29Jan12:43 pmEST

The Real Champion Might Be Gassius Clay

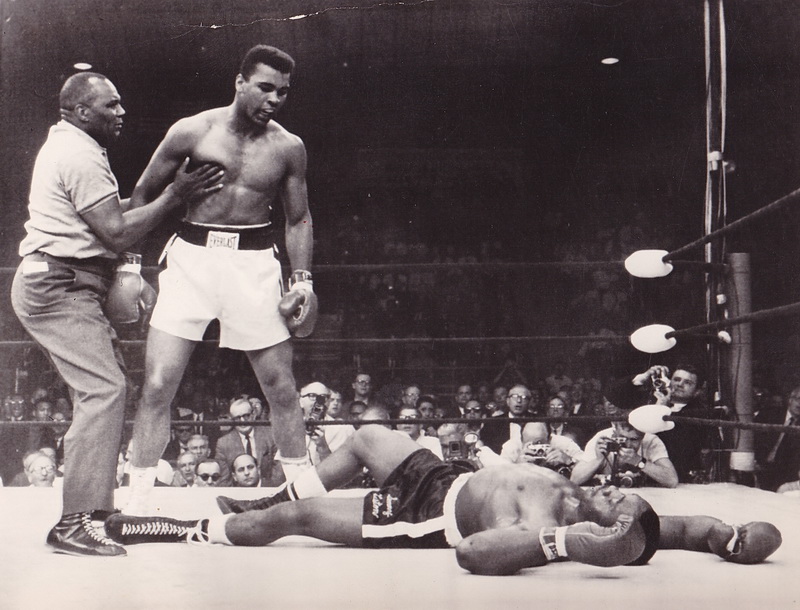

While most market players are closely watching the wild swings in the crude oil pits, what with the constant news flow and apparent (until today) correlation to equities, natural gas may the champion of the two who floats like a butterfly and stings like a bee.

On the daily chart of the UNG ETF, below, holding over $8.40 now would be very impressive into the weekend. To be sure, natty remains mired in a multi-year bear market.

But unlike crude it has plenty of demoralized bulls from recent years who have all but given up on a major bottom, and with perhaps the worst of the winter storms behind us, it is easy to embrace the bear case for natty--Perhaps too easy.

Beyond weather and the supply/demand arguments, however, is the simple gap-fill test we have been watching closely for Members. Specifically, the light blue line illustrates the gap down to the "Slot machine" at $7.77 held brilliantly on a weekly closing basis, galvanizing bulls to make a stand after yesterday's inventory report.

Going forward, for the above reasons I am slightly more interested in playing natural gas long than crude oil, though both may end up enjoying a relief rally anyway.

Setting Sail to Discover the... Let's Hope Zika Goes the Way...