29Apr12:37 pmEST

Better Call Paul

It may very well be just another inflationary head-fake which leads to a deflationary crash, not unlike what we saw in the first half of 2008 which completely unwound in the latter part of the year. But the uptick in inflationary signals is worth noting, beyond gold.

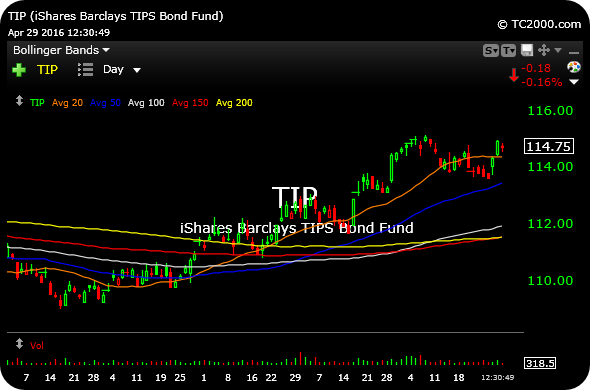

TIPS, for example, or Treasury Inflation Protected Securities, bottomed out over the holidays at the end of 2015, a few weeks before the precious (and global) metals and miners commenced their spectacular rallies, leaving many "Greenspan Boys" in the money management business in a state of disbelief that asset classes are actually capable of defying Central Bankers' wishes (or commands).

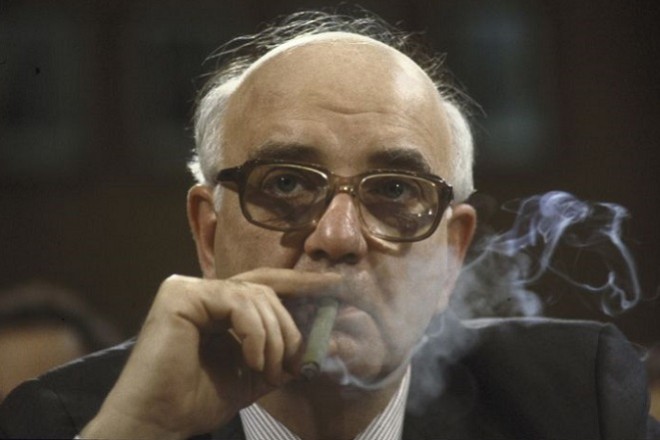

To be sure, these preliminary signs of inflation barely represent an appetizer compared to the inflation feast former Fed Chairman Paul Volcker (pictured above) had to negotiate several decades ago.

Indeed, we are just now coming out of an extended period of secular deflation, with many debt deflationary signs still present. The macro concerns about this apparent contradiction remain to be seen, in terms of whether we are witnessing a certain 1970s-esque "Stagflation," or the extreme bear case of the early stages of runaway "hyperinflation," while bulls will argue this is a mere and rather healthy "re-inflation."

What we do know is that the longer gold and TIPS continue to rally this year without the Fed raising rates again, Yellen falls further behind the curve. The Fed is used to be being behind the curve, and some would argue that is actually where they want to be--Just not too far behind.

The determining factor, then, regarding whether The Fed is appropriately behind the curve or too far behind likely comes down to the rates on the 10-year, as usual.

TLT, for example, staged an initial false breakout earlier this month, as bond bulls try to regroup here to guard against a further reversal lower into the summer months. Should that happen, say, with TLT back below $128 and then eventually $120, the spike in rates will align with the strength in gold, even TIPS, in terms of reality meeting inflation expectations.