08Dec10:20 amEST

Biotech Tidal Waves on the Stormy Sea

The wildcard for a the broad market to levitate into year-end continues to be if we see biotechnology sector stage a melt-up higher. This morning, we are seeing just that, with the IBB sector ETF up nearly 2% even as other damage is seen in the market. There is no telling how long a "blow-off" can last, so it is usually best to nimbly play along or step aside altogether.

Specific biotech long setups I have been charting, such as BLUE, are participating in the move. Also keep an eye on CLDX to see if that catches a bid off its 20-day moving average pullback.

Nonetheless, the rest of the market is not too inspiriting thus far. The marquee Nasdaq issues are a mixed bag, with FB GOOG PCLN green, but NFLX TSLA rather weak.

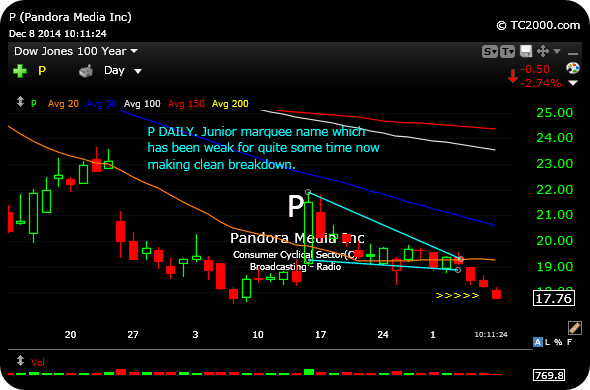

In addition, the three junior marquee names I have been charting as short setups for a while now continue to reflect damaged charts playing themselves out. On their daily charts, below, note the downtrends which P TWTR YELP remain in as they punish longs. They are oversold now, so could easily bounce. But I suspect bounces should be sold into until further notice.

My UNP short is off to a good start, and I would consider adding to it today if the sellers gain more control.

The wildcard for a the broad market to levitate into year-end continues to be if we see biotechnology sector stage a melt-up higher. This morning, we are seeing just that, with the IBB sector ETF up nearly 2% even as other damage is seen in the market. There is no telling how long a "blow-off" can last, so it is usually best to nimbly play along or step aside altogether.

Specific biotech long setups I have been charting, such as BLUE, are participating in the move. Also keep an eye on CLDX to see if that catches a bid off its 20-day moving average pullback.

Nonetheless, the rest of the market is not too inspiriting thus far. The marquee Nasdaq issues are a mixed bag, with FB GOOG PCLN green, but NFLX TSLA rather weak.

In addition, the three junior marquee names I have been charting as short setups for a while now continue to reflect damaged charts playing themselves out. On their daily charts, below, note the downtrends which P TWTR YELP remain in as they punish longs. They are oversold now, so could easily bounce. But I suspect bounces should be sold into until further notice.

My UNP short is off to a good start, and I would consider adding to it today if the sellers gain more control.