27Feb2:07 pmEST

Close to Solving the Mystery

As a follow-up to my previous blog posts and video analysis about the gold miners likely being in the final round of a heavyweight fight before they either cement a major bottom or resume their bear market lower, consider three of the top holdings in the GDX, ETF for senior gold miners.

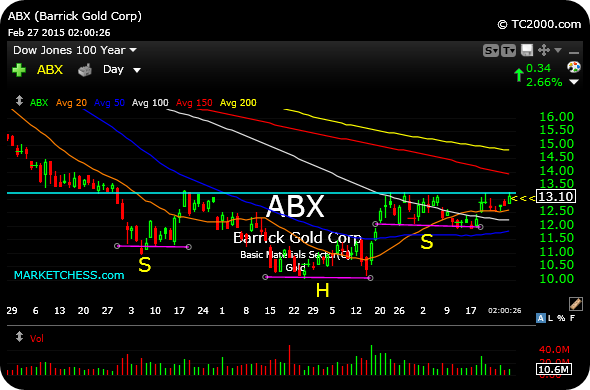

ABX is close to trying to confirm a massive inverse head and shoulders bottom on the first chart, below, of the daily timeframe. Watch $13.25 for a breakout trigger.

GG likely needs to clear $23 to work on its own weekly inverse head and shoulders bottom, on the second chart.

NEM has already been strong and likely needs to clear $27.40 in the coming weeks.

I would continue to key off these for clues as to the GDX's next directional break.

Playing a Quality Setup; Che... Trapping the Big Cat with a ...