19May1:14 pmEST

More Celebration for Shorties in This Sector

The main sector in the broad market we have abhorred, going back a good while, has been solar. Simply put, the technicals in the TAN, solar sector ETF, have been undesirable for as far back as it can be recalled. And, more importantly, the continuos risk of individual solars blowing up, so to speak, has not yet abated. SUNE is one such example, and Elon Musk's SCTY is not much better. SEDG's latest earnings blow-up now yields a daily chart bear flag at risk of breaking down. And smaller players like CSIQ TSL YGE all seem like high risk/moderate reward plays at best.

At some point. solar may very well be the future of modern energy. But the market continues to throw a wrench in that thesis, as evidenced by the weakness even in First Solar, generally regarded as one of the safer plays in the solar sector.

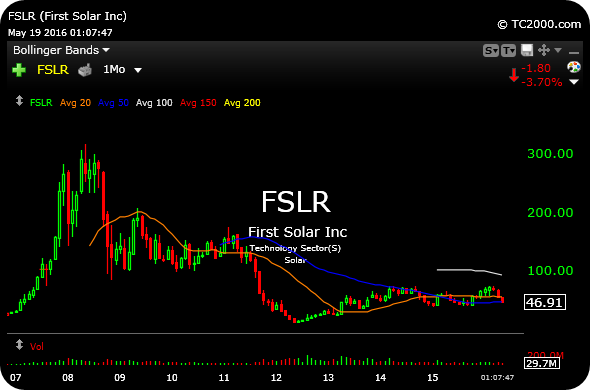

On the FSLR monthly chart, below, note how the name lost more than 30% in recent months. But beyond that, the overall theme of the chart since the 2008 peak is still one of dead money, a lack of clear trend and more sector risk keeping a lid on any upside momentum.

Another bearish wildcard may be the resurgent U.S. Dollar, which can throw a wrench, indeed, on any bull commodity thesis if the greenback turns into a freight train with a genuinely hawkish Fed. Against that backdrop, solar be in the crosshairs even more, in terms of high risk plays.