11Mar3:21 pmEST

Ponder This Wedge Over Your Friday Night Dinner

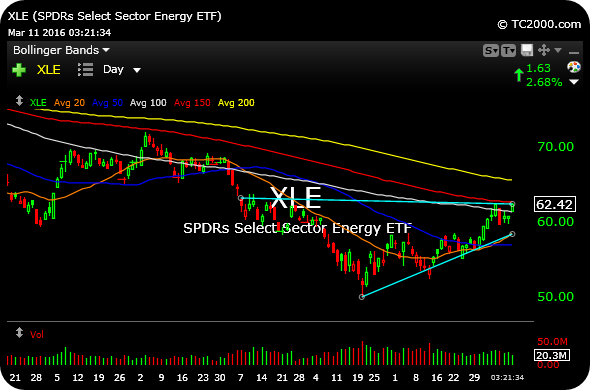

To follow-up on my previous blog post, the energy stocks in the XLE ETF continue to coil tightly below multi-month resistance. And just as is the case with the IWM QQQ versus the DIA SPY, with the former two well below their 200-day moving averages while the latter two are already there, the issue is whether the XLE plays catch-up higher to the likes of HYG JNK next week (HYG JNK both already cleared multi-month resistance with a gap up today).

As you know, there is an close connection between HYG JNK and energy stocks. Given the turmoil in the energy sector in recent quarters, it bears watching this relationship to the upside now, as well.

On the XLE daily chart, below, note the light blue lines indicate a wedge pattern. Over $62.60 early next week, and you can envision a quick XLE move to its 200-day moving average (yellow line) perhaps into the FOMC around the middle of next week.

These are the types of ideas which are tough to front-run, given overall market damage not healed this year. But if the rally continues, it is a good idea to be armed with actionable, go-to setups.

I will discuss this one and plenty more for Members over the weekend.