25May10:41 amEST

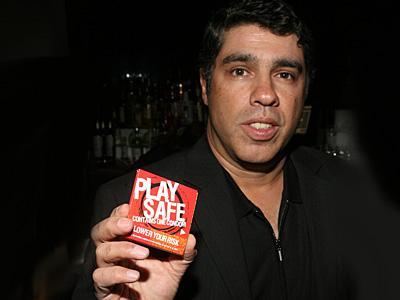

Play Safe with Baba Booey

After a spirited rally yesterday over $80 resistance, BABA is being slammed down roughly 4% this morning on the back of an SEC accounting investigation.

While it is true that risk is omnipresent on Wall Street, China issues should be generally viewed as slightly higher risk plays than run-of-the-mill domestic stocks.

True, we have seen plenty of similar issues and probes here in the U.S.. But there have also been plenty of delisting of high beta, popular China names over the years; in some instances they were just halted and never traded again. BABA is a prominent China name, and a controversial but sizable global brand.

But the issue is not so much expecting a delisting from BABA or anything of the sort. Rather, it is known the higher risk territory you are entering with virtually any China play, and adjusting accordingly via smaller position sizing and a fairly tight leash on the trade.

In light of the BABA downside reversal this morning, keep an eye on JD, another high beta China name, for a bear flag breakdown below $23.

Elsewhere, we have that continued holiday squeeze higher. Despite the JD setup and China issues, I am not in a rush to put on short exposure. Instead, we are simply taking what the market gives in the way of quick-hitting holiday trades.

Stock Market Recap 05/24/16 ... Twitter Potheads Playing Hac...