25Oct1:30 pmEST

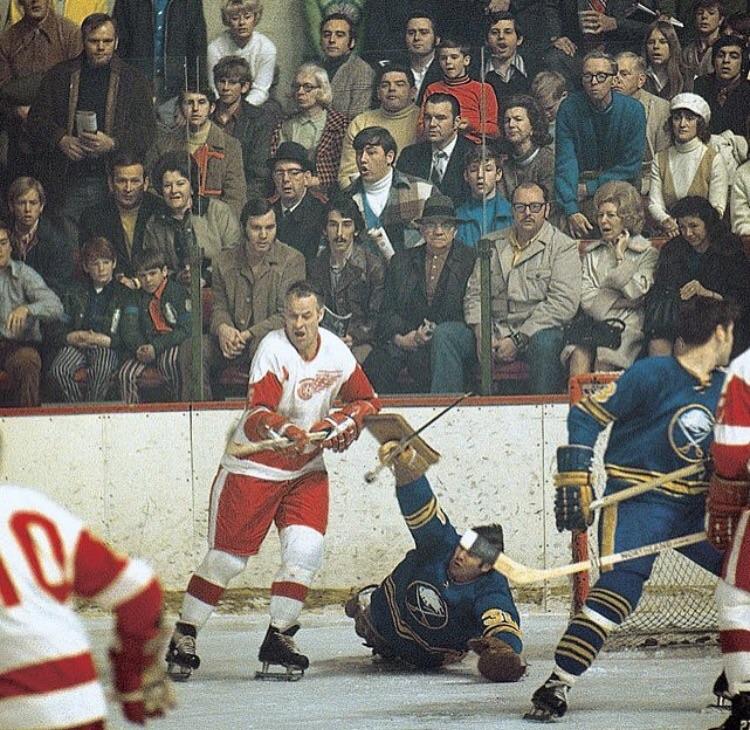

Feels Old School Out There

The CBOE Volatility Index (popularly known as the "VIX") is finally popping today alongside the selloff in equities. Indeed, it has been quite some time since we have seen a VIX move which did not immediately get smacked down.

Thus, it will be interesting to see if the move higher in the "Fear Index," as the VIX is often referred to, will last into the closing bell today, let alone the rest of this week.

As you can see, we need to take things one step at a time here, given that the overarching bull market in all major averages remains clearly intact on just about all timeframes. But that ought not to be used as an excuse to simply hold losers all the way down (see: AMD CMG IRBT earnings moves, for example), nor to throw caution to the wind with new longs in assuming that this pullback in the broad market will automatically get bought.

I suppose our prior analysis of HMNY in terms of buying support (or lack thereof) is apropos, since we want to apply that same discipline to the broad market if we do see a deeper pullback in the near-term.

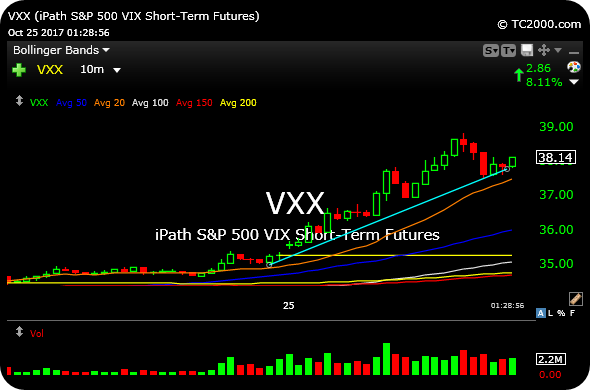

Regarding the VIX, the VXX ETF shows a 10-minute chart which has yet to collapse. In fact, this looks like a steady trend day higher at the moment--Almost, dare I say it, like an old school market pullback which can be completely normal and eventually buyable.