17May3:42 pmEST

Now It's Up to Number 23

News-driven or not, a violent sell-off the very next day after the S&P 500 Index makes a new all-time high is always a concern. The S&P is currently dipping below its 50-day simple moving average. And even though dip-buyers have been remarkably, even historically, resilient for years now I am not going to be lulled into complacency.

In terms of determining whether this sell-off is just getting started or is, instead, a mere shakeout, I am looking beyond the indices. In other words, it is not particularly useful to simply cherry-pick the number of points the Dow is off, or that Treasuries, gold, and the VIX are catching expected spikes.

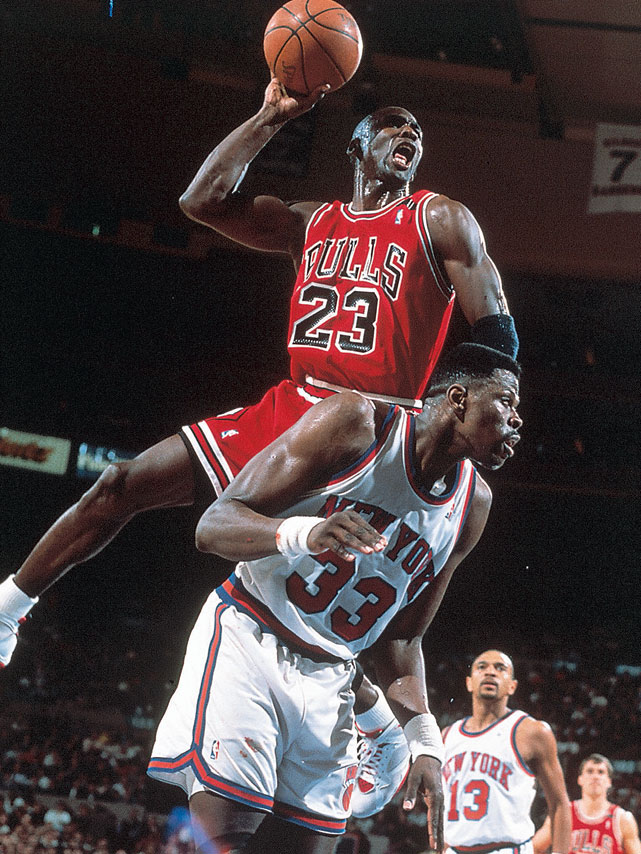

Rather, we want keep an eye on tangible levels for important parts of the market. Specifically, the $23 level on the XLF, sector ETF for the (mostly) big banks.

On the updated daily chart, below, bulls are trying to hold onto the level, perhaps desperately. Below $23, and the market sell-off may have some more meat to it than bulls care to envision right now.

Again, Citi figures to be a viable "catch-down" trade to the other banks, given its holdout status this week.

More in my recap after the bell.