23May11:00 amEST

Volatility Still Sleeps with the Fishes

To kick off the week leading up to Memorial Day Weekend, stocks are drifting with a bullish bias, particularly in the biotechnology arena.

Interestingly, the volatility ETFs, such as VXX UVXY TVIX, are in the red as I write this while the actual VIX is green. One way to interpret this action is that the retail trader is wholly complacent, refusing to hedge with the volatility products seemingly designed to cater to the retail trader. Another argument is simply hat those ETFs are broken and thus impossible to analyze, either way. And yet another theory is that the red VIX ETFs, again, indicate much ado about nothing, in terms of stock remaining resilient and on the cusp of a major breakout higher.

What we do know is that as long as the actual VIX stays below 20, it is awfully hard to see anything in the way of a meaningful correction in stocks.

And with biotech on the come now, bulls may have some ammunition for a vast array of squeezes higher if they can hold the morning progress.

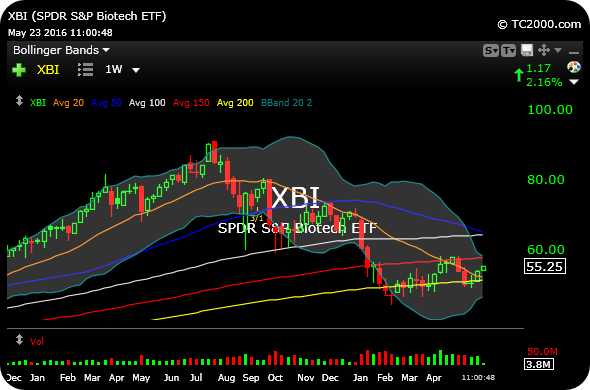

On the XBI (small/mid-cap biotech ETF) weekly chart, below, note the Bollinger Bands now pinched in after a steep downtrend since last summer (after a ferocious multi-year uptrend). Biotech seem to be on the cusp of their next directional move. And bears had likely better keep XBI below $60 this summer or risk losing control over a downtrend in a significant part of the market.

Full-Length Weekend Strategy... Will Starbucks and the Consu...