15Apr2:29 pmEST

You Always Wait Three Days to Call, Baby

On a slow market day, the temptation may be to rush in and stick in a bid for some type "knife catch" and a fast-moving upside play.

However, just as we noted a few months back with the post-earnings disasters that were DATA and LNKD, when stocks see shocking disequilibriums like these, it typically is best to wait three sessions for the players of size to unwind their positions and let those who want out to, in fact, get out.

The Three Day Rule may seem arbitrary, but it typically saves heartache from those times when a massive gap down (or up) will surprisingly follow-through in the coming sessions before being gravity eventually come into play, if only for a bit.

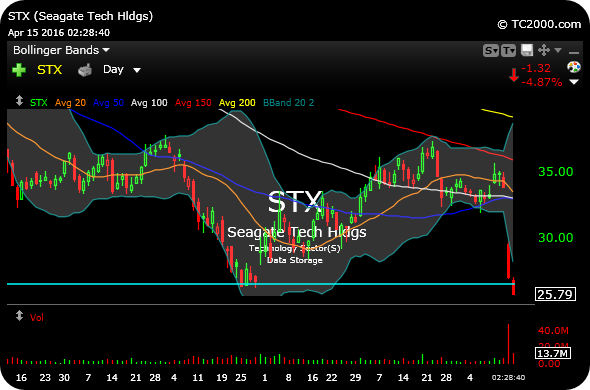

Such is the case with Seagate, an earnings disaster and seen cratering under its winter lows on the daily chart, below.

Clearly, STX is oversold and pushing multi-year lows, which makes it tempting to bottom-fish. But there are likely larger forces at play, namely big market players stepping aside and unwinding positions in light of the latest earnings news.

Come next week, STX may very well be a candidate for a quick, actionable long scalp. But right now, we are on day two and the Three Day Rule should be in effect.