04Feb1:59 pmEST

Pop Quiz, Hotshot!

Are you more familiar with the CEO of Palantir's hair than you are with the actual business model of Palantir?

Are you more familiar with the CEO of Palantir mocking the stock's short-sellers (the stock has almost no more shorts left to squeeze, however) than you are with the actual business model of Palantir?

Are you more familiar with the CEO of NVIDIA's black leather jacket than you are with NVIDIA's circular financing?

These are important questions to ponder as we finally see some actual selling in tech for the first time with any real teeth in several quarters. True, GOOGL tonight and then AMZN earnings tomorrow evening still hold the key for major tells on the mega cap tech leaders.

However, the deteriorating technicals of PLTR (and Robinhood, another marquee growth stock which dominated the final eight months of 2025) cannot be ignored.

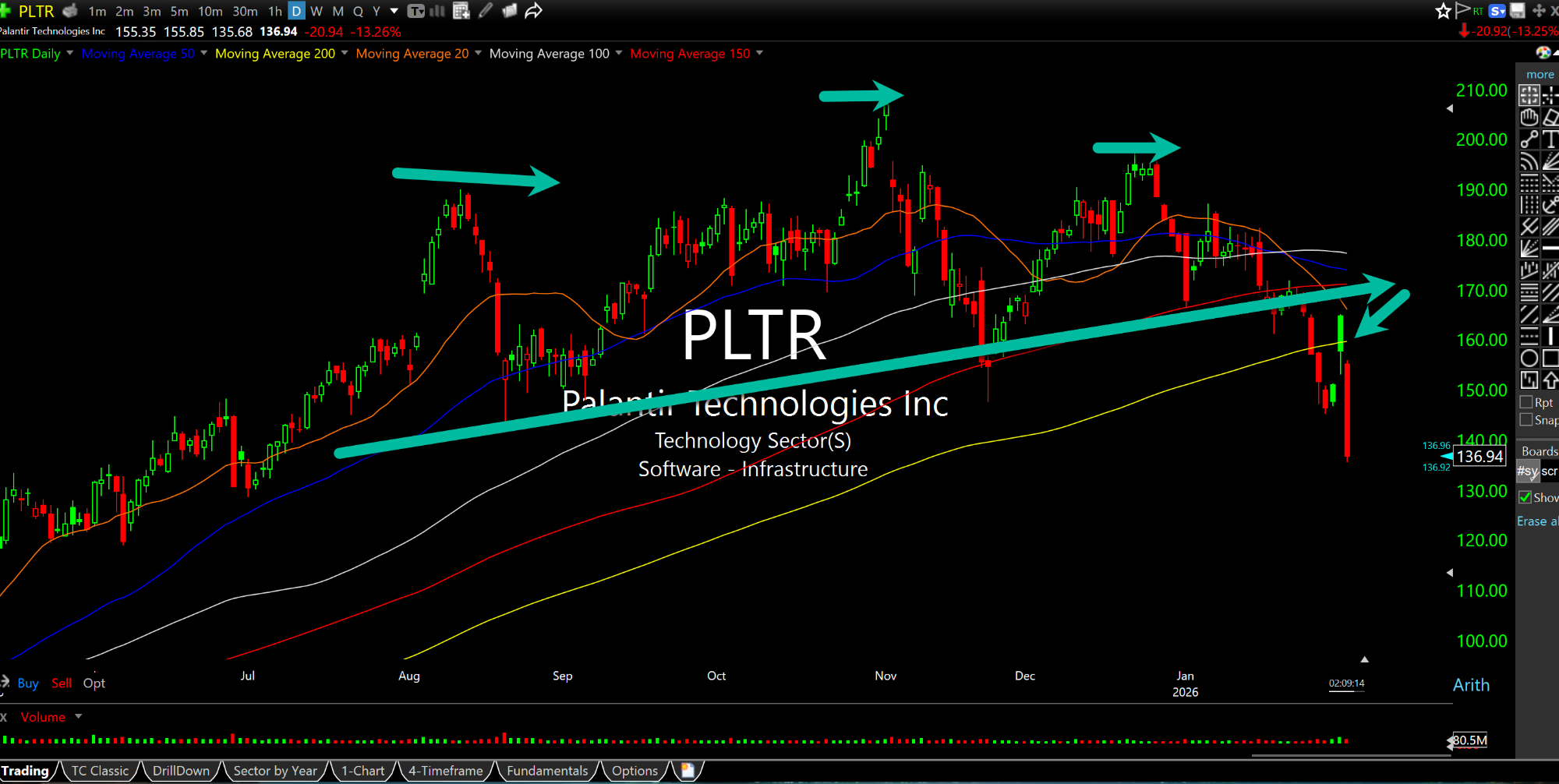

On the updated PLTR daily chart, below, we have yesterday's earnings pop given back, and then some. Beyond that, the failure occurred at the 200-day moving average and the "neckline" support of a multi-month topping pattern.

So unless this is a magnificent bear trap we have the makings of a bonafide top in place for big, bad, Palantir.

Overall, one of the consequences of a one-way melt-up in AI/growth stocks for an extended period time with a loose liquidity backdrop is that it was seen as taboo to even broach the subject of what these firms actually do and how they set up their various businesses and accounting. Now that some selling has set in those are tough questions which will likely need to be considered as longs face their first stiff test since last April, but now from much higher levels.

And all of this is happening as the VIX barely touches 20, indicative of a market which reflects its leaders both at The Fed and inside the Beltway at-large: Hell-bent on doing whatever it can to prevent even a run-of-the-mill correction which, ironically, sets up an even bigger decline if history is any guide.

Reminder: This is Still Noth... Did Bezos Really Leave Jassy...