09Feb1:02 pmEST

Now We're Cooking with Gas!

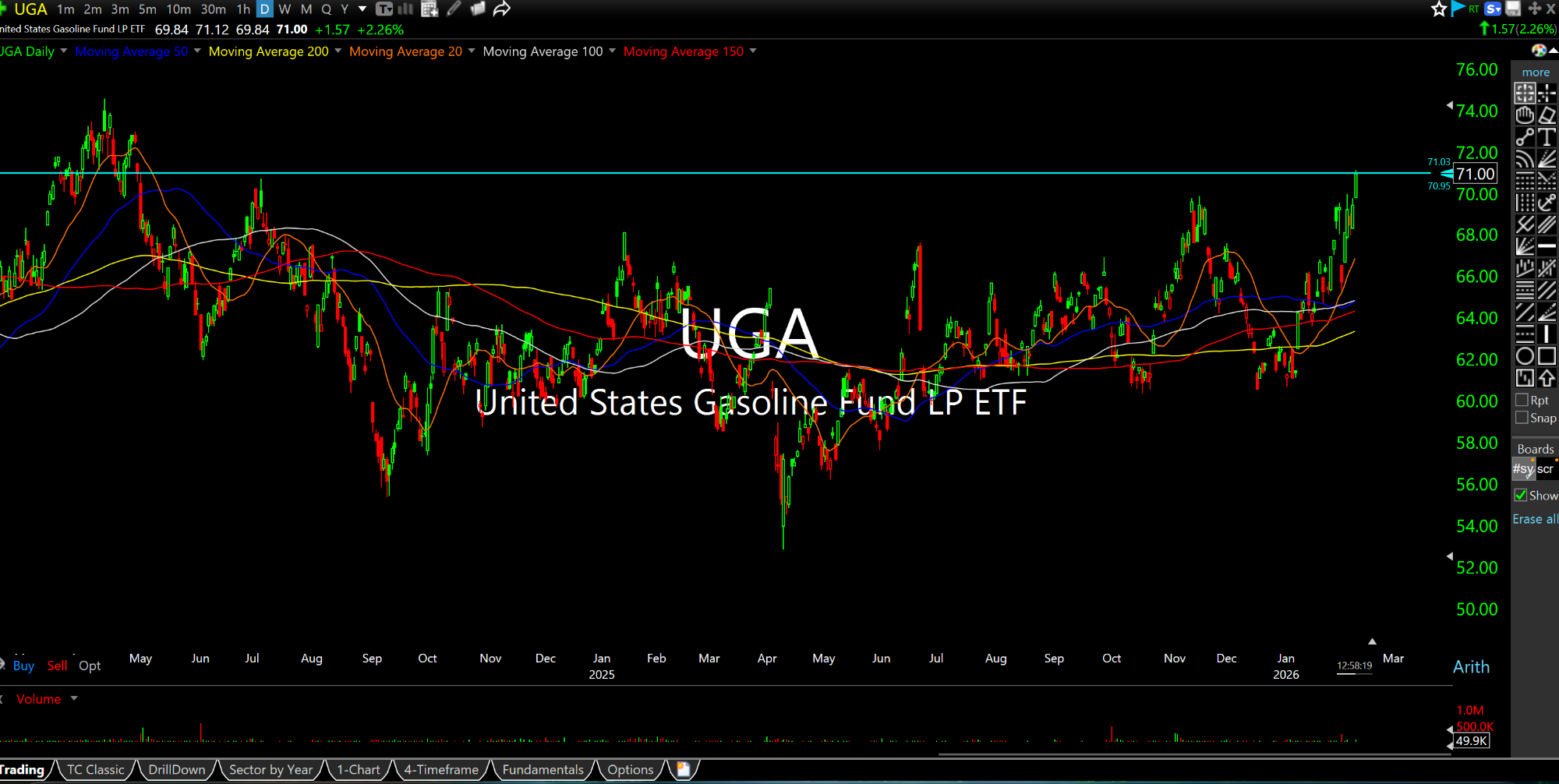

The UGA ETF (below on the daily chart, zoomed-out) tracks RBOB gasoline futures contracts traded on the NYMEX. It is designed to reflect the spot price of unleaded gasoline in lieu of prices at the pump, which of course can fluctuate wildly in differences parts of the country.

As you can see, UGA is trading today at its highest level since April 2024 while crude oil (using USO ETF as a proxy) attempts to break a daily chart bull flag higher. Although UGA is fairly lightly traded in terms of volume it is a good gauge of gasoline prices and perhaps a leading indicator of the energy sector.

Seeing as we are in the dead of a harsh winter in most parts of the country, it is surprising to see UGA surging the way it is. One can only imagine the potential moon shot we have coming in the spring months as we head toward summer driving season and tons of natural demand.

But my view all along has been that if the White House and Congress continue to "run it hot" at the expense of actively reducing significant spending and entitlements, then we should eventually expect oil and gas to defy the deflationistas concerns of a classic recession where oil sinks. Instead, the stagflationary scenario still seems viable, where oil and gas surge into economic malaise, ostensibly exacerbating it.

On that note, gold and silver are right back at it to the upside. I still think they could easily be knocking out wider range consolidations into late-winter. However, the many top-callers in the metals are likely uneasy with the impressive resiliency in recent sessions.