24Feb2:22 pmEST

Picking Through the Coal Rubble; Chess Moves

Seeing as natural gas provided me with some fruitful long trades over the past few weeks, it makes sense that coal will now get into the act for some type of snapback rally.

As everyone knows by now, coals have been left for dead, with bankruptcy still on the table for some of them. Nonetheless, quick trades should still be for the taking.

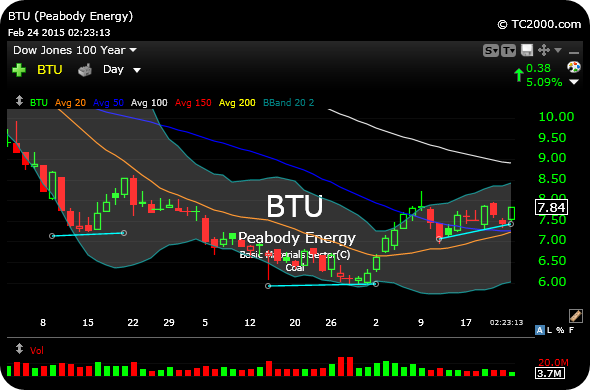

With this in mind, I just went long BTU at $7.80 with a stop-loss below $7.40. This position squats to roughly 4% of my trading portfolio capital.

I am also playing for a short squeeze higher in this coal name, as roughly 20% of the float is short, a high amount.

But, mostly, the daily chart below shows a potential bottoming formation (light blue lines). The recent basing action could easily be some time of "right shoulder" in that bottom.

I am not looking to make any hero calls for a multi-year bottom, though. I will take it one at a time with these coal stocks. But I do see potential for a nice reversion rally to that upper Bollinger Band