02Aug10:34 amEST

A Truly Bizarre Celebration

Of all the times we have seen the mainstream (non-financial niche) media report on the Dow Jones Industrial Average and "stocks" making all-time highs, this particular time strikes a certain chord given the lackluster price action beneath the surface.

Indeed, the Apple jubilation from last night's earnings, not to mention FEYE ONCE and a few other earnings winners, is wearing thin on plenty of indices, sectors, and individual names as small caps are now off nearly 1% as I write this.

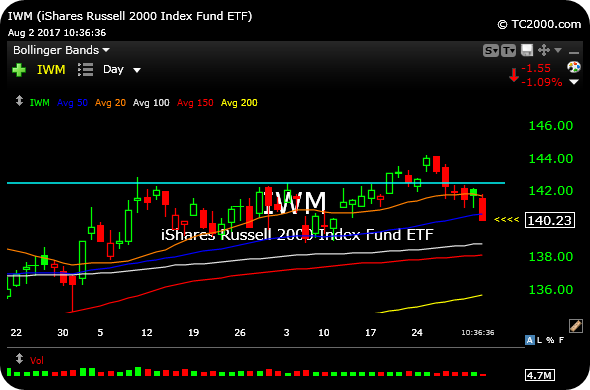

As you can see on the IWM daily chart, below, the ETF for the small cap-dominated Russell 2000 Index is slicing its 50-day moving average. Failure of dip-buyers to make a stand here would add credence to the bear case that we just witnessed a major false breakout, or bull trap, in July with the IWM breakout.

Of course, bears may be getting ahead of themselves, as usual. But what we can say for sure is that this price action has been sloppy and is getting sloppier by the day, which stands in stark contrast to the Apple and Dow celebrations. If anything, the Dow and AAPL moves may be the perfect smokescreen for some looming August selling.

The Real Champion Might Be G... Sunday Matinée at Market Ch...