing

The VIX remains below 20 even as software stocks in the IGV ETF slide further with a rather steep angle of descent. Palantir earnings failed to ignite a broad market rally. And the partial government shutdown ending this afternoon failed to spark much for rally, too.

That said, dip-buyers are vocal that this selling is overdone. After all, recency bias dictates that any and all dips are to be gobbled up. And while that still may be the case let us make one thing clear: This broad market volatility remains tame by historical standards. A VIX above 30, for example, would usually get us much closer to actual fear.

However, in this market regime the pattern has been one or two days of pulling back before an immediate spike higher, possibly to new highs.

That may change now, with AMZN GOOGL earnings awaiting us the rest of this week and yesterday's rally stopped in its tracks today. But NVIDIA does not report until February 25th. And I still view the semis, overall, as the big key to this tape. The SMH ETF undercut yesterday's lows, despite TER rallying hard after earnings--AMD and SMCI report tonight.

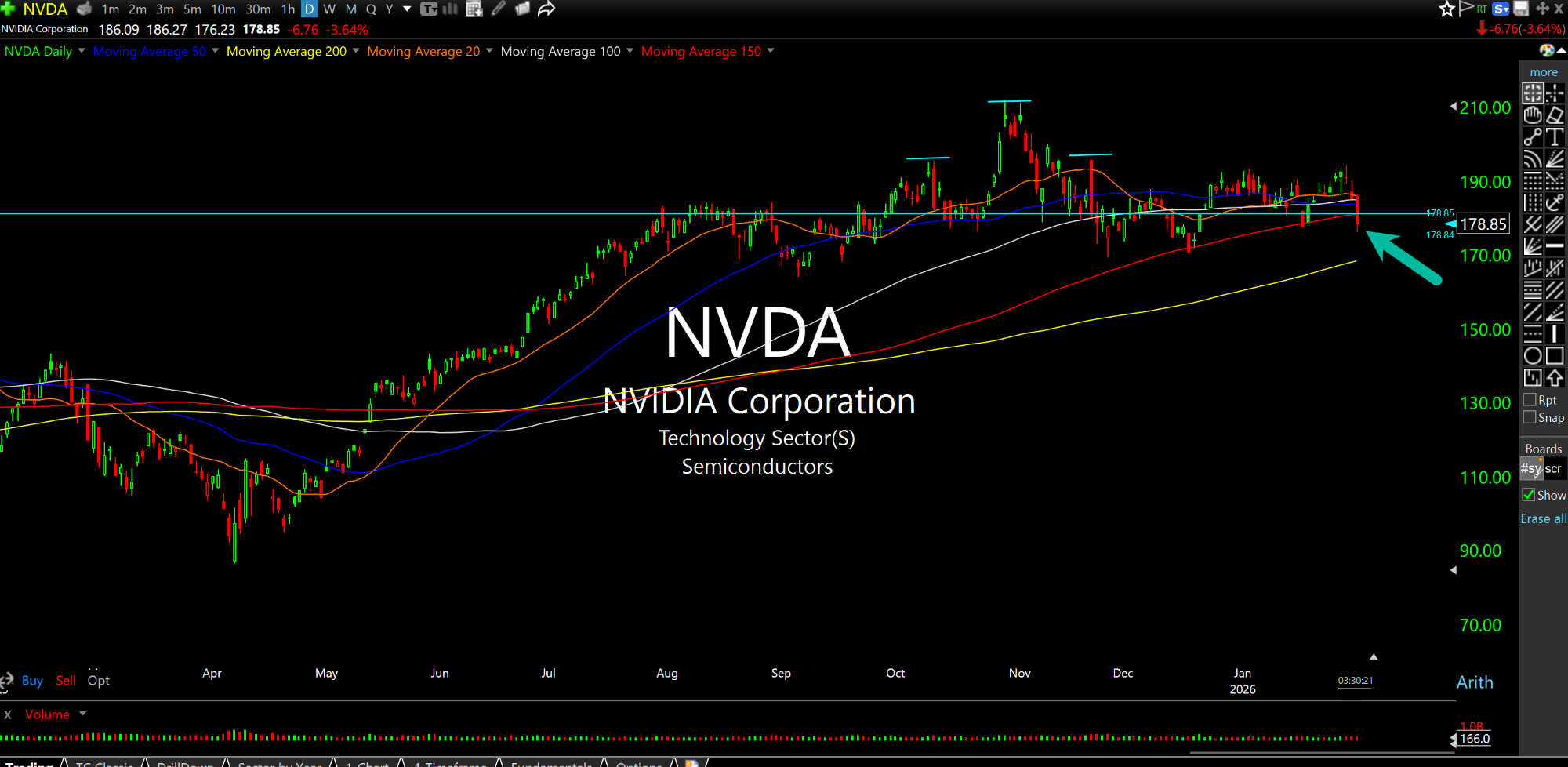

As you can see on the NVDA daily chart, updated below, though, the monster leader has been diverging from its sector for quite some time in a bearish manner. Although the vocal CEO is now trying to walk back any negative OpenAI comments over the weekend, the market does not seem so forgiving this time around.

Watch a move below $170 to confirm a pre-earnings breakdown.