11Aug1:11 pmEST

Perception Matters; But Facts Are Facts

We have a Nasdaq-led market bounce going today, though small caps are slightly red and gold and Treasuries are both green as I write this. Thus, the rally is not likely to scare too many bears into the weekend if we finish where we are currently trading.

Of course, these types of market scenarios bring out the usual arguments, with bulls arguing that we are simply going to stage a "V-shaped" rally back to new highs as shorts are slowly trapped, while bears will point to the many ongoing divergences and lack of buying power, just yet.

At the moment, the QQQ ETF for the Nasdaq is holding its 50-day moving average, but the actual Nasdaq Composite Index is still below its own 50-day. The reason for that discrepancy is the larger cap "FANG" names in the QQQ are weighted heavily and are leading the bounce today.

Still, the fact remains that bears have plenty of work ahead of them if they are going to prevail in sustaining a deeper market pullback than anything we have seen in quite some time. Rallies will need to be stuffed, and opening bounces need to turn into red closes.

Another concern in this market is something one of our Members, @busterstacks, pointed out: The commercial real estate stocks in the IYR ETF.

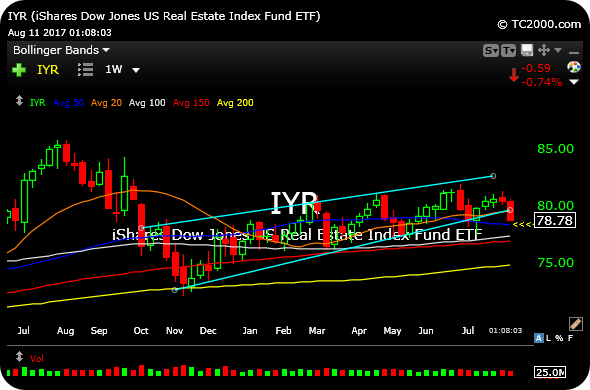

On the weekly chart for IYR, below, note the "REITs" are looking rather heavy and at risk of a major wedge light blue lines) breakdown.

At issue for us is whether to extrapolate IYR weakness to the broad market. Some will argue that the REITs, such as SPG, are unique indicators of business strength or weakness, but others will claim they are less reliable due to changing dynamics of the economy (the Amazon effect, e.g.) as well as the dividend-paying stocks being more defensive in nature.

Either way, we cannot argue with the ugly action in IYR this week, as denoted by the weekly candle nearly completed in solid red. SRS and DRV are the levered bear ETFs.

Stock Market Recap 08/10/17 ... Saturday Night at Market Che...