23Jan10:43 amEST

Time to Catch the Fat from Falling Chips

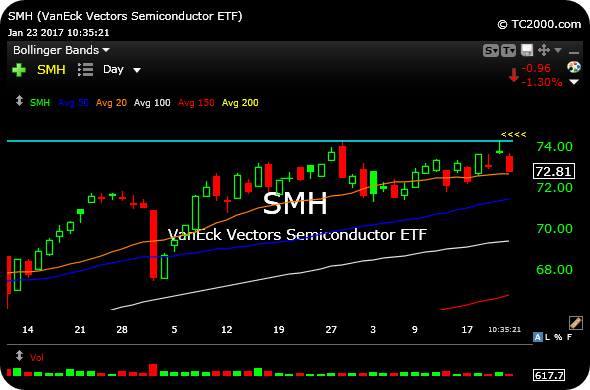

Beyond the QCOM issues (a name we had been short for Members over the last few weeks and closed out the position this morning in front of Wednesday's earnings report), semiconductors are reversing soundly off their late-december highs, seen on the SMH sector ETF daily chart, below.

With the long reversal doji candlestick off those prior highs last Friday, sellers are seizing an initial opportunity to push one of, if not the, strongest parts of the market lower after an epic multi-quarter bull run.

Indeed, if bears are to succeed at achieving even a mild market pullback, let alone bonafide correction during a seasonally rough time of year, then bears almost assuredly will need to drip off the excess fat in some of these monstrous chips. The true test will come as we navigate through earnings season--Look no further than the SWKS rally last week, for example.

But bears are off to a decent start and no one should be surprised the SMH, on a tear since BREXIT last summer, finally reset during the dead of winter. SOXS is a high beta, triple-levered short ETF for the chips as a group. Given the M&A risk still present, I would favor either shorting the mega caps in the space, or shorting the sector as a whole in lieu of shorting mid-cap names.

Weekend Overview and Analysi... It's Going to Take a Team Ef...