29Dec10:53 amEST

Married to a Thesis, Within Reason

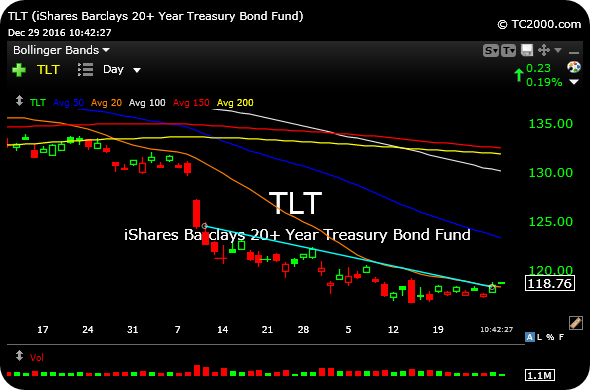

For a while now, we have been looking for the multi-decade bond bull to continue to show more signs of coming to an end. Recently, the price action has begun to confirm that thesis in a more pronounce way. Still, there is much more work to do; namely we need to see rates on the 10-year surge at least back over 3%.

In the meantime, TLT became rather steeply oversold into mid-December. At that point, many traders piled into TLT looking for a relief rally which did not imminently materialize. Instead, financials kept grinding higher and bonds were churning, at best, sideways if not slightly lower.

Now, however, we may finally reaching that moment when some reversion sets in for the new year. Today, for example, is the first session the XLF (financial sector ETF) is losing its 20-day moving average (orange line, second daily chart, below) since before the Election in early-november. This is quite a long time, indeed, to go without testing that reference point.

And regarding TLT, on the first chart, below, if bonds bulls can hold a move over $118.90 they should finally get some relief.

It is worth noting the varying timeframes of these ideas, since the new long-term bond bear case can withstand a relief rally here into, say, mid-January or even February/March, just as the bull case for banks should be able to factor in a multi-week consolidation or pullback.

Stock Market Recap 12/28/16 ... Out on a Limb But Not Breaki...