13Sep1:21 pmEST

Singing the Same Tune

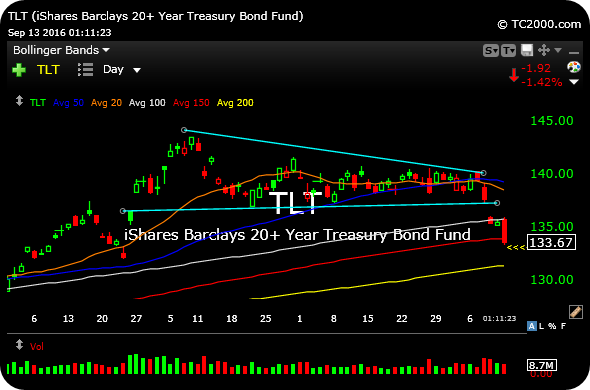

With Treasuries taking it on the chin yet again today, the link between some of the sectors famous for paying out hefty dividends and TLT is on full display.

Specifically, note the uncanny resemblance between the TLT and XLP daily charts, below. XLP is the ETF for the highly defensive consumer staples, such as KMB KO. The two daily charts are essentially singing the same tune, all related back to rates suddenly moving up. As "safe" as these stocks may be, in the near-term they likely are unwinding what had become a rather crowded trade by investors seeking a yield-alternative to government bonds.

Of course, the next FOMC Announcement will be a major risk to either side of this trade. But, for now, bond bears are making themselves relevant again, after years if not decades of being outcasts.

With this in mind, we have a few "sitting ducks" in the safety sectors which have not yet cracked but may be ripe to do so, rendering them actionable short setups. I will note these for Members now in my usual Midday Video.

Slim Pickings, So Head to th... It's Been a Lonely, Dark Roa...