18Feb1:15 pmEST

Checking in on Major General Chess

As noted earlier today both on my main X feed (@chessNwine) and with Members, I am deferring to the price action in crude oil in lieu of bloviating about whether or not America will escalate against Iran. You can be sure there are geopolitical pundits everywhere now, many claiming they have the inside scoop or have picked off a magical tell regarding the military buildup off Iran's coastal waters.

On that note, oil is surging today and sporting a much-improved technical setup. True, this could just be another buy-the-rumor then sell-the-news move, as we ought not rule out the infamous "Trump TACO," where Trump basically softens a given stance considerably in the face of a risk-off move in stocks.

However, I must say that the buzz surrounding a major escalation with Iran, and all of the likely subsequent geopolitical ramifications from it, seems eerily calm at the moment.

After all, an internet meme for a few years now has been making the rounds, stating humorously that "Nothing Ever Happens." This, on top of the "TACO" meme, seems like a recipe for complacency should we actually escalate on Iran.

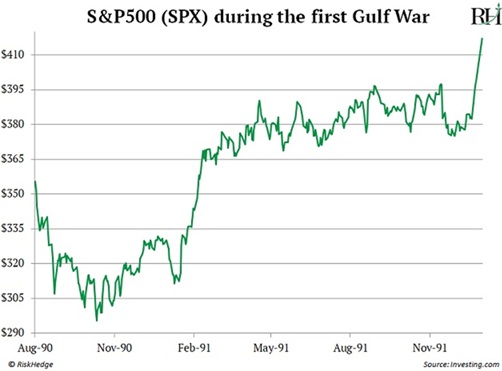

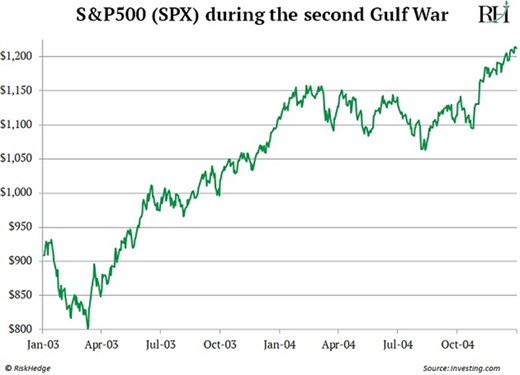

Beyond that, looking back to the first and second Gulf Wars, respectively below relating to their S&P 500 Index performance at the time, we saw a sharp initial sell-off in both cases before an eventual rebound. While many individual stocks have been correcting, the senior indices have not had any meaningful correction (beyond 10%, for example) yet.

Again, this strikes me as complacency.